Gas market returns to negative price dynamics

Gas prices in the U.S. experienced a powerful collapse in the second half of January. As indicated in the previous forecast, after the end of the period of abnormally cold weather, the cost of natural gas quickly began to return to last year's lows. Prices are now down to the levels of spring 2023, trying to stay above the level of 2. There are chances for some upward price bounce, but the fundamental environment in the gas market is still not optimistic.

Hedge funds and other professional investors are reverting to a strictly bearish positioning in the gas market. According to Reuters, contracts for nearly 600 billion cubic feet of natural gas were sold in the past week. This was the strongest sell-off in U.S. gas contracts since August 2021. Warm weather that replaced the mid-January freeze is contributing to the negative market sentiment. As a result, investors' net position in the U.S. gas market has once again become short.

Also, the recent decisions of the U.S. authorities contributed to the negative price dynamics of the fuel. The White House administration announced the suspension of new LNG export permits. This step followed pressure from environmental organizations worried about too large-scale use of fossil fuels. For energy markets in Europe and Asia, this news may cause gas prices to rise, but the situation is the opposite for American fuel producers.

A large part of gas production in the U.S. is a by-product of oil production. Because of this, natural gas production volumes are much harder to control, and last year they regularly broke records even in the face of a very negative price picture. In the absence of growth in LNG exports, gas will remain on the domestic U.S. market, where a large surplus is consistently recorded even without these volumes. As a result, fuel costs will come under even more pressure.

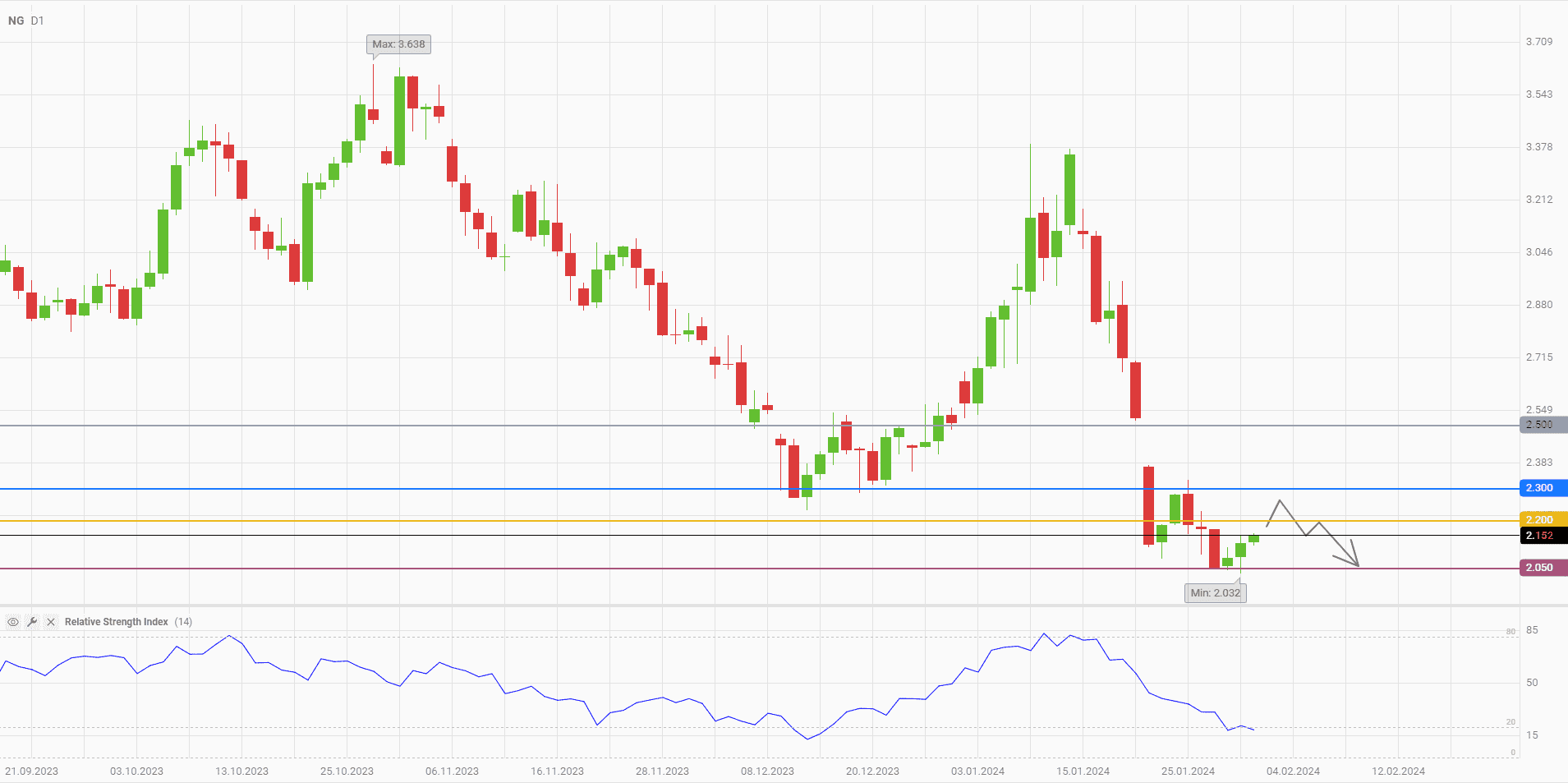

The current state of technical oversold conditions suggests a slight recovery in gas prices. It is highly likely to be limited to the 2.2-2.3 range, where potential profits from short positions will once again attract the attention of the bears.

Consider the following trading strategy:

Sell gas in the range of 2.2 to 2.3. Take profit - 2.05. Stop-loss - 2.5.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account