GBPUSD requires a pullback after update of yearly highs

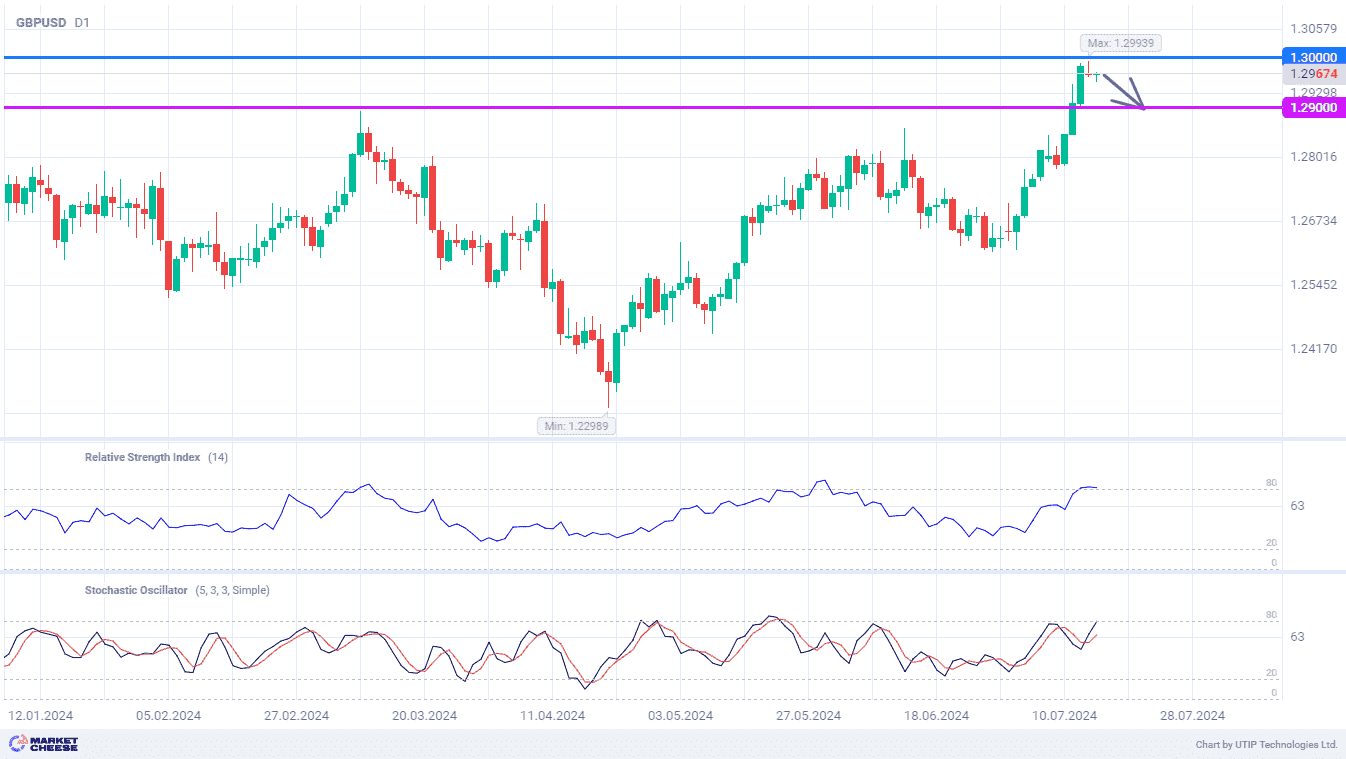

The GBPUSD currency pair showed a powerful upward movement last week. Quotes updated the annual maximum and came close to the important level of 1.3. This mark halted the upward momentum, which was replaced by a small correction. Since the end of June, the pound against the dollar strengthened without significant pullbacks, which additionally increases the probability of the beginning of a full-fledged wave of GBPUSD decline. The first target of the bears will be the previous high of 2024 set in March just below the level of 1.29.

The growth of the British currency against its US counterpart was triggered by statistics showing a further slowdown in US inflation. However, tomorrow price growth data for June will also be released in the UK, which could trigger the exact opposite reaction from the pound. Surveys of economists conducted by Bloomberg and Reuters point to further stabilization of inflation near 2%.

Tomorrow's inflation report will be the last before the Bank of England meeting on August 1. Market participants pricing in a 50/50 chance of a rate cut, but among professional analysts this figure exceeds 80%. Their point of view was reinforced by yesterday's speech of the representative of the British regulator Swati Dhingra, who since February has consistently voted in favor of easing monetary policy.

More dovish stance of the Bank of England could also be supported by labor market data. The full report for June will be presented on Thursday, but preliminary survey data already confirm a decline in labor demand. Statistics compiled by Recruitment & Employment Confederation reflect a 1.6% decline in the total number of vacancies in the UK over the past month. At the same time, the number of new vacancies fell even more sharply, by 2.6%. As a result, regulator officials will be forced to start cutting interest rates and GBPUSD will go down.

The RSI and Stochastic indicators give an overbought signal on the daily chart of GBPUSD. This additionally increases the chances of a corrective pullback of the pair to the level of 1.29.

The following trading strategy can be suggested:

Sell GBPUSD in the range of 1.295–1.297. Take profit — 1.29. Stop loss — 1.3.

Traders can also use a Trailing stop instead of a fixed Stop loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account