Natural gas prices may reverse trend amid higher demand and excess inventories

Natural gas prices are moderately higher on Monday as investors take advantage of last week's selling. The recent downtrend is due to high production levels and abundant gas in US storage.

Gas production in the 48 states rose to 102.1 billion cubic feet per day in July, up from 100.2 billion cubic feet per day in June and 99.5 billion cubic feet per day in May. This increase came after a reduction in drilling activity earlier in the year as prices fell to 3.5-year lows.

Utilities added 32 billion cubic feet of gas to storage for the week ended June 28, according to the US Energy Information Administration (EIA). The total amount of gas in US storage reached 3134 billion cubic feet. That's about 19% above normal for this time of year.

With hotter weather next week, gas demand, including exports, is expected to rise from 105.9 billion cubic feet per day this week to 106.8 billion cubic feet per day, according to financial services firm LSEG. The Electric Reliability Council of Texas (ERCOT), which manages the power grid for much of the state, said peak demand this week will approach but not exceed July's peak. The forecast is due to a heat wave that is forcing homes and businesses to turn their air conditioners on full blast.

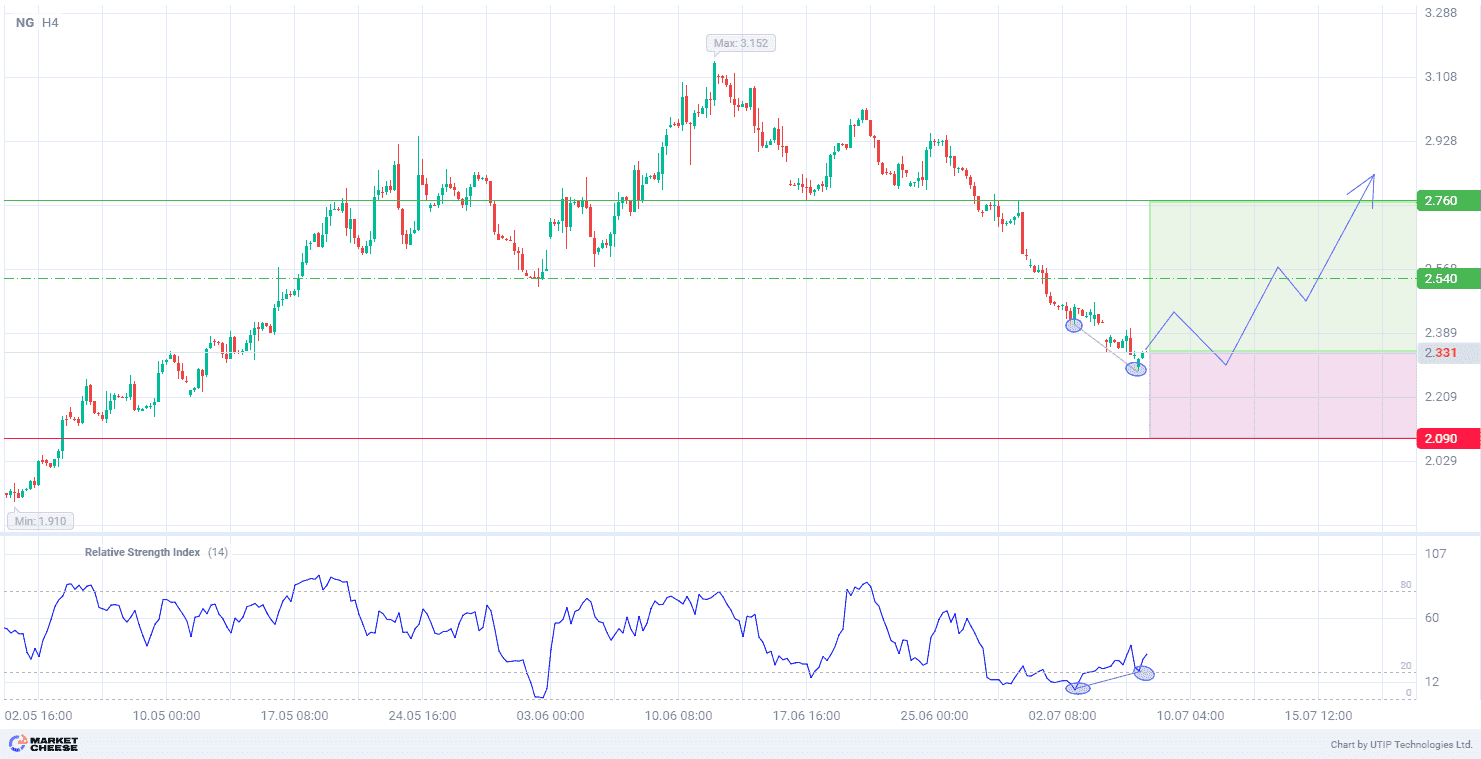

Natural gas price technicals are showing a downtrend on the H4 timeframe. The divergence of the Relative Strength Indicator (RSI) (default readings) indicates a possible trend reversal.

The short-term outlook for the natural gas price suggests buying with a target at 2.760. Partial profit taking is recommended around 2.540. A stop loss could be set at 2.090.

Since the bullish trend is short-term, the trading volume should not exceed 2% of your total balance to reduce risks.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account