Second rate cut by Bank of Canada will send USDCAD to 1.383 level

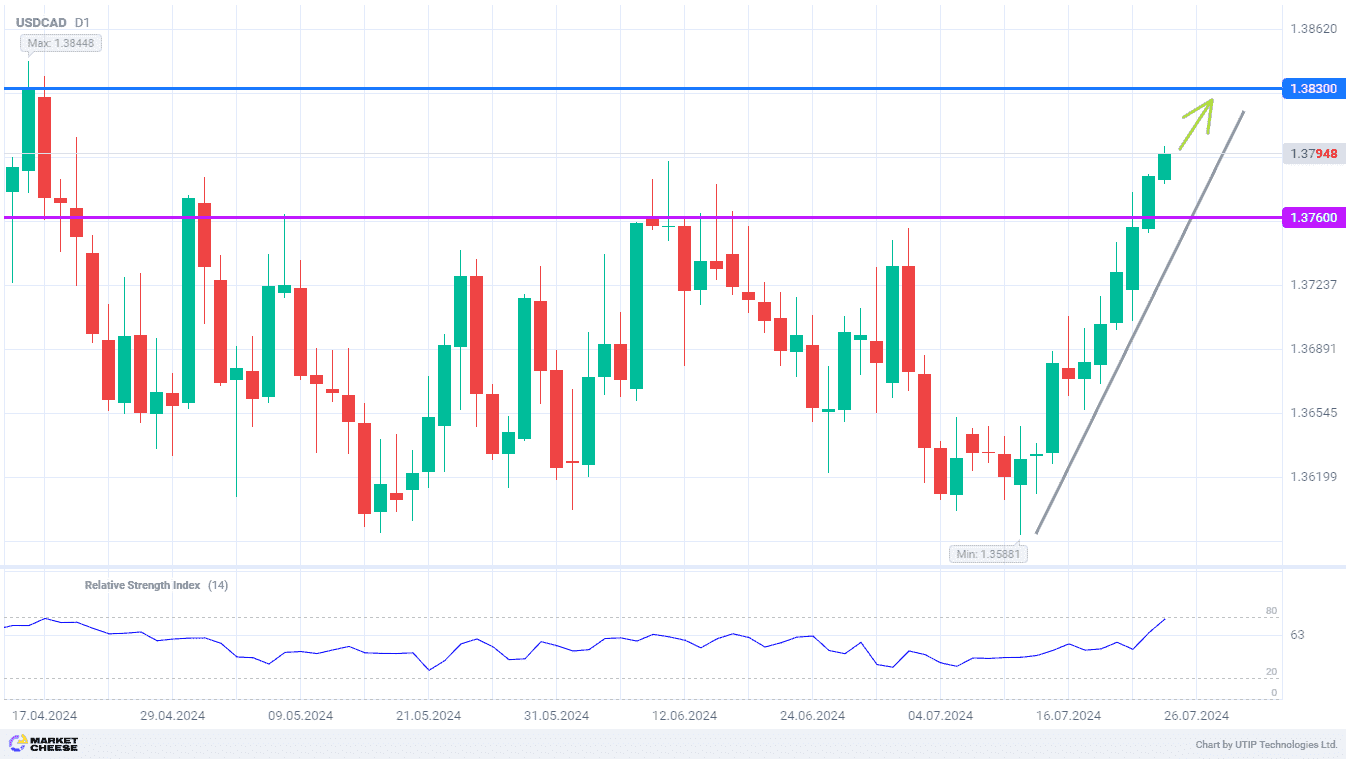

The USDCAD currency pair continues to move in line with the uptrend that started at the July low of 1.359. Quotes have already recovered all summer losses and are now aiming for the annual maximum, set in April, above the level of 1.384. The wave of strengthening of the U.S. dollar against its Canadian counterpart does not yet show signs of ending, except for the emerging overbought on technical indicators. It is likely that traders will indeed start profit taking, but not before updating the 2024 top.

The Canadian dollar is showing a decline against most other currencies amid expectations of the outcome of today's meeting of the Bank of Canada. According to Reuters poll, the key rate will be reduced from 4.75% to 4.5% with a probability of more than 80%. Analysts will also be interested in the Bank of Canada's updated forecasts for economic growth and inflation for the current year. Most likely, both indicators will be revised downward.

Randall Bartlett, senior director at Desjardins Group, notes weak indicators for the Canadian economy in 2024. He estimates that almost all GDP growth is now being driven by increased population migration rather than domestic factors. Avery Schoenfeld, chief economist at CIBC Capital Markets, also points to negative statistics on retail sales, investment and the real estate sector. In such an environment, forecasts for the Canadian economy to grow by 1.5% this year and 2.2% next year are unlikely to be met.

In an interview with Bloomberg, Carlos Capistran of Bank of America said that chances of further monetary policy easing in Canada are high. According to him, earlier analysts believed that the Bank of Canada would not want to get too far ahead of the Fed in the rate-cutting cycle. However, the economic situation in Canada worsened faster, so this divergence looks justified. Besides, the scale of the Canadian dollar depreciation does not cause concerns yet, allowing the country's regulator to lower the cost of borrowing again.

The USDCAD uptrend line supports the bulls in their intention to reach 1.383, and possibly to renew the maximum of the current year. In this case, it is worth to take profits, as the risks of correction will increase significantly.

The following trading strategy may be offered:

Buy USDCAD at the current price. Take profit – 1.383. Stop-loss – 1.376.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account