Gas prices may increase due to change in US LNG export policy

Natural gas prices have been rising since Tuesday, partially recovering from last week’s significant losses. According to Bloomberg, the key role in this process was played by renewable energy sources.

The increased use of wind and solar power plants in Europe, as well as the recovery of nuclear power generation in France, have helped to meet electricity demand. This has led to a 12% drop in gas prices this year.

Meanwhile, US President Joe Biden's Administration soon will announce its decision on controlling gas-export permits. According to Bloomberg, it may stall the realization of such large-scale projects as the LNG terminal on the Gulf Coast.

At the same time, environmentalists are increasing pressure on the US government to stop building LNG export platforms. According to activists, the terminals only prolong the world's dependence on gas and prevent the use of cleaner energy.

Executives in the US oil and gas industry expressed concern over the White House's potential revision of its approach to liquefied natural gas (LNG) export project approvals, fearing a negative impact on the sector.

American Petroleum Institute President and CEO Mike Sommers, speaking at the US Energy Association's forum on January 23, stressed the importance of US natural gas to Europe. He also outlined possible consequences for US allies if export permits are canceled. According to him, this could be the most significant decision of the current administration.

Concerns of the industry representatives and anticipation of the White House’s decision may become a temporary growth factor for gas prices.

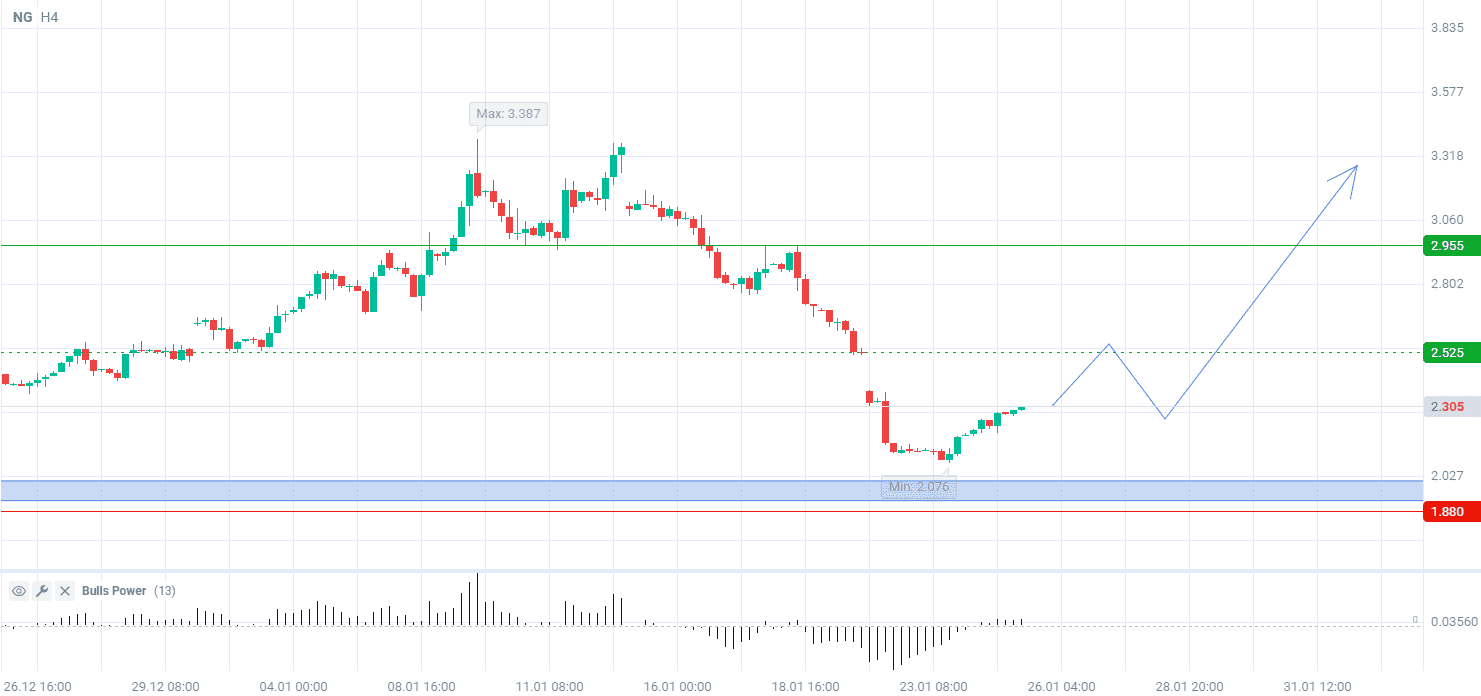

Natural gas prices have bounced upward at 130 points away from the lows of 2023. The price's proximity to strong support is correcting the direction of gas costs. Bulls Power indicator (standard values) on the H4 timeframe is increasing in the positive zone, indicating an upward movement.

Signal:

The short-term outlook for natural gas suggests buying.

The target is at the level of 2.955.

Part of the profit should be taken near the level of 2.525.

A Stop-loss could be set at the level of 1.880.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account