Pound returns to early February levels

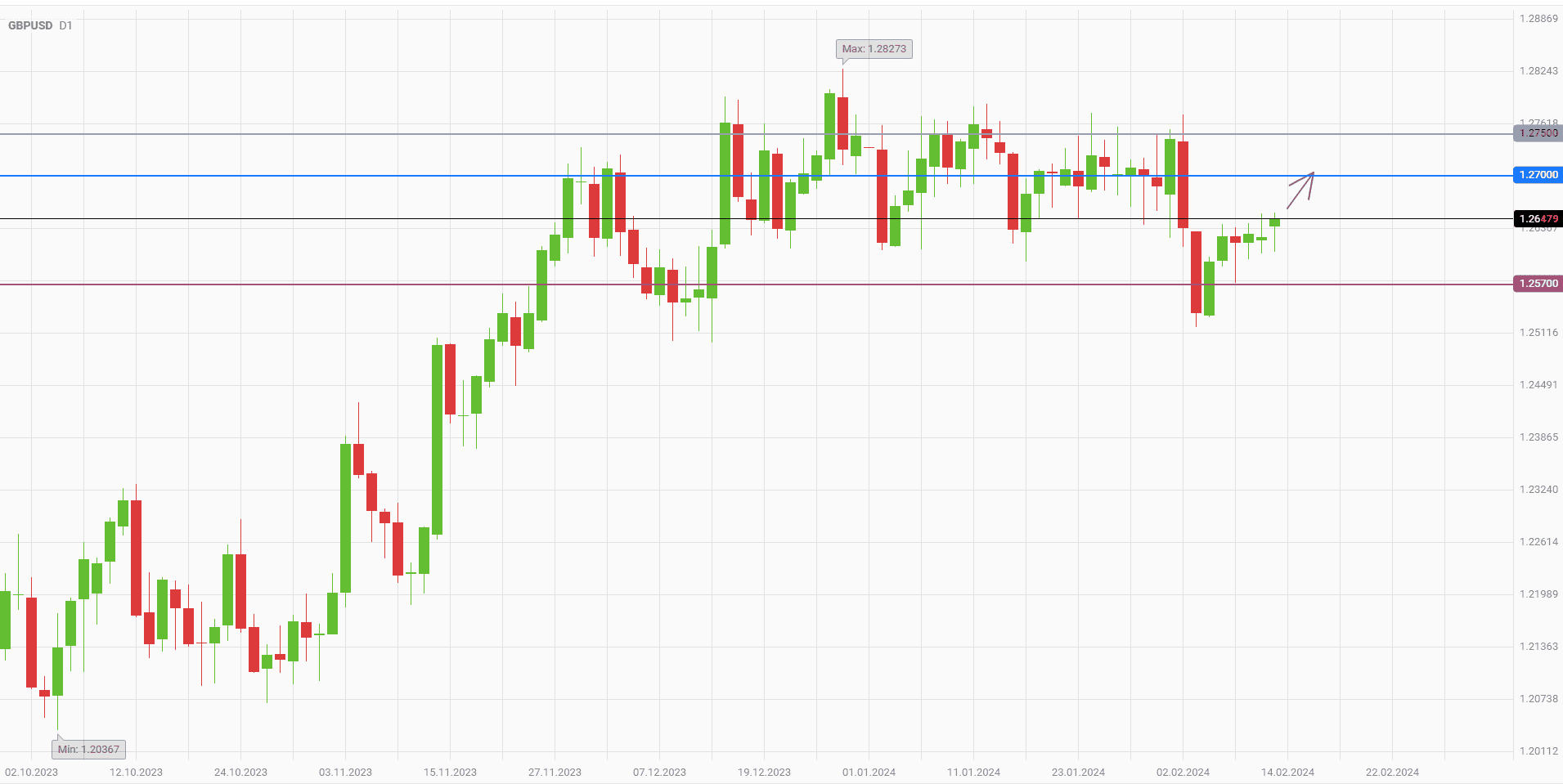

The GBPUSD currency pair is gradually recovering its positions after a sharp fall on February 2 and 5. The bears' pressure weakened below the level of 1.26, which the buyers of the British currency did not fail to take advantage of. By the current moment, half of the drawdown has already been recovered, and the next growth targets at 1.27 and 1.275 are becoming relevant. The quotes may reach the first of these levels in the nearest future.

The pound should be supported in its upward movement by the UK labor market statistics released today. All indicators were better than analysts' expectations. Noteworthy is the unemployment rate (3.8%), which returned to the lows of last spring. At the same time, the wage growth rate continues to slow down (from 6.7% to 5.8%), but still exceeds the forecast values (5.6%). The Bank of England received another argument in favor of a long period of keeping interest rates at current levels.

Keeping tight monetary policy makes the pound a very attractive object for carry-trade operations. Director of research XTB Kathleen Brooks notes high demand for the British currency, due to which it showed last year the second result against the dollar, losing only to the franc. At the same time, the yield of 10-year bonds of the United Kingdom is almost equal to US debt securities.

Bank of America currency strategist Kamal Sharma recommends traders to avoid short positions on the pound. According to his expectations, the Bank of England will be the slowest among global regulators in the cycle of interest rate cuts. Foreign exchange market participants have a similar view, holding a long position of more than $2.7 billion on the pound. This is one of the highest values in the last 10 years, indicating a significant potential for GBPUSD strengthening.

The current wave of GBPUSD growth can quickly enough bring quotes back to the levels of early February. At the same time, it makes sense to wait for today's US inflation data to increase the reliability of the deal. If the slowdown in price growth meets expectations, the dollar exchange rate will be under pressure.

The following trading strategy may be offered:

Buy GBPUSD in the range of 1.26–1.265. Take profit - 1.27. Stop-loss - 1.257.

Also, traders can use a Trailing Stop instead of a fixed Stop-loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account