Gas prices may rise with deeper production cuts

Natural gas prices rebounded from 2020 lows, rising due to key player's – the United States – promises to suspend some drilling and cut production.

US gas prices surged about 13% on Wednesday on the back of Chesapeake Energy's planned production cut of 30% in 2024. The company will be the biggest US gas producer after its merger with Southwestern Energy, according to Reuters.

Chesapeake lowered its previous capital expenditure forecast for the current year by about 20% due to fewer drilling rigs and deferred well completions. As a result, the company's gas production will fall to about 2.7 billion cubic feet (bcf) per day in 2024. In 2023, this figure was 3.5 bcf.

Chesapeake officials attribute their decision to the significant drop in gas prices, which recently hit their lowest level in 3.5 years. According to the producer, the gas market is clearly oversupplied.

Chesapeake was not the only US company to announce production cuts this year. So, Antero Resources and Comstock Resources also plan to reduce drilling, as well as the current largest US gas producer, EQT.

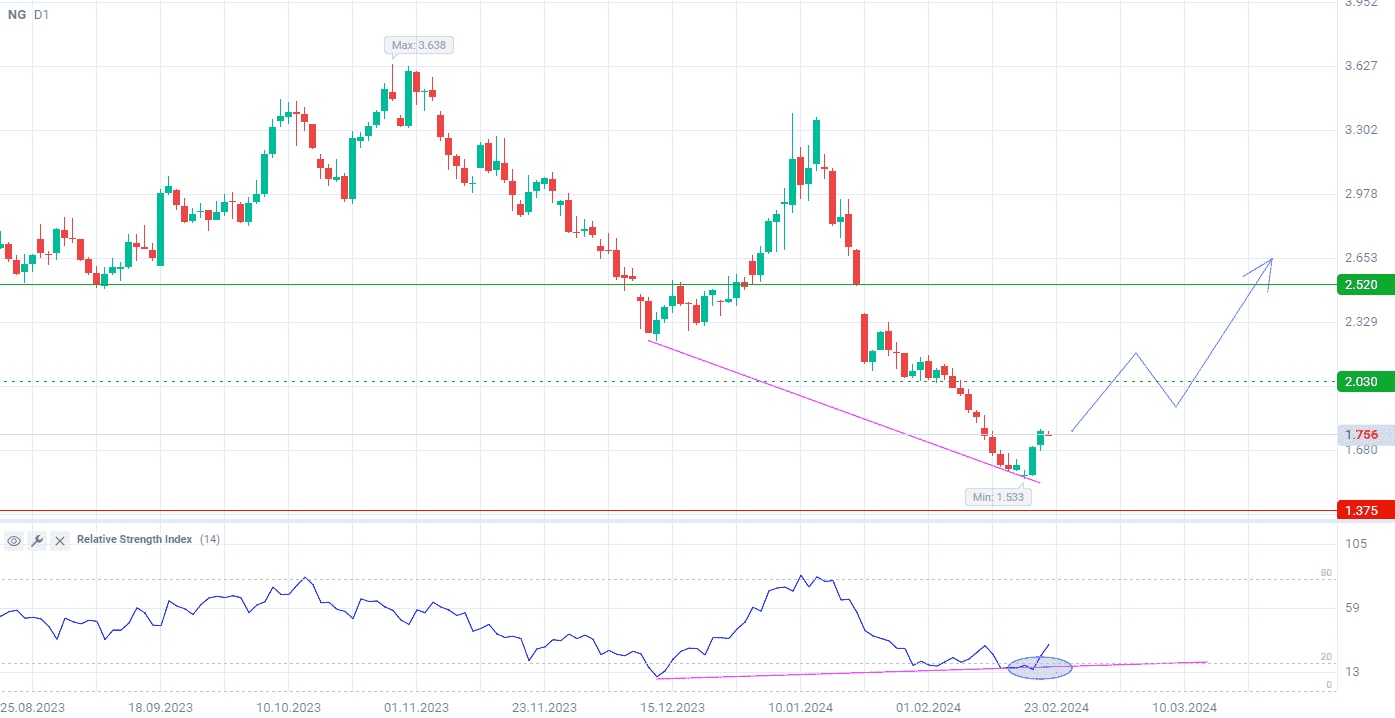

Natural gas prices are still in a downtrend on the D1 timeframe. However, no clear trend is seen. Divergence and the curve's exit from the oversold zone of the Relative Strength Index (RSI) (standard values) show a potential upward change in the price direction.

Signal:

The short-term outlook for natural gas suggests buying.

The target is at the level of 2.520.

Part of the profit should be taken near the level of 2.030.

A Stop-loss could be set at the level of 1.375.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account