Investors reconsider Fed rate cut outlook and push silver prices higher

On Wednesday, silver prices showed moderate growth for the fifth consecutive day. The recent trading session was backed by investors' reaction to slightly dovish remarks of Federal Reserve (Fed) Chair Jerome Powell.

As the Fed Chair said on Tuesday, the US is back on a “disinflationary path”. However, before reversing monetary policy, the US regulator needs more evidence of a slowdown in the country's consumer price growth. According to the May data, the Fed's preferred inflation gauge remained unchanged month-on-month. At the same time, the year-on-year growth rate of consumer spending in the country slowed to 2.6%. This is still above the US central bank's 2% target, but on its way to a gradual decline.

In Powell's words, the US central bank may be at a point when further disinflation will increase the risk of higher unemployment. This statement was made ahead of the FOMC minutes publication.

Traders are also expecting the release of ADP data on employment and weekly jobless claims later today. Friday's non-farm payrolls report (NFP) is also of interest. The publication of NFP data could impact the silver market if the figures reinforce expectations of a rate cut in September or November.

According to the CME FedWatch Tool, traders are pricing in about a 67% chance of monetary policy easing in September.

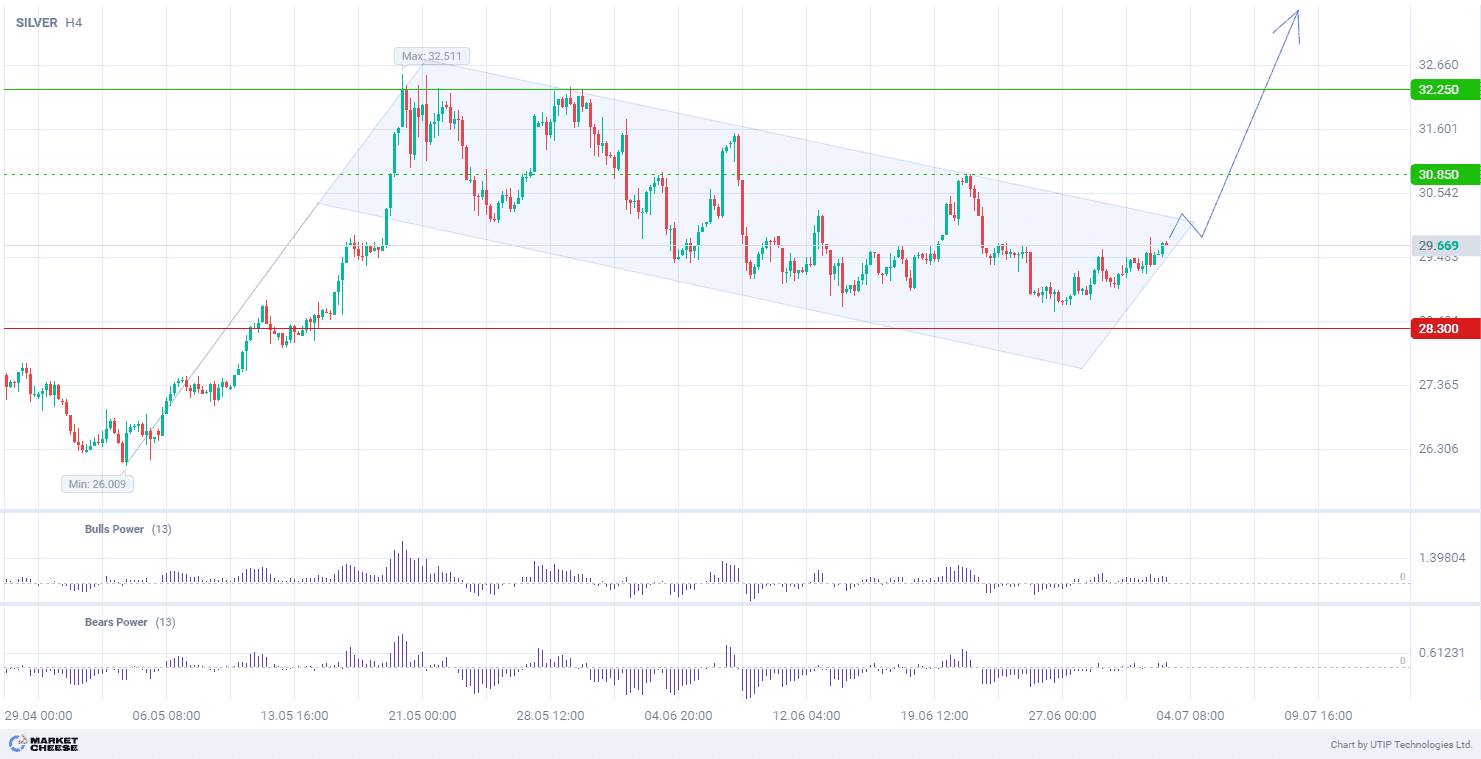

At the technical level, silver prices are within the main corrective part of the flag chart pattern on the H4 timeframe. The pole of the pattern has an upward impulse. While breaking through the flag resistance, the price may increase volatility towards growth. The Bulls Power and Bears Power indicators (standard values) are in the positive zone, confirming the formation of a buying trend.

Signal:

The short-term outlook for silver suggests buying.

The target is at the level of 32.250.

Part of the profit should be taken near the level of 30.850.

A stop-loss could be placed at the level of 28.300.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account