Expectations of soft policy of the Fed support GBPUSD growth to the level of 1.3360

Quotes of the GBPUSD currency pair traded in a narrow range on Tuesday, consolidating the previous day's growth to a one-week high. Investors took a wait-and-see stance ahead of key central bank decisions — the two-day Federal Open Market Committee (FOMC) meeting, which starts on Tuesday, and the Bank of England's policy update on Thursday.

The U.S. Federal Reserve (Fed) will announce its decision on Wednesday. According to CME FedWatch, traders are pricing in a 68% chance of a 50 basis point rate cut and a 32% chance of a 25 basis point cut. This is holding back U.S. Treasury bond yields and preventing the dollar from strengthening, creating favorable conditions for the currency pair to rise.

On the other hand, the pound is supported by expectations that the Bank of England will have a slower pace in cutting rates than the Fed. However, slowing wage growth in the UK and stagnant GDP in July may limit the growth of the British currency.

No significant economic data from the UK is expected today, so the market dynamics will depend on the dollar movement. At the beginning of the North American session, traders' attention will be focused on the U.S. retail sales data and U.S. bond yields.

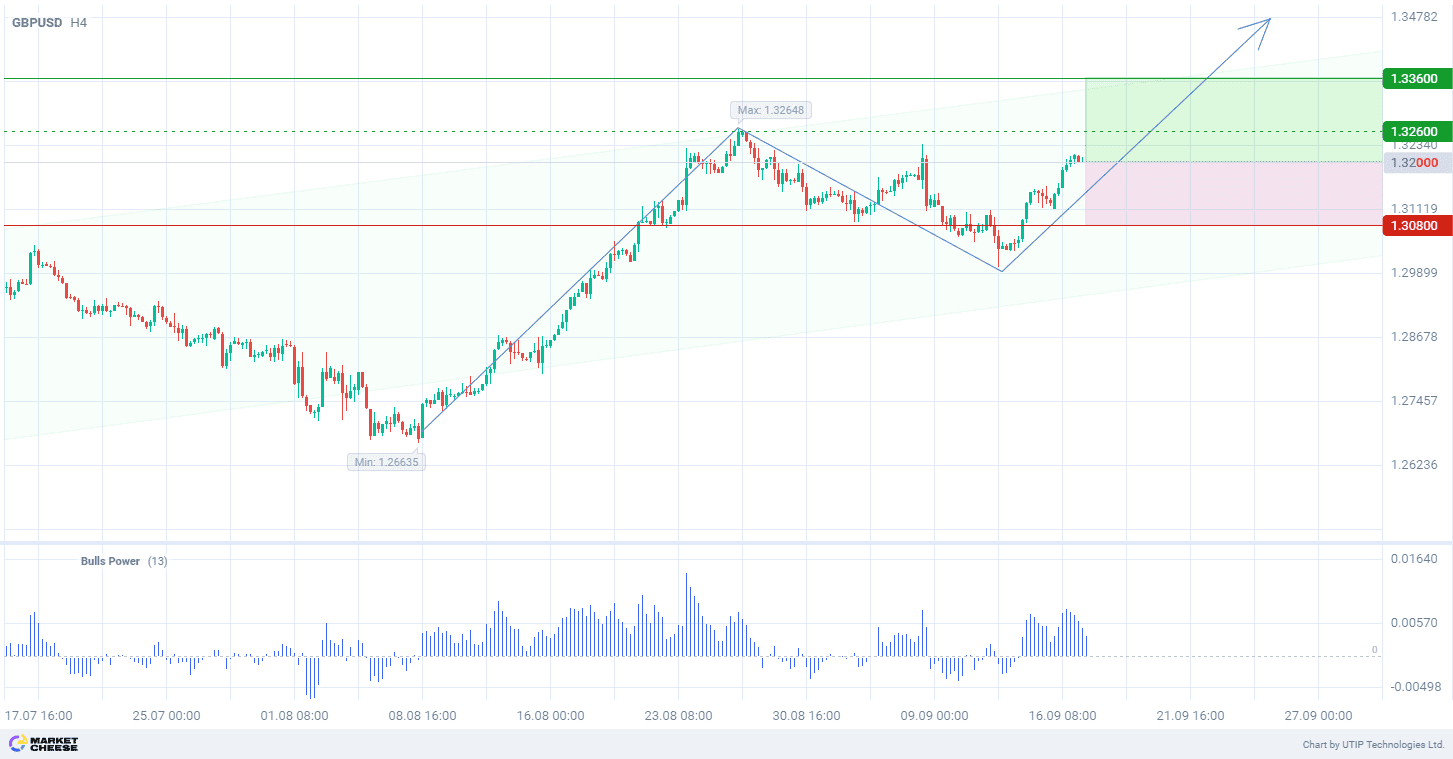

From the technical point of view, GBPUSD is forming an uptrend on the D1 timeframe. In terms of wave analysis, the price is forming the third ascending wave on the H4 timeframe. The Bulls Power remains in the positive zone, which strengthens the signal for the currency pair growth and possible strengthening of the third wave’s momentum.

The short-term outlook for the GBPUSD currency pair is to buy with the target at 1.3360. Part of the profit could be fixed near the level of 1.3260. The Stop loss could be placed at 1.3080.

The bullish trend is of a short-term nature, so it is suggested to limit the trading volume to no more than 2% of your capital.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account