Oil price growth has stalled and risks a correction

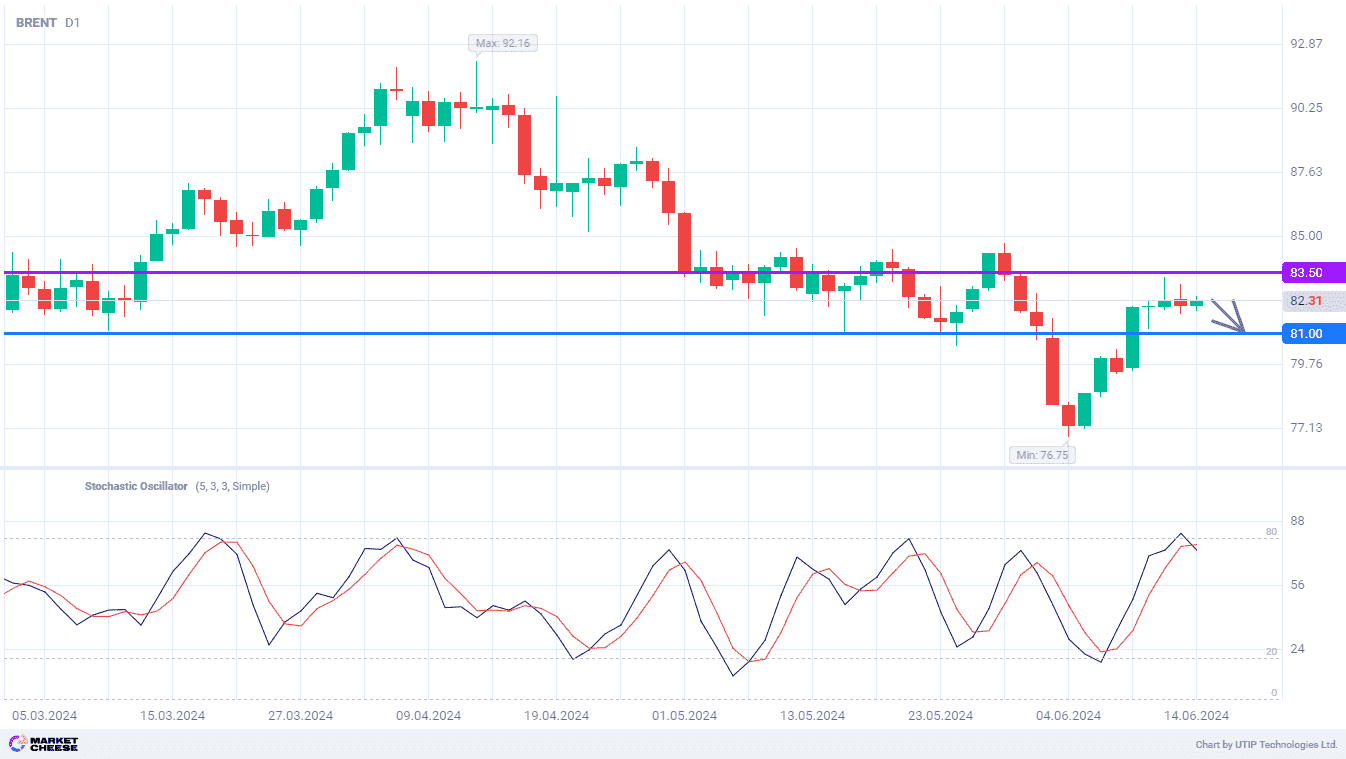

Brent oil prices at the beginning of the current week continued to rebound from the 4 month lows, set just below the level of 77. However, after strong growth on Monday, the upward movement stopped, the price began to consolidate around the 82 mark. After redeeming the drawdown that took place in late May and early June, the activity of bulls decreased. In such a situation, sellers of oil can intercept the initiative and bring the price down to the level of 81.

Oil market participants pay more and more attention to the demand from China. This country was supposed to become the main driver of crude consumption growth in 2024, but it has not happened so far. Instead, local refineries have started to reduce refining volumes. The crisis in the real estate sector has had a negative impact on the performance of the Chinese economy, and the constant increase in the number of electric cars raises the likelihood of a bearish trend in oil demand.

In the US, refining remains strong, but the gradual build-up of fuel inventories also suggests a lack of final demand for petroleum products. US gasoline stocks are now almost 6% higher than a year ago, while distillate stocks are 8% higher than a year ago. The buildup of inventories has a negative impact on corporate profitability, which may cause refiners to limit fuel production and reduce crude oil consumption.

Further pressure on oil prices could come from the recovery of exports from Kurdistan. According to Roth MKM estimates, this will increase the volume of supplies to the global oil market by 300 thousand barrels per day. Analysts see this scenario as moderately negative for commodity prices. The seasonal increase in demand observed in the summer will be offset by the increase in supply, and the price increase expected by market participants may not materialize.

The Stochastic Indicator on the daily chart of Brent crude is already signaling a short-term reversal and the imminent onset of a correction. The first target on the way down is 81.

Consider the following trading strategy:

Selling Brent oil in the range of 82-82.5. Take profit – 81. Stop loss – 83.5.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account