Fall in UK inflation will put pressure on GBPUSD

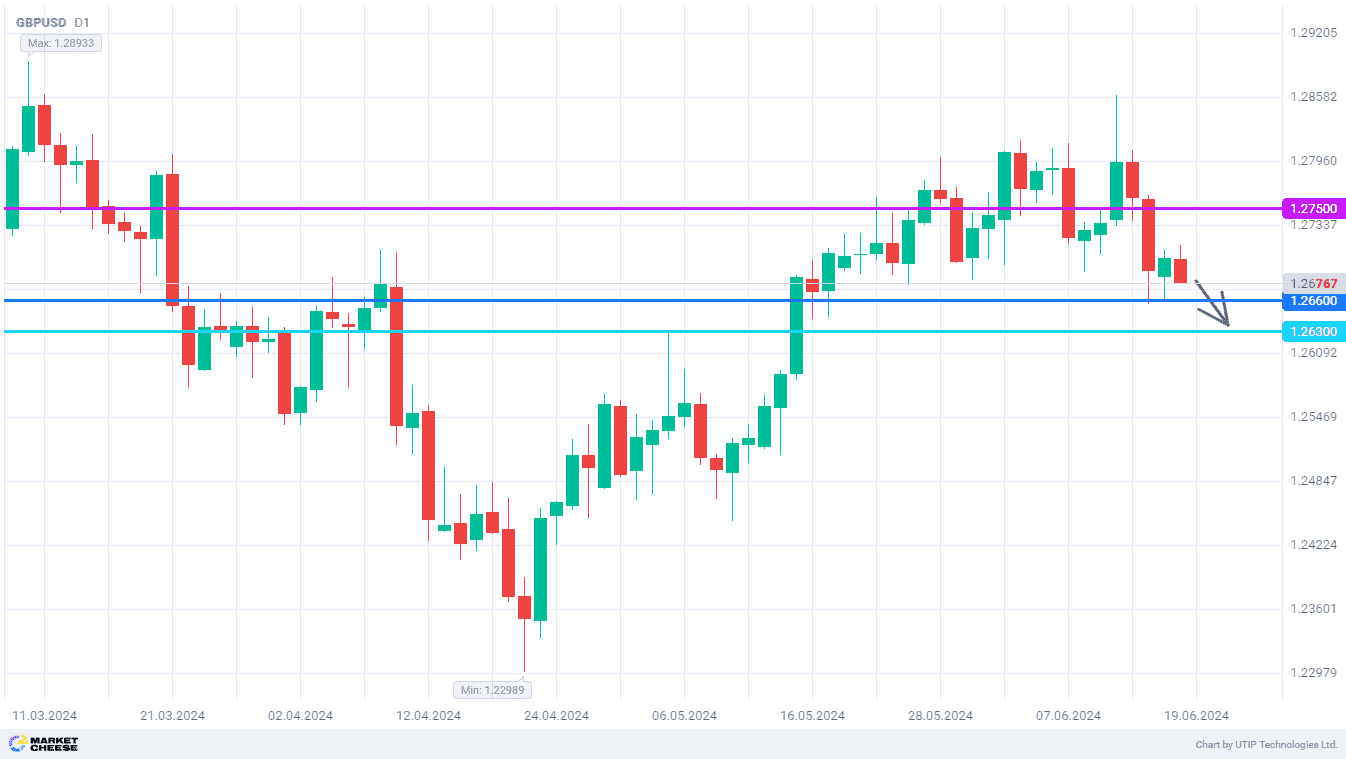

At the end of last week, the GBPUSD currency pair experienced a strong decline, which resulted in reaching a monthly low. On Monday, the quotes slightly rebounded upwards from the level of 1.266, but near the level of 1.27 the activity of buyers has noticeably decreased. Prior to the main events of the current week, currency market participants do not tend to open long positions on the pound. This may lead to a quick return of GBPUSD to the level of 1.266.

On Wednesday, the UK statistical offices will report on inflation data for May. According to the economists' consensus forecast, the rate of price growth will reach the Bank of England's target of 2% for the first time in 3 years. Moreover, according to Dan Hanson and Ana Andrade from Bloomberg Economics, the overall inflation rate is expected to fall below this level by the end of June. This can only be prevented by price increases in the services sector, but even in this area inflation is expected to slow down from 5.9% to 5.5%.

Having analyzed the economic statistics, the Bank of England will hold a meeting on monetary policy on Thursday. The analysts do not expect any changes in the level of interest rates. The attention will be drawn to the forecasts regarding the meeting of the British regulator in August. ING strategist Chris Turner believes that a new positive data on inflation will change the opinion of the Bank of England officials, and they will acknowledge the possibility of monetary policy easing in the last month of summer.

According to Turner, lower inflation rates and "dovish" statements of British officials will put significant pressure on the pound exchange rate. This will be especially evident when paired with the dollar, considering the persistent strength of the U.S. currency. The Fed spokesmen have recently confirmed their intention to lower the key rate in the US only once before the end of 2024. The Bank of England is expected to take 2 steps to ease monetary policy, which would widen the rate gap with the Fed and could lead to a further decline in GBPUSD.

The nearest "bearish" target for GBPUSD is to reach the level of 1.266. If successful, the benchmark will shift to 1.263.

The following trading strategy can be suggested:

Sell GBPUSD in the range of 1.269-1.271. Take profit 1 – 1.266. Take profit 2 – 1.263. Stop loss – 1.275.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account