Pullback in silver prices from 12-year high of 32.7 is not going to last long

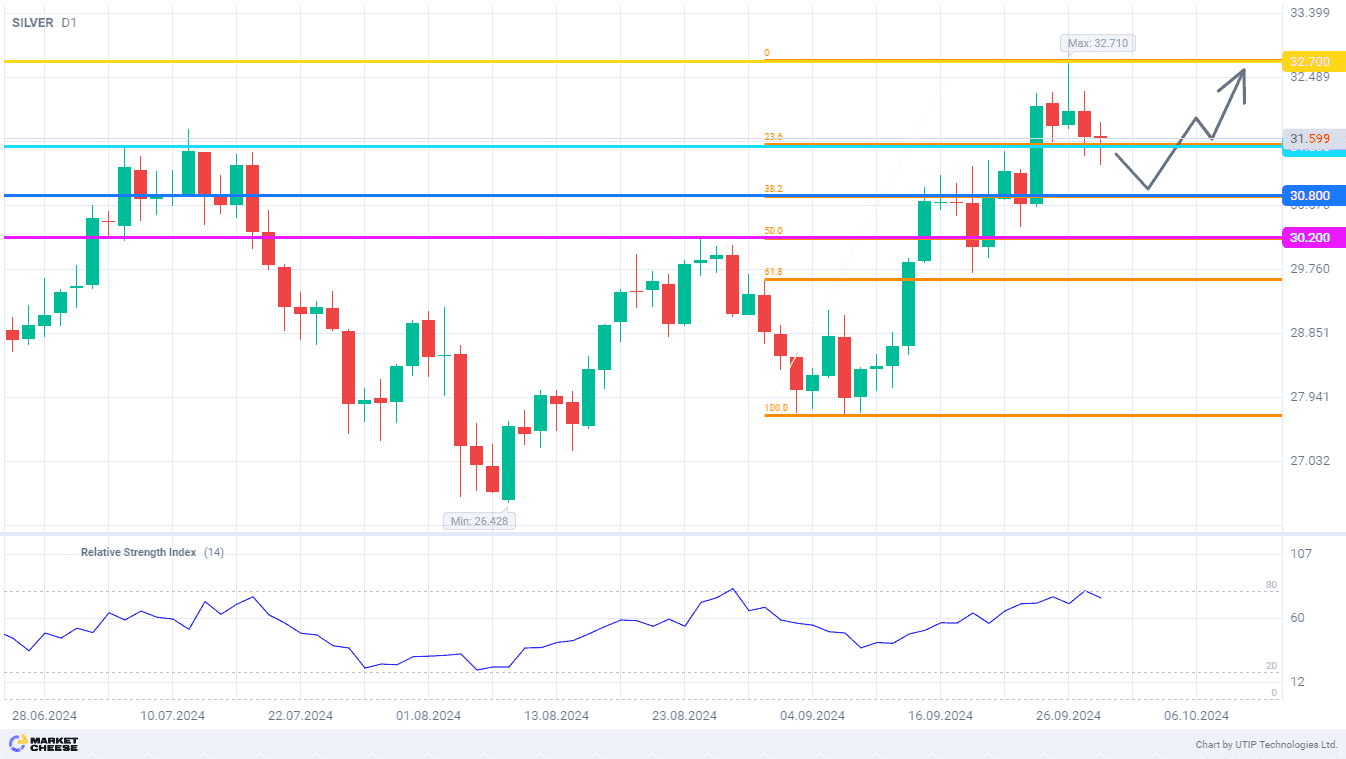

Last week, silver prices surpassed the July highs and reached 32.7 for the first time since December 2012. At those levels, buyers of the white metal were actively taking profits, as a result of which we see a downward price pullback. The first correction target at the 23.6% Fibonacci level (at 31.5) was quickly accomplished, and now the bears are turning their attention to the 38.2% Fibonacci level (at 30.8). This is where the silver price will again attract interest in terms of resuming growth.

The price of the white metal has been supported by a large-scale stimulus program for the Chinese economy, adopted in recent days by the country's authorities. Combined with the cycle of interest rate cuts by leading central banks, the demand for precious metals may rise significantly. Ole Hansen from Saxo Bank considers silver to be the main beneficiary of the recent changes. According to his estimates, the price of this metal will outperform gold quotes by 10%.

At the same time, the rally in the precious metals market is already showing signs of overheating. According to BTIG analysts, since the beginning of 2024 silver has grown in price by more than a third. From the tactical point of view a correction is most likely to occur now, and during this process it would be reasonable to increase long positions at more favorable prices. BTIG's longer-term forecast assumes the continuation of the rally in silver prices, the positive trend is expected to continue for at least 6–12 months.

Citi experts also keep expecting the price of the white metal to reach new multi-year highs. Their target price for silver until the end of this year is at the level of $35 per ounce. In 2025, the price of metal can rise up to $38. Representatives of the US bank point to the increasing deficit of silver in the global market, which may reach the 15-20% of the global consumption. This creates a strong fundamental basis for persisting high prices of the white metal.

The RSI indicator on the daily chart of silver prices has reached the overbought zone, confirming the correction signal. The price pullback to the 30.8 level can be used as a buying opportunity with the expectation of a further return to 32.7.

We can suggest the following trading strategy:

Buy silver near the level of 30.8. Take profit - 32.7. Stop loss - 30.2.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account