Gold did not hold below the $2000 level

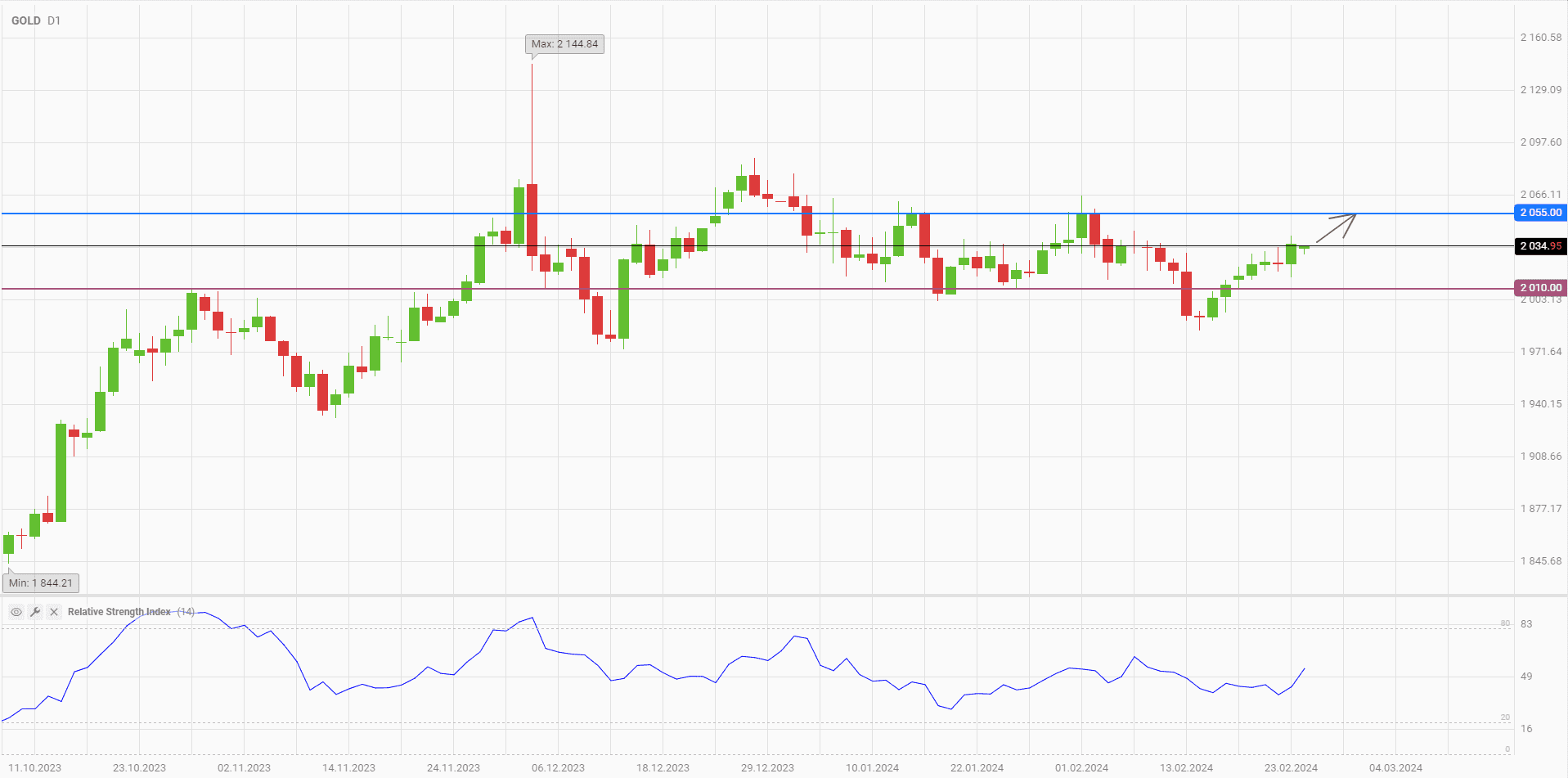

Last week, gold prices continued to rebound from a 2-month low set on February 14. The price of the yellow metal fell below the level of $1990 per ounce, but the bears failed to maintain it at these levels. Buyers actively used the opportunity to increase long positions in gold, bringing the metal back to the sideways range of 2010-2055. The current trend has all chances to approach the upper boundary of this range.

Market participants from Asia, where the level of demand strongly depends on the cost of the yellow metal, are the most active in buying back the drawdown in gold prices. This tendency was again confirmed by the Swiss customs service, which reported about the record export of gold from the country for 8 years. In January, shipments of the metal to India increased by 73% and reached 14 tons. At the same time, the volume of gold exports to China more than doubled to 77.8 tons.

As emphasized by analysts of BMO Capital Markets, the rise in purchases of the precious metal in China was due to an increased demand for jewelry during the celebration of the Lunar New Year. Investors' attempts to hedge risks amid the country's slowing economic growth also caused an increase in gold supplies. In the future, Asian consumers of the yellow metal will play an increasing role in the price dynamics in the market.

As the Taipei Times notes, Chinese youth is increasingly turning to gold as a safe haven asset amid rising unemployment in the country. The younger generation sees the yellow metal as a safe investment in unstable times. Earlier, gold jewelry was bought mainly by the older generation, but now the trend has changed. The slow recovery of the country's economy, the protracted crisis in the real estate sector and the decline in the stock market contributed to this.

Technical indicators on the daily chart of gold have reversed upward, but remain far from the overbought zone. In this situation, there is a high probability of the price growth continuation up to the level of 2055.

Consider the following trading strategy:

Buy gold at the current price. Take profit - 2055. Stop loss - 2010.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account