Intention of ECB to keep pace with Fed rate cuts puts pressure on EURUSD

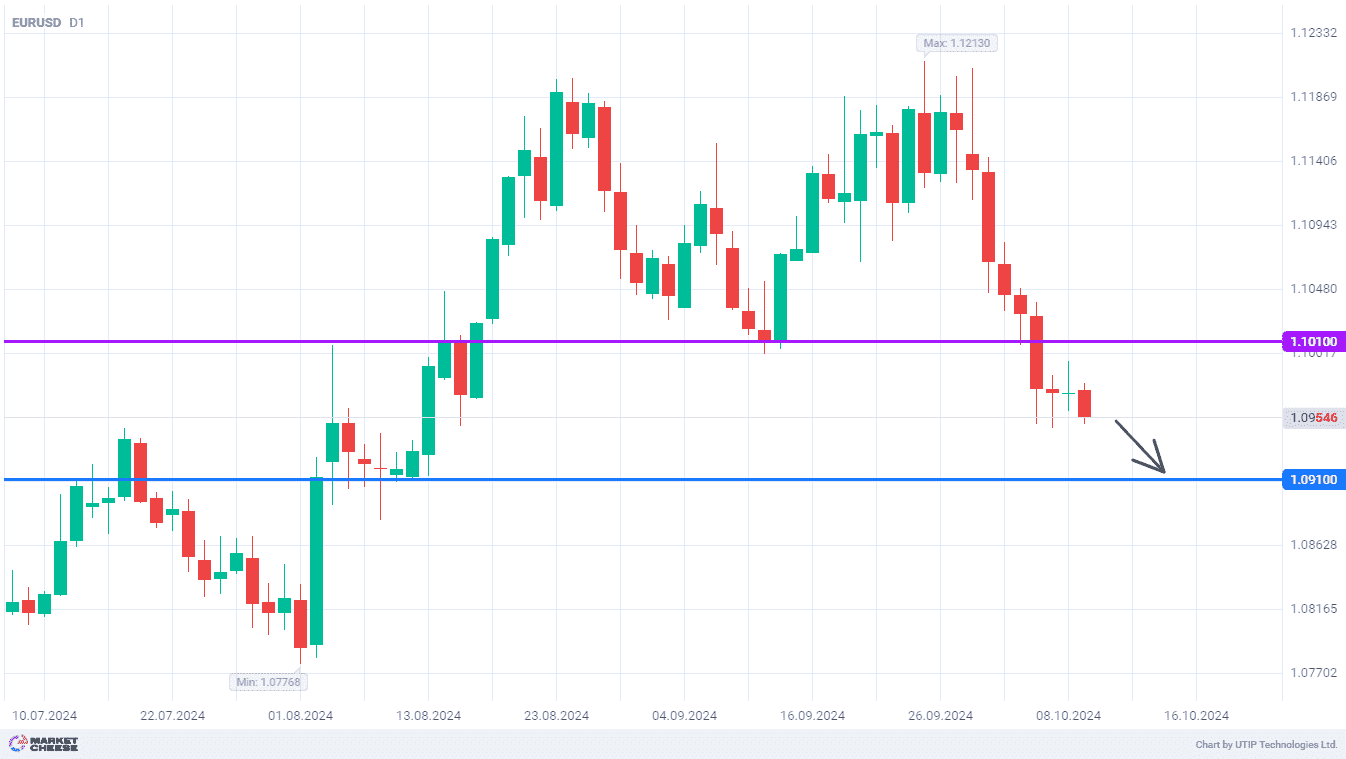

In recent days, the EURUSD currency pair has been trying to stabilize after last week's sharp decline. Although the downward movement has been halted, the bulls still lack the strength to pull the price back up. This was clearly demonstrated by Tuesday's trading session, by the end of which the entire daily gain was lost. The euro-dollar ratio still has the downside potential to the level of 1.091, after which profit on short positions can be fixed.

The recovery of demand for the US currency is supported by released statistics, reflecting the persistence of the country's economy. In particular, after the September report on the labor market, Goldman Sachs strategists reduced the probability of recession in the US from 20% to 15%. In their opinion, the Fed has no reason for a sharp easing of monetary policy, and some officials may already regret the decision to reduce the rate by 0.5% last month. Thereafter, the regulator will stick to the standard step of 0.25%.

Meanwhile, in Europe, the situation has changed in the exact opposite way. Previously, the ECB had planned to cut borrowing costs by 0.25% each quarter, but now the regulator has to accelerate. According to Reuters polls, there is a 90% probability that a rate cut will be delivered at both remaining ECB meetings before the end of the year. Expectations have been revised by inflation data and a worsened economic growth outlook for a number of EU countries.

Mike Dolan from Reuters considers the current state of the situation to be quite illustrative. As soon as the Fed decided to significantly ease monetary policy, the ECB and many other central banks began to prepare for similar measures. Due to this, dollar-denominated assets remain highly attractive, as the interest rate differential between the US and other countries is still large. According to Dolan, the superiority of the US economy over the one of the EU will provide a corresponding advantage to the dollar compared to the euro.

Tomorrow's US inflation report may partially reduce the pressure on the EURUSD quotations. Nevertheless, even in case of positive statistics, the chances of reaching the 1.091 level won't be lost.

The following trading strategy may be offered:

Sell EURUSD at the current price. Take profit – 1.091. Stop loss – 1.101.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account