GBPUSD trades towards trend support at 1.2525 on expectations of lower UK inflation figures

Quotes of the GBPUSD currency pair stabilized on Tuesday, as the market evaluates comments made on Monday by representatives of the Federal Reserve System (Fed).

As Fed officials have warned, the central bank needs more evidence of falling inflation to start cutting interest rates. According to Philip Jefferson, a member of the Fed's Board of Governors, it is too early to judge the duration of the disinflation trend in the country. Last month's data was encouraging, but things could change at any moment.

Jefferson characterized the current monetary policy in the U.S. as restrictive and declined to predict a rate cut in 2024. Instead, the Fed vice chairman intends to keep a close eye on incoming economic indicators, including the country's GDP growth prospects and the balance of risks.

According to the CME FedWatch Tool, investors expect a 25-basis point decline in borrowing costs in September and two more declines by the end of the year, with a 76% probability of occurring.

Meanwhile, markets are preparing for the publication of the April Fed meeting minutes and inflation data in England. The reports will be released on Wednesday.

The UK Office for National Statistics predicts that the consumer price index will show a decline to 2.1% in April from 3.2% in March. The main reason may be a decrease in energy costs for households.

Inflation peaked at 11.1% in October 2022, but dropped in recent months due to lower energy prices and slower food price growth.

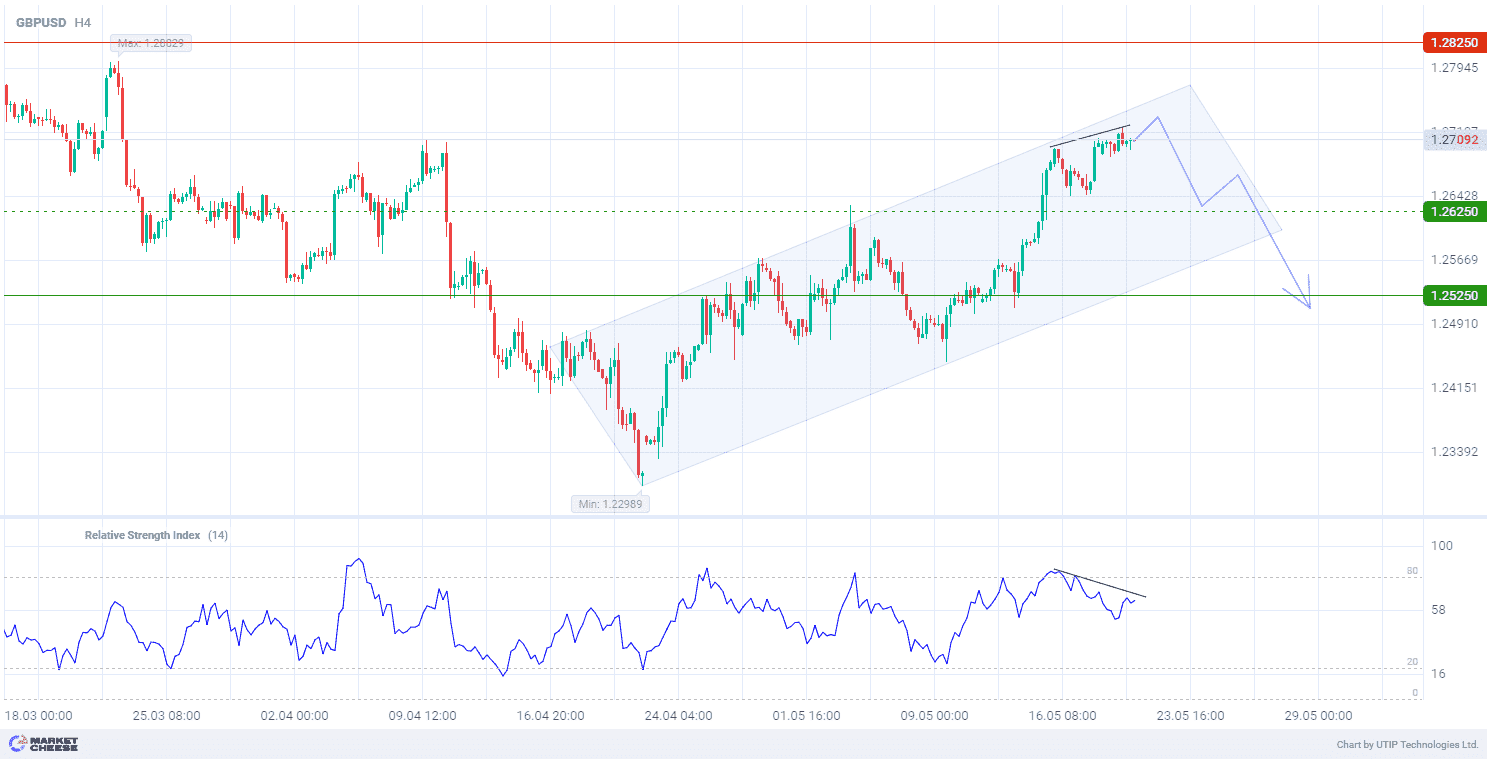

On the technical level, GBPUSD quotes demonstrate the formation of an upward trend on the H4 timeframe. However, the divergence of the Relative Strength Index (RSI) indicator (standard values) portends a possible change in the direction of the course.

Signal:

The short-term outlook for GBPUSD is to sell.

The target is at the level of 1.2525.

Part of the profit should be taken near the level of 1.2625.

A stop-loss could be placed at the level of 1.2825.

The bearish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account