Japan is preparing to end negative key rate

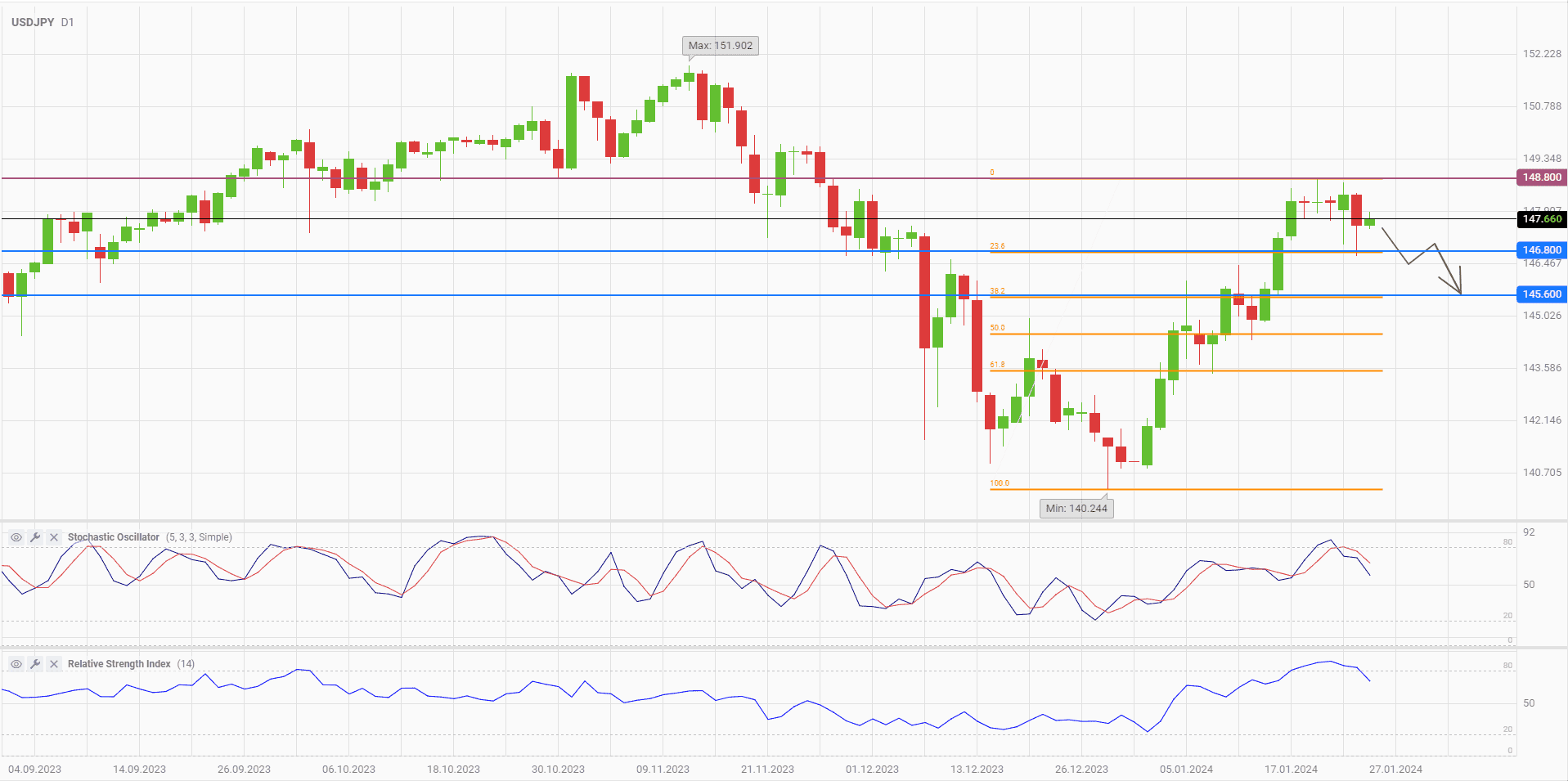

The USDJPY currency pair showed the sharpest fall over the month at Wednesday’s trading session. Although half of the correction was bought back by the end of trading, the price reversal signal towards decline is clearly seen in the technical indicators. The three-week uptrend leaves behind a lot of opportunities for the correction, which the bears have already started to use. The day before the quotes hit the first target at the level of 146.8, and this is by no means the limit.

The Bank of Japan held its first monetary policy meeting of the year on Tuesday. No crucial decisions were made, but market participants did not expect them. Much more interesting was the speech of Governor Kazuo Ueda and his comments on further actions of the BOJ. And there were significant changes in Ueda's rhetoric.

The BOJ’s governor pointed out the positive dynamics of inflation and wages in the services sector. Thus, the number of factors in favor of further shift from ultra-loose monetary policy is increasing. The moment of the first key rate hike since 2007 is getting closer, and market participants with almost 50% probability expect to see the regulator’s move in April. By summer the negative rate will be canceled with almost 100% probability.

The BOJ's position was supported by Masato Kanda, Deputy Finance Minister in charge of the country's monetary policy. According to him, the previous policy allowed Japan to overcome deflation and supported GDP growth, but there were also negative effects. Among them, he pointed out the yen's loss of its status as a safe-haven currency, which now only the dollar and the franc have. Higher interest rates may attract new investors in Japanese bonds.

On the daily chart of USDJPY, the RSI and Stochastic indicators are moving downwards after exiting the overbought zone. There are good chances for further decline in the quotes. If the level of 146.8 is broken, the sellers may target 145.6.

Consider the following trading strategy:

Sell USDJPY at the current price. Take profit 1 – 146.8. Take profit 2 – 145.6. Stop loss – 148.8.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account