Pullbacks in gold prices may be good chance for taking long positions

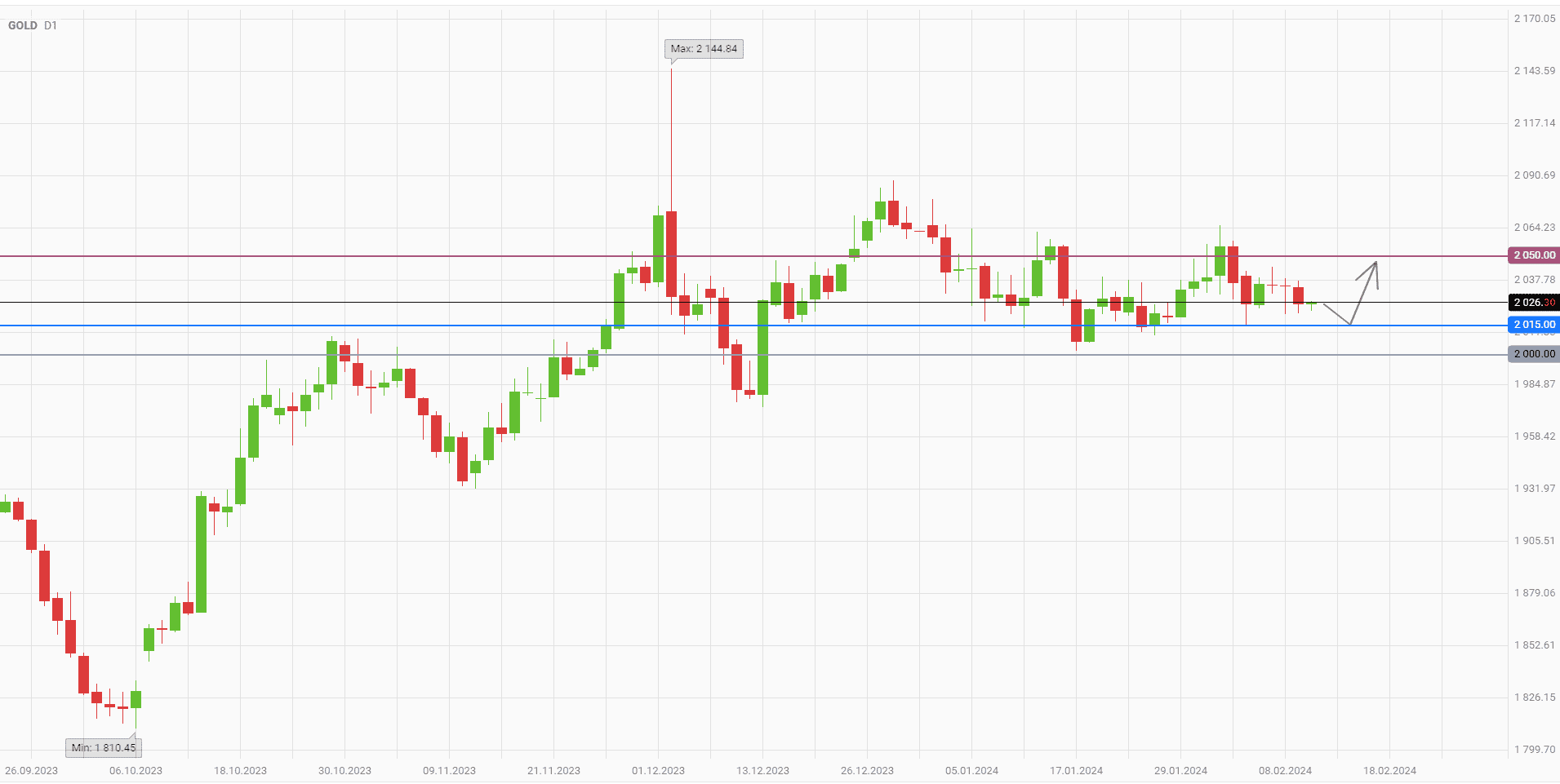

Gold quotes, in accordance with the previous forecast, once again made their way from the lower boundary of the sidewall to the upper. Above the level of $2050 per ounce, buyers have fixed the profit, and now gold is rolling back to the baseline. In the absence of a pronounced trend, it makes sense to gradually restore long positions at favorable prices, waiting for a new impulse of gold prices growth.

It is likely that market participants will see even more attractive prices for gold this week. Tomorrow in the U.S. will be published statistics on inflation for January, also in the coming days speeches of several members of the Federal Reserve System (Fed) are expected. These events may further strengthen the dollar and put pressure on gold. But in the long term it will not interfere with the next wave of growth of the precious metal.

Now several factors are playing against gold at once. The U.S. economy is actively growing, unemployment remains low, and the rate of inflation and wage growth is too high. In addition, the growth of the stock market attracts the main attention of investors, who withdraw some funds from safe haven assets. According to analysts TD Securities (TDS), a significant rise in gold prices will begin closer to the summer, when its price may reach $2300 per ounce.

TDS representatives expect the Fed to start the cycle of rate cuts in May or June, even if inflation will not reach the target level of 2% by then. Also, analysts pay attention to the events of the second half of the year, in particular the presidential elections in the U.S. Promises of candidates to reduce taxes and increase spending will boost demand for gold. In such a situation, investors tend to look for protection against inflation, and gold has historically been very successful in fulfilling this function.

It seems to be an interesting tactic to buy gold if the price approaches the level of 2015. As long as quotes are holding above the support of 2000, the main scenario is a new rise to the level of 2050.

The following trading strategy may be offered:

Buy gold near the level of 2015. Take profit — 2050. Stop-loss — 2000.

Also, traders can use a Trailing Stop instead of a fixed Stop-loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account