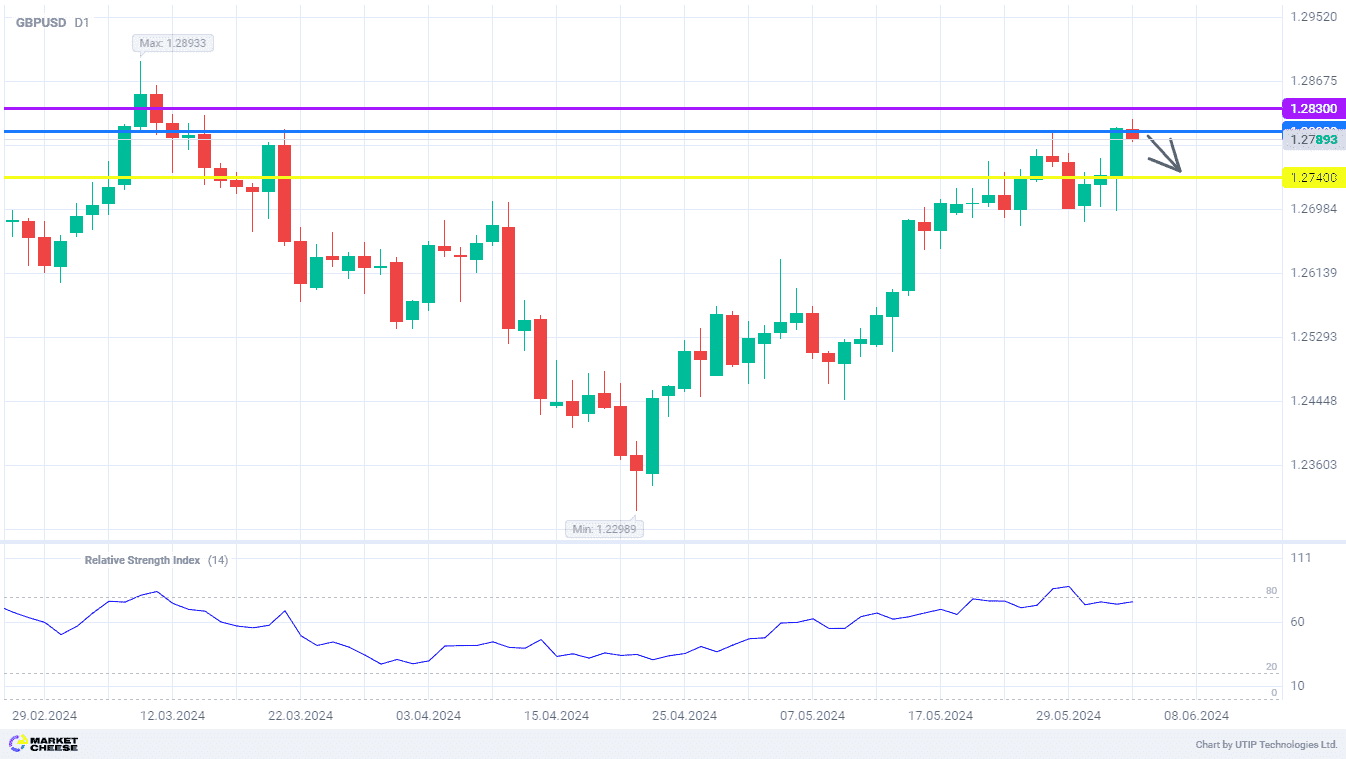

GBPUSD pullback may be triggered again at 1.28

The GBPUSD currency pair, as expected, pulled back down from the level of 1.28 during the local correction. Afterwards, the quotes returned to growth, and at today's trading session exceeded 1.281 for the first time since mid-March. However, higher prices often provoke bearish activity, and such a scenario is happening now. Last week's drop is clearly not enough to fully remove the technical overbought condition, so the sellers of GBPUSD have good chances to reach the level of 1.274.

The recent weakening of the dollar was driven by the Manufacturing Purchasing Managers Index (PMI) from the ISM. It dropped from 49.2 to 48.7, failing to meet expectations of growth to 49.8. However, traders are unlikely to sell the US currency aggressively ahead of the May labor market report. According to Econoday experts, Friday's statistics may turn out to be better than the consensus forecast due to the seasonal factor of employment growth. In this case, dollar demand in the currency market will quickly recover.

At the same time, the UK economic data is not quite positive. Today's Barclays report showed the minimal growth in consumer spending by the bank's clients since February 2021. In turn, the British Retail Consortium (BRC) reported a weak recovery in sales last month. After a 4% decline in April, sales in the UK stores rose by only 0.7 % in May. A year ago, this indicator increased by almost 4%.

Reuters analysts also point out that the Barclays and the BRC figures are not adjusted for inflation. Given the price growth rate of 2.3% in April, the real spending and retail sales in the UK show negative dynamics. This is an unfavorable factor for the country's economy and for the national currency.

As long as GBPUSD has not consolidated above the level of 1.28, it is recommended to open short positions. The target of the corrective pullback could be set at 1.274.

Consider the following trading strategy:

Sell GBPUSD not above the level of 1.28. Take profit – 1.274. Stop loss – 1.283.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account