New prime minister of Japan sent yen plummeting

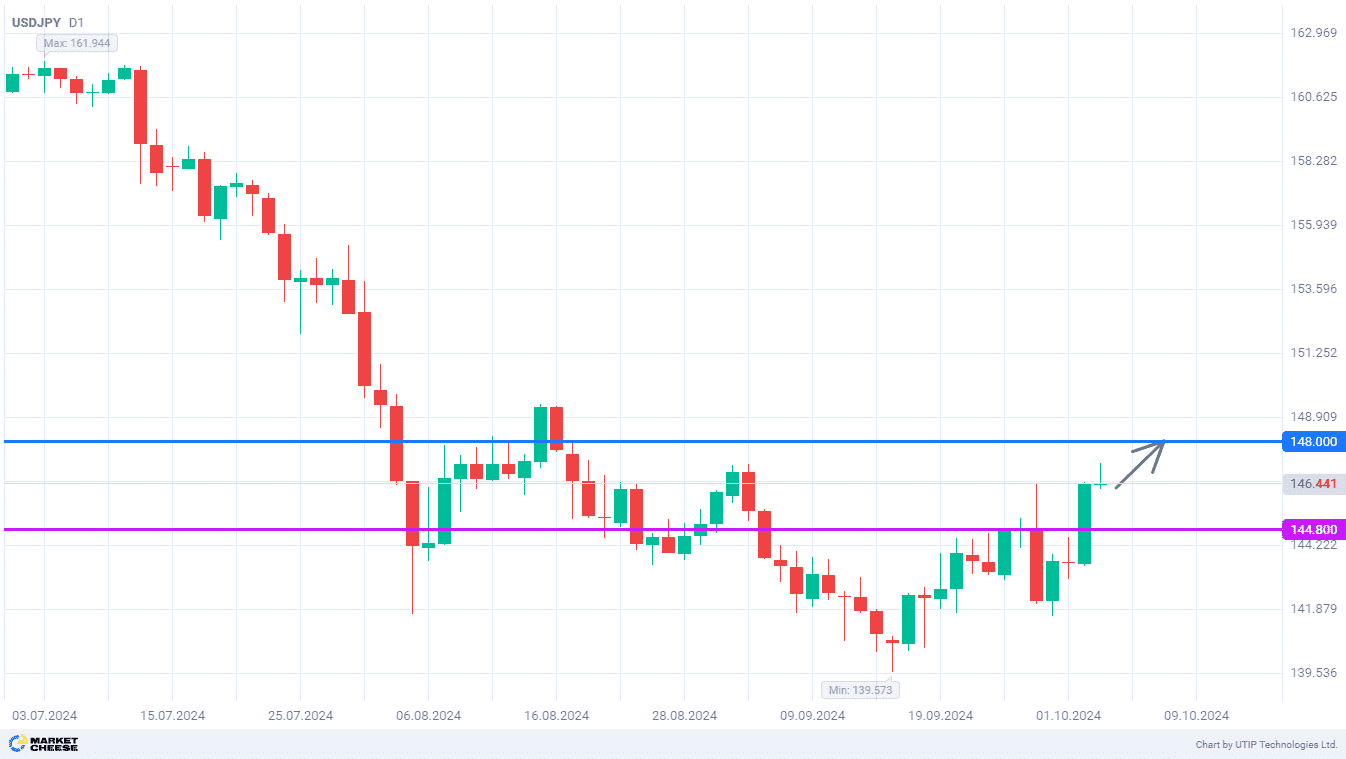

During Wednesday's trading session, the USDJPY currency pair demonstrated strong growth. The upward movement is continuing today, as the price has tested the level of 147 for the first time in a month. With such pace, the bulls can quickly reach the 148 level and the highs of August. In addition to the general strengthening of the dollar on the world financial markets, the news from Japan also contribute to the growth of quotations. As expected, the authorities of the country began to take measures against excessive strengthening of the yen.

During yesterday's speech, the new Prime Minister of Japan Shigeru Ishiba stated that the national economy is not ready for higher rates. According to analysts polled by Bloomberg, by doing so, the minister wants to win support before the parliamentary elections on October 27. The previous head of the government Fumio Kishida sparked discontent of Japan's business community due to the sharp strengthening of the yen, that led to the collapse of the stock market and reduction of revenues of exporting companies.

The given events caused a revision of market participants' expectations. Traders previously expected the next key rate hike to be delivered by the Bank of Japan in December, but now the timing has shifted to January. Taro Kimura from Bloomberg Economics believes that the Japanese regulator will take a wait-and-see approach, monitoring the Fed's actions. If the US central bank still manages to ensure a “soft landing” of the economy, the Bank of Japan will be ready for further tightening of monetary policy. But there is still not enough data to confirm this scenario.

Against this background, experts at RBC Capital Markets and Mizuho Securities expect a reversal of the medium-term trend of USDJPY towards growth. According to their estimates, quotations may return to the range of 150–155 yen per dollar. Since interest rates are not expected to rise in the near future, Japanese investors have no motivation to massively return capital to their homeland. Carry trade is getting relevant again, putting pressure on the yen exchange rate and increasing demand for dollars. According to Mitsubishi UFJ Trust and Banking Corp. forecast, this strategy will be effective until the end of the year.

As long as USDJPY quotations have not dropped below the 144.8 level, buyers have good chances to reach the 148 level. It may happen in the next few days.

We can suggest the following trading strategy:

Buy USDJPY at the current price. Take profit – 148. Stop loss – 144.8.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account