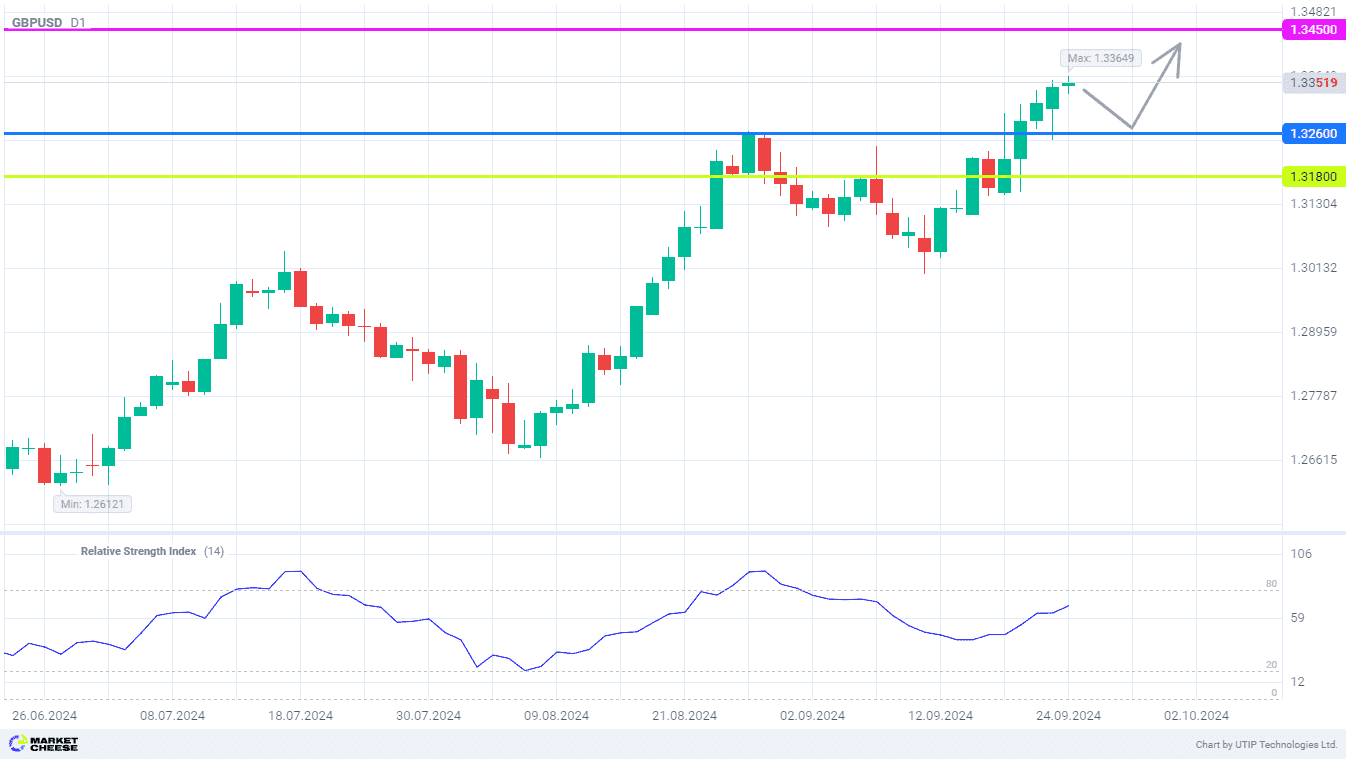

Level 1.345 is next target for GBPUSD buyers

The GBPUSD currency pair continues updating the 2.5-year highs on a regular basis. The entire drawdown of late August-early September was bought back in just a week, confirming the strength of the current uptrend. Now the prices may go into a local correction, but it is unlikely to go beyond the 1.326 level. The price pullback will provide an opportunity for lucrative opening of long positions with the expectation of the GBPUSD further growth to 1.345.

The strengthening of the pound against the dollar was supported by yesterday's speech of the UK Finance Minister, Rachel Reeves. Commenting on the budget preparation for 2025, Reeves dramatically changed her position regarding the country's transition to severe austerity. According to her statement, similar actions taken after the 2008 crisis have only exacerbated the problems in the British economy. Although spending cuts are necessary, they are not going to be massive. Moreover, the minister promised to exclude public investments from the budget deficit calculations.

The rejection of a large-scale sequester of British budget expenditures is a strong pro-inflationary factor. In such circumstances, the Bank of England should be very cautious in easing its monetary policy in order to avoid triggering a new surge in prices. The regulator's representative Catherine Mann urged to keep the restrictive level of interest rates until all the risks of another inflation wave disappear. In this regard, Mann welcomed the Bank of England's decision not to cut the key rate last Thursday.

The Reuters analysts note that traders have doubts about the further actions of the British regulator. Before the September 19 meeting, market participants were 100% confident in the monetary policy easing being delivered in November, but by the current moment this probability has fallen below 70%, in their opinion. According to new forecasts, the Bank of England will complete the cycle of rate cuts at the end of next year at about the level of 3.4%. A similar figure for the Fed is estimated to be at 2.9%, which suggests that the pound's advantage over the dollar will remain intact.

Technical indicators on the GBPUSD chart show the increasing probability of a correction. The price decline to 1.326 can be used for buying in anticipation of the following growth of the level of 1.345.

The following trading strategy option could be suggested:

Buy GBPUSD on the decline to the level of 1.326. Take profit - 1.345. Stop loss - 1.318.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account