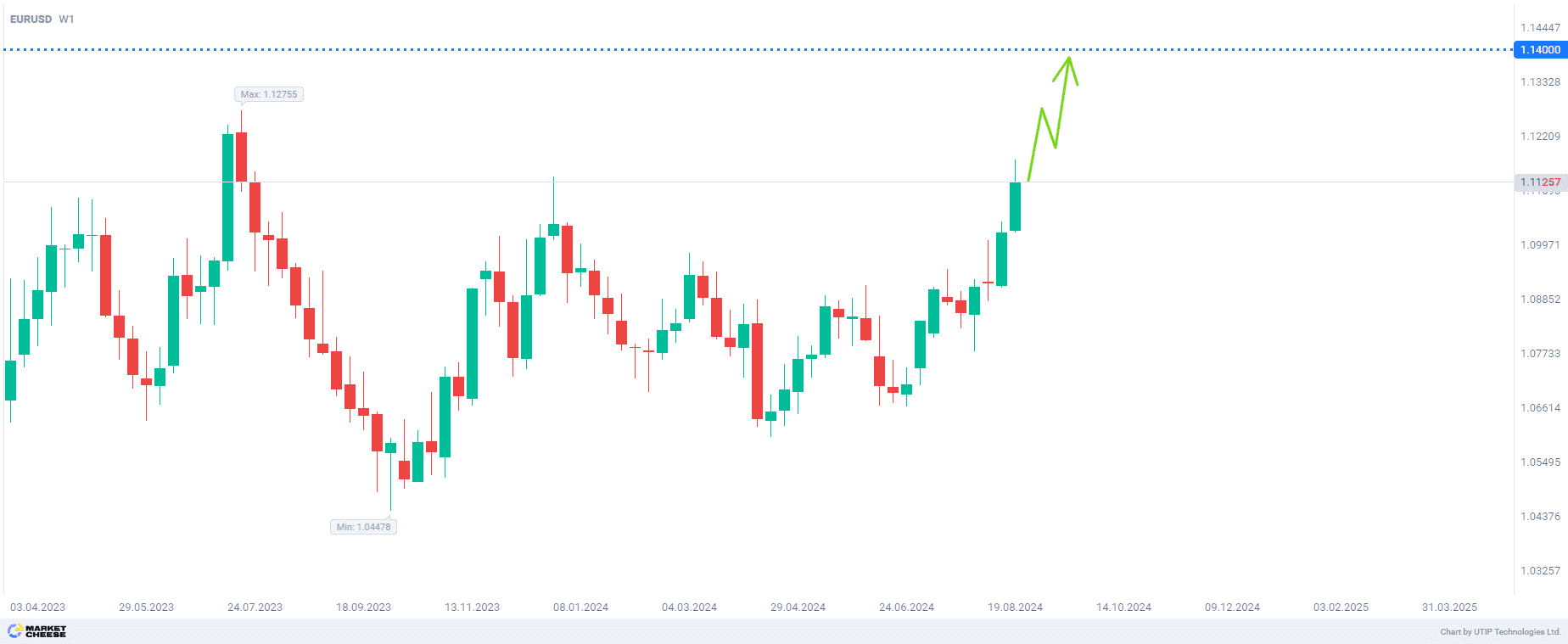

Long-term EURUSD buying to 1.1400 level

Minutes of the Fed's meeting released this Wednesday reported that the "vast majority" of policymakers believed that a rate cut in September would likely be appropriate if the expected data came in, confirming market expectations.

On Thursday, employment data showed that the number of Americans filing new claims for unemployment benefits rose last week, consistent with a gradual cooling of the labor market.

A slowdown in overall U.S. business activity this month added to evidence that the economy is slowing and inflation is falling. Mortgage rates have already started to fall, helping to support stronger-than-expected existing home sales.

As expected, the U.S. dollar went into a recovery correction against the euro ahead of today's speech by Federal Reserve Chairman Jerome Powell.

Interest rate futures markets have priced in a 25 basis point cut in the Fed Funds rate next month and the likelihood of a 50 basis point cut by the end of the year.

The U.S. central bank is expected to begin cutting interest rates at its upcoming meeting as most Fed officials are buoyed by encouraging inflation data and increasingly concerned about the labor market.

The Fed targets 2% annual inflation by the personal consumption expenditures price index; by that gauge inflation was 2.5% in July.

Looking ahead to the next 2-4 months, we should expect the EURUSD rate to strengthen to the 1.1400 level.

The overall recommendation is to buy EURUSD for the long term.

Profit could be taken at 1.1400. A stop loss could be set at 1.0900.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, does not exceed 2% of your deposit.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account