It is time for oil buyers to take good profits

In Thursday's trading session, Brent crude oil prices once again reached a six-month high. For the first time since late October, the price of oil surpassed the $91 per barrel mark. Since the middle of last week, the cost of Brent has risen by more than 7%, without a single pullback. On the eve of the weekend, many market participants will surely prefer to take profits, especially since a number of fundamental and technical factors are clearly in favor of at least a small correction.

The rise in oil prices does not sit well with major commodity consumers. In particular, the Chinese economy, which has just begun to recover its previous growth rates, is obviously not in favor of expensive fuel. At the beginning of 2024, Chinese refineries were increasing demand for oil, but last year it was purchased at much more favorable prices. Faced with a significant increase in the cost of oil, China is inclined to reduce imports and utilize accumulated stocks of raw materials.

Another factor that could halt the rally in the oil market is the US decision to stop replenishing the Strategic Petroleum Reserve (SPR). The Department of Energy is not willing to pay more than $79 per barrel for WTI, while current prices are above $86. Eventually, the US authorities may even start selling oil from the SPR again in an attempt to lower fuel prices ahead of the presidential election.

Bjarne Schildrop, chief commodities analyst at Skandinaviska Enskilda Banken, attributes the current rise in black gold prices to geopolitical instability in the Middle East. However, these events are only having a psychological impact on traders' sentiment, and the volume of oil supplies from the region has not changed significantly. According to Shieldrop, even a partial easing of tensions can cause a sharp correction in the oil market.

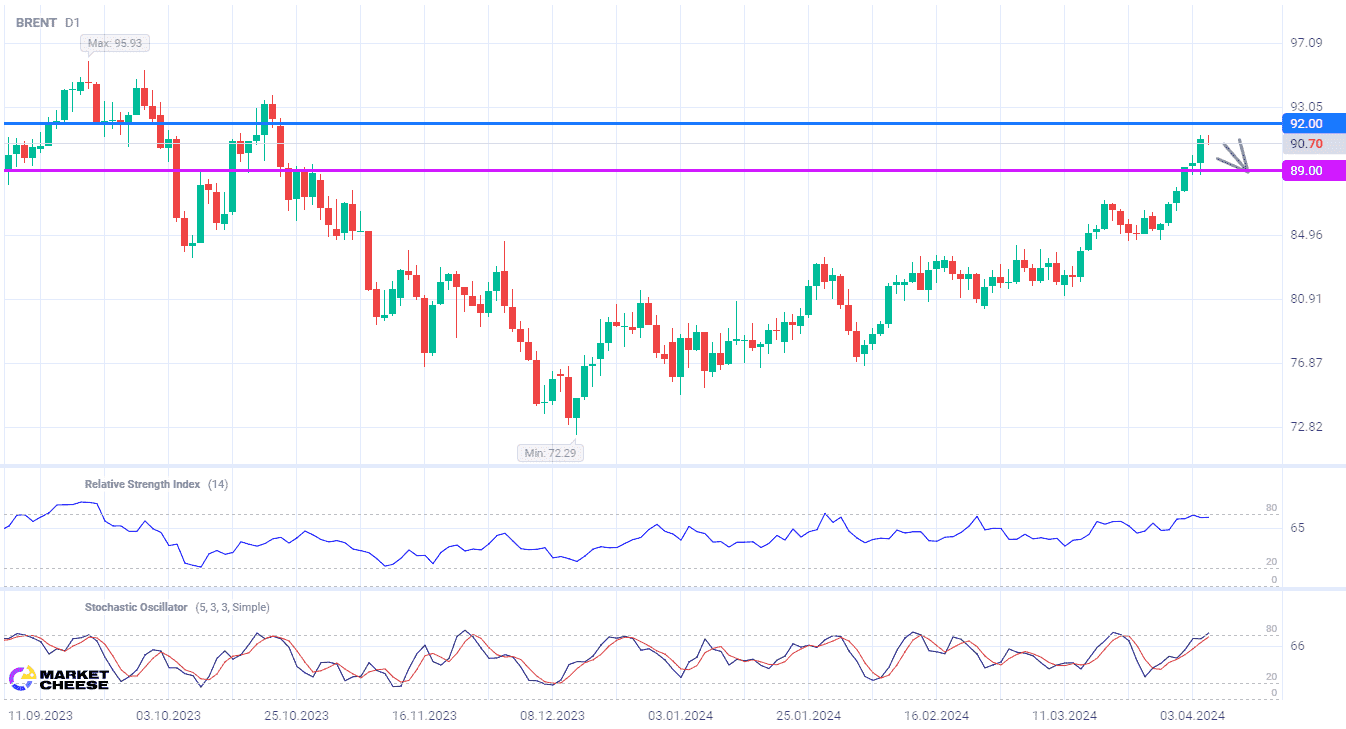

The RSI and Stochastic indicators on the Brent oil chart have reached the overbought zone and are preparing for a downward reversal, which will be accompanied by a full-fledged sell signal. The first target of the pullback is the 89 level.

Consider the following trading strategy:

Sell Brent oil at the current price. Take profit - 89. Stop loss - 92.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account