Gold to save its strength for another upward spurt

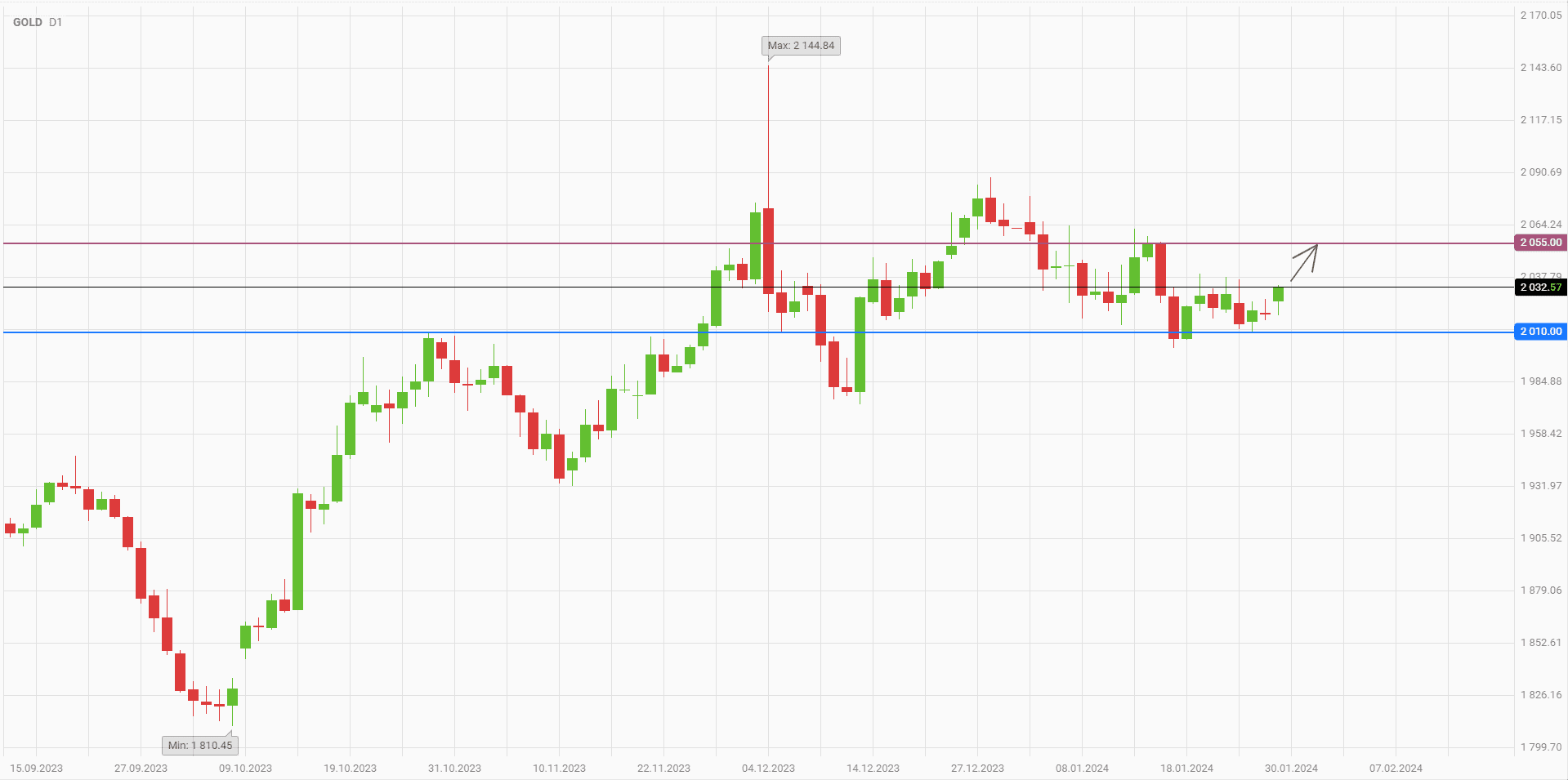

Gold prices spent the last week without sharp movements, consolidating in the range of 2010-2040. But since Monday morning one can already see the upward momentum caused by the activation of the yellow metal buyers. The next days' events are highly likely to lead to a price breakout from the current flat range. In this case, gold may rise to $2055 per ounce or even return to the highs of early January, located above the level of 2070.

Today's positive mood in the gold market is due to two main factors. Traders are paying attention to the new surge of tension in the Middle East, increasing demand for the yellow metal and other safe haven assets. At the same time, market participants are in anticipation of the first meeting of the Fed in 2024. Its results will be announced on Wednesday, and this event will definitely cause increased volatility in financial markets.

Also Reuters analysts reported about the increase in demand for gold in China. Over the past week, the local premium to the price of the yellow metal compared to world prices rose from $42-54 to $46-57 per ounce. The main reasons were new measures of the Chinese government to stimulate the economy, as well as the approaching New Year according to the lunar calendar. During the remaining days until February 10, the population of China can additionally increase the consumption of gold.

In addition, Reuters experts point to the quiescence in the Indian gold market. Local traders are waiting for February 1, when the federal budget for the next fiscal year is presented. Market participants count on the reduction of import duties on gold bars. The Ministry of Commerce of India has already supported representatives of the jewelry industry, recommending to reduce the duty from 15% to 5%. This step will support demand for the yellow metal.

The nearest target for the gold market bulls is the mid-January highs near the 2055 mark. If successful, it will open the way to the range of 2070-2080, but it will require soft rhetoric from Jerome Powell and other Fed officials.

Consider the following trading strategy:

Buy gold at the current price. Take profit - 2055. Stop loss - 2010.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account