Expectations of Fed rate cuts and geopolitics support gold price growth

Gold prices rebounded after Monday morning's losses, trading now near the highs reached on Friday. Investors are still waiting for new signals regarding the possible interest rate cuts by the US Federal Reserve.

According to the US Bureau of Labor Statistics, the Producer Price Index (PPI) for final demand increased by 1.8% in September. At the same time, the core index rose by 2.8% year-on-year. These data was slightly higher than expected, but points to a slowdown in price growth. This reinforces expectations of further easing of the Fed's monetary policy.

According to the CME FedWatch figures, the probability of the Fed reducing borrowing costs by 25 basis points in November is 89%. The probability of keeping the interest rate unchanged is 11%. This sets the stage for higher gold prices, as lower rates make precious metals more attractive to investors.

Additionally, the escalation of geopolitical tensions in the Middle East supports the demand for gold as a safe haven asset. At the same time, the US dollar is getting close to its mid-August peak, restraining the yellow metal's price rise.

This week, investors will keep an eye on the comments of the Federal Reserve representatives and the data on retail sales in the United States.

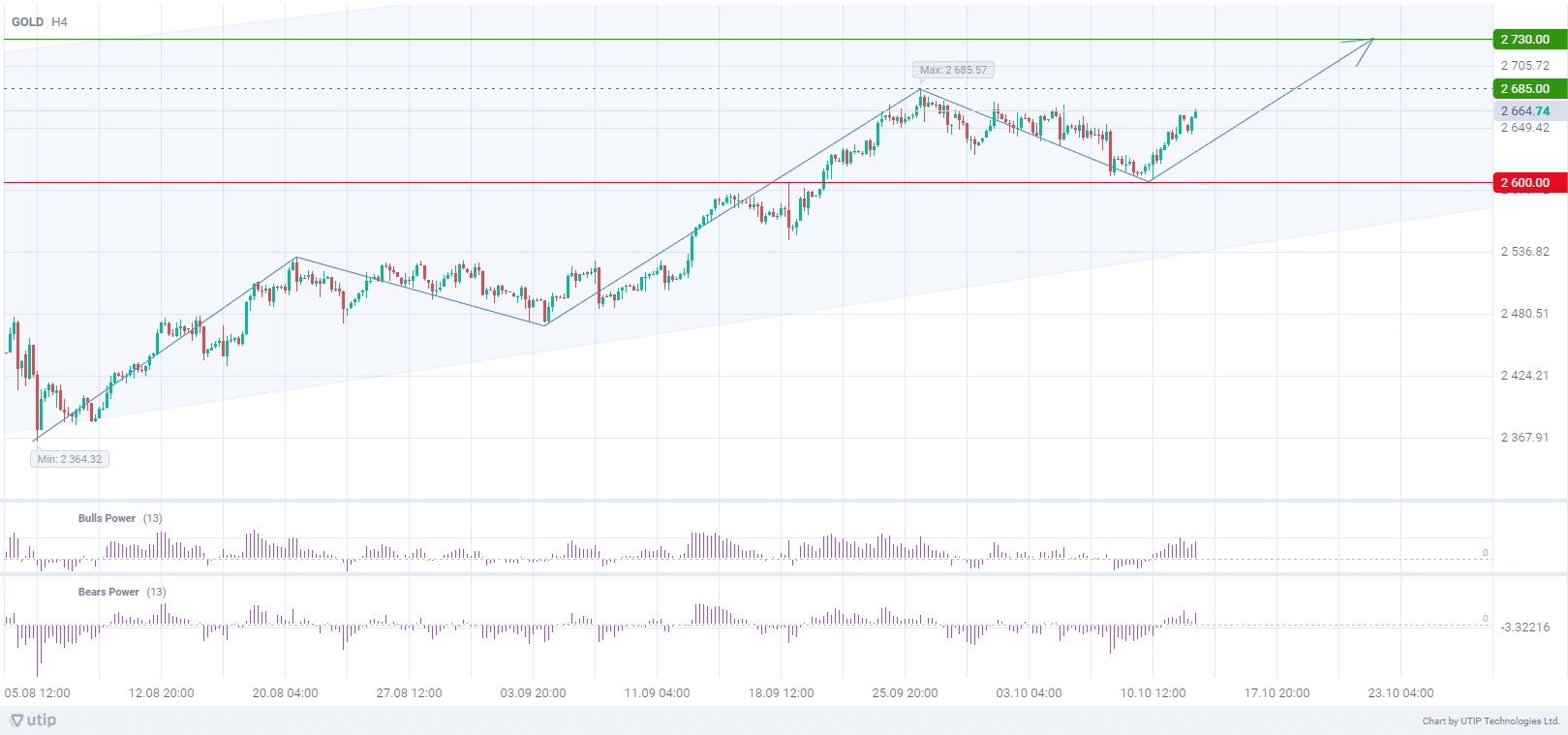

From the technical analysis viewpoint, gold prices are still following the uptrend on the daily timeframe (D1). Wave analysis of the H4 chart indicates the formation of the fifth ascending wave. The volumes of Bulls Power and Bears Power indicators (standard values) are in the positive zone, confirming the upward trend.

Signal:

The short-term outlook for GOLD suggests buying.

The target is at the level of 2730.00.

Part of the profit should be fixed near the level of 2685.00.

The stop loss is set near the level of 2600.00.

The bullish trend has a short-term nature, so it is worth choosing a trading volume of no more than 2% of the balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account