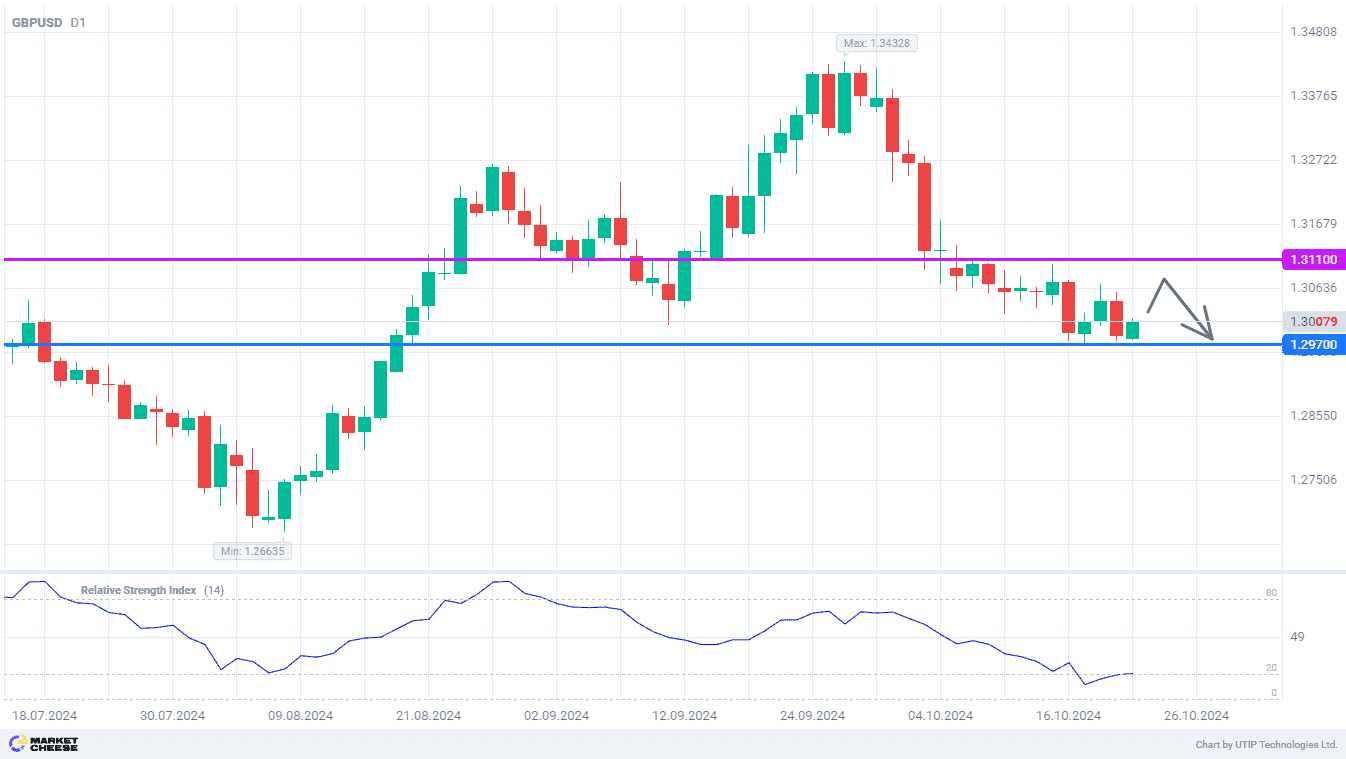

GBPUSD can not go far from 1.297 mark

GBPUSD has slowed its downward movement over the past few days, but there is still no significant rebound from the 2-month low of 1.297. Given the accumulated oversold condition, going short at current prices is not attracting many bears. Nevertheless, selling the pound against the dollar remains fundamentally relevant, and traders will be able to resume this strategy when prices move closer to the 1.31 level. Going forward, GBPUSD has a good chance of returning to the 1.297 level.

Analysts at Reuters are paying attention to the ratio of UK and US government bond yields. For the first time since mid-August, US securities have outperformed their British counterparts. This was helped by last week's inflation data, which showed that price growth in the UK slowed to 1.7%. Investors are now expecting the Bank of England to be more active in easing monetary policy.

ING currency analyst Chris Turner urges traders to pay close attention to Andrew Bailey's testimony this week. The head of the British regulator will begin a series of speeches today, which will continue through Friday. According to Turner, market participants are underestimating the speed at which the Bank of England can lower the key interest rate. The ING representative believes that GBPUSD will remain around the 1.3 level in the near future, with price fluctuations in the range of 1.297-1.306.

Meanwhile, demand for the dollar in the financial markets continues to grow as the US presidential election approaches on November 5. According to JPMorgan strategists, investors are actively liquidating short positions on the US currency that were opened during the 3rd quarter. At the same time, the net position on the dollar remains neutral, with no clear bias toward buying. In this regard, the experts at JPMorgan believe that the potential for the US currency to strengthen is far from exhausted.

The RSI on the daily chart of GBPUSD indicates that the price may go up. This can be used to sell the pound against the dollar with a target of 1.297.

Consider the following trading strategy:

Sell GBPUSD when the price rises to the range of 1.302-1.306. Take profit - 1.297. Stop loss - 1.311.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account