Level 30 remains main target for buying out silver market drawdowns

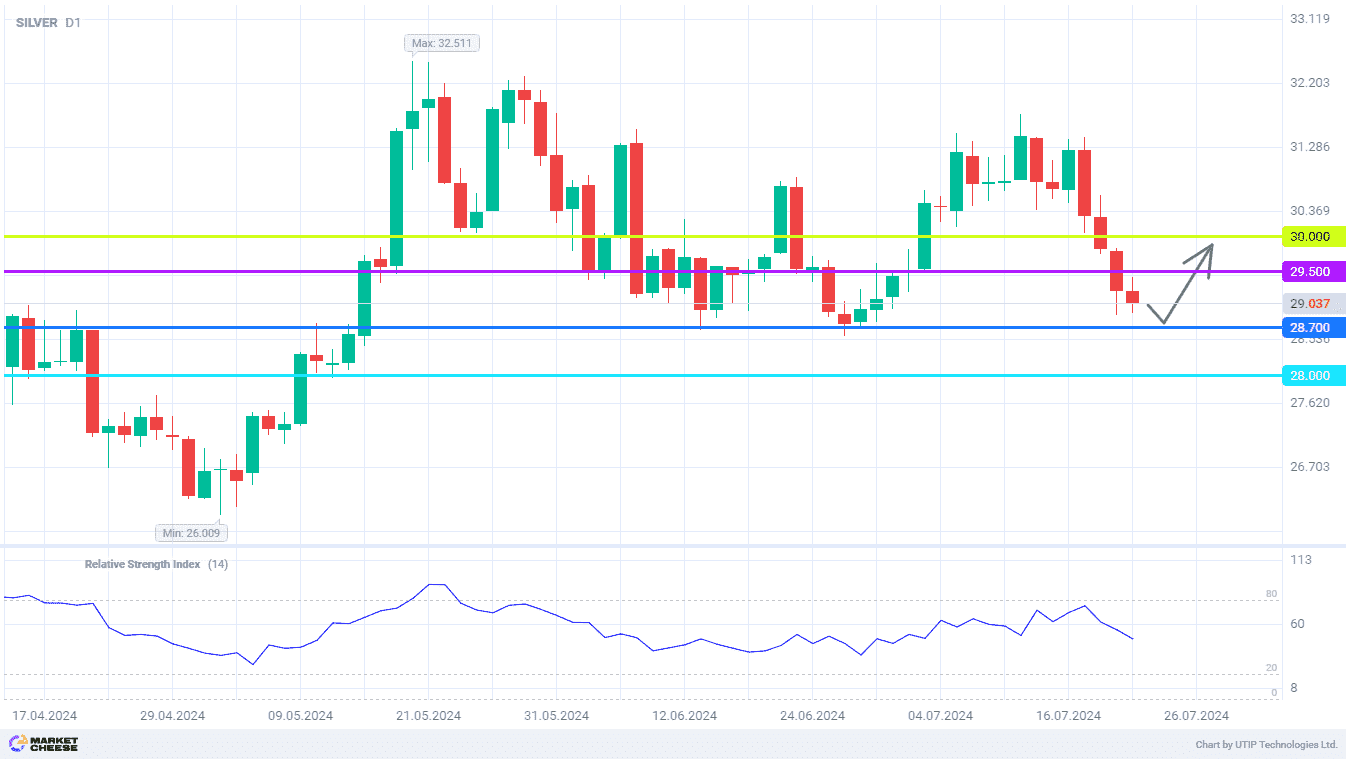

In the last week, silver quotes went into correction, having lost all the gains from the beginning of the month. Price came close to the range of 28.7-29, which in June has already proved to be a good support. At the current levels, the appeal of purchasing silver with expectation of the next upward reversal has grown considerably. If this scenario is realized, the bulls can again focus on the levels of 29.5 and 30.

Citigroup experts maintained a positive outlook on the precious metals market in their new report. According to their assessment, slowdown in consumer price growth and cooling of the US labor market increase the probability of a quick reversal in the Fed's monetary policy. Interest rates cuts by the Fed will be a favorable factor for silver prices and a number of other metals.

The bank's analysts studied the dynamics of precious metals prices during 4 previous cycles of the Fed's rate cuts. Their median yield was about 13% during 6 months after the first-rate cut. Over a 12-month period, the level of precious metals yields reached more than 20%, the report said. Citigroup's calculations are in line with forecasts for silver to rise to $38–40 per ounce by the second half of 2025.

Meanwhile, the physical market for silver remains in deficit. In 2023, silver shortages totaled 184.3 million ounces, but by the middle of this year, the shortage had increased to 215.3 million ounces. Keith Neumeyer, CEO of First Majestic Silver, estimates that the increase in the metal's shortage is due to a 2% rebound in industrial demand with a 1% decline in supply. Neumeyer predicts that silver shortages will continue at high levels in the coming years.

Last week's correction helped to relieve the overbought RSI indicator on the daily silver chart. In the 28.7–29 range, buyers of the metal will build up long positions in anticipation of a new wave of higher prices, with targets at 29.5 and 30.

The following trading strategy may be offered:

Buy silver in the range of 28.7–29. Take profit 1 – 29.5. Take profit 2 – 30. Stop-loss – 28.

Traders can also use a Trailing stop instead of a fixed Stop-loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account