GBPUSD correction provides good opportunity to buy

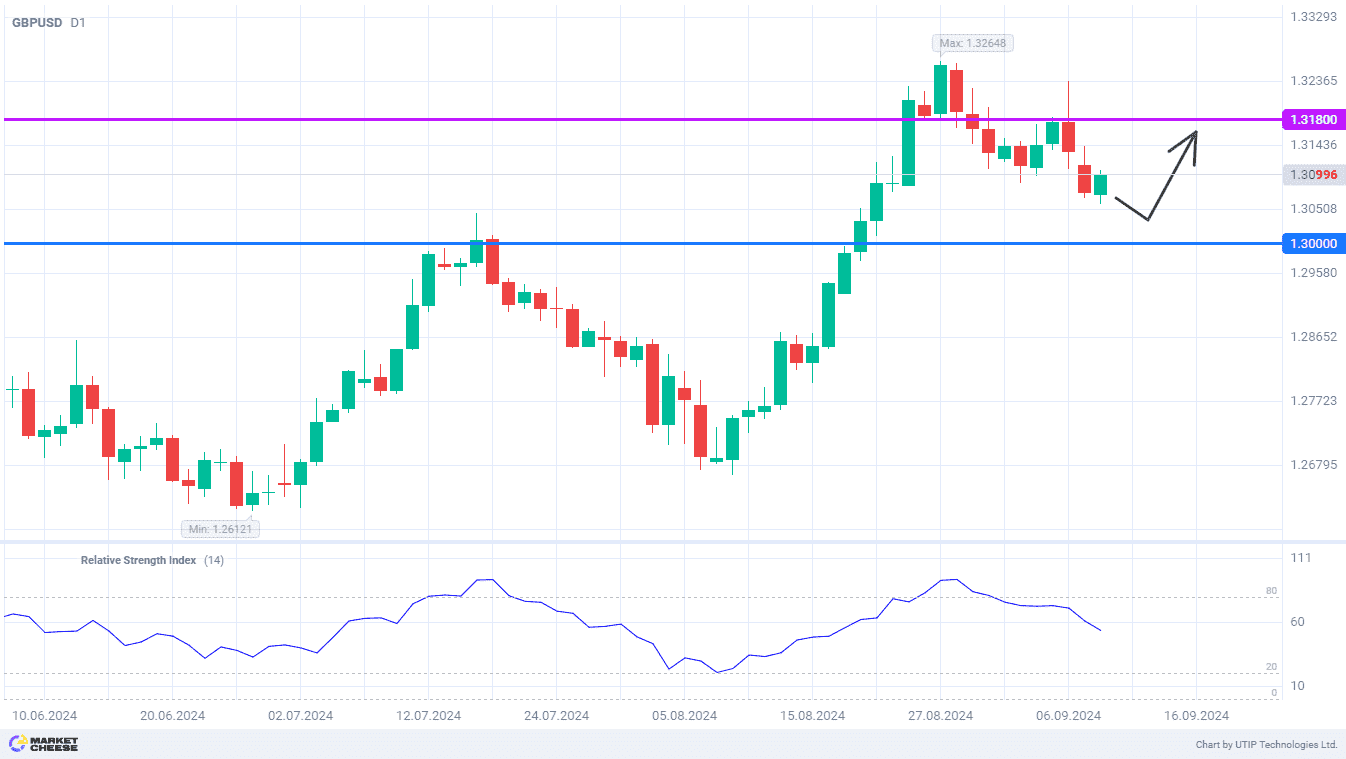

The GBPUSD currency pair updated its 2-year high in late August, and then it began a corrective decline. The rate pullback has already reached the level of 1.31, where buying the pound against the dollar starts to look interesting again. Over the past two weeks, technical indicators have exited the overbought zone, no longer preventing a new wave of GBPUSD growth. The first sign of this wave may be the price return to 1.318.

At Tuesday's trading session, the pound was supported by recent statistics on the UK labor market. All indices were as expected or even better, except for the wage growth rate. An increase in the number of employed people by 265,000 (against the forecast of 115,000), as well as a sharp decline in the number of claims for unemployment benefits from 102,300 to 23,700 looks particularly impressive. Such statistics once again raised concerns that the British labor market is not cooling enough.

Financial market participants are getting more and more confident that the Bank of England will not cut the key rate again at the next meeting in September. The second rate cut will take place only in November. Bloomberg analysts expect a cautious cycle of rate cuts in the UK, especially given the persistence of wage growth above 4%. Under such circumstances, it is unlikely that the BoE inflation target of 2% will be achieved in the foreseeable future.

At the same time, Reuters experts are worrying about the Fed's actions. According to them, after 5 years the risk of excessive fall in US inflation below 2% arises again. Lower commodity costs along with a slowing US labor market may have a significant impact on the country's average price level, especially if the Fed fails to implement a soft landing of the economy. The likelihood of this scenario is increased by the current situation in China, with its deflation spreading to other countries through large volumes of exports.

If tomorrow's price statistics for August in the US comes out within expectations, GBPUSD will have every chance to recover to recent highs. The nearest target is the level of 1.318.

Consider the following trading strategy:

Buy GBPUSD at the current price. Take profit – 1.318. Stop loss – 1.3.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account