Selling AUDCAD as Australian inflation cools

Australia's central bank considered it necessary to remain “vigilant” about the risks of higher prices and kept interest rates at a 12-year peak, stating that the latest data had been insufficient to provide an accurate inflation forecast.

Minutes of the Reserve Bank's June 17–18 meeting published on Tuesday showed that the board discussed further policy tightening but decided to keep the key rate at 4.35% as a “more appropriate” option.

The Reserve Bank of Australia (RBA) also reiterated that it will do whatever is necessary to bring inflation back to its 2–3% target and that it is “difficult to either assume or rule out” future policy moves.

The minutes shed light on the board's line of thinking, and there is a chance that the RBA may resume policy tightening at its meeting on August 5–6. These fears intensified after a partial gauge of consumer prices showed that inflation accelerated to 4% in May, well above the central bank's target of 2–3%.

Financial market (overnight rate) suggests a 65% chance of a key rate hike to 4.6% this year, although a Bloomberg News survey conducted between June 28 and July 1 showed that most economists expect the RBA to keep interest rates unchanged in August and throughout 2024.

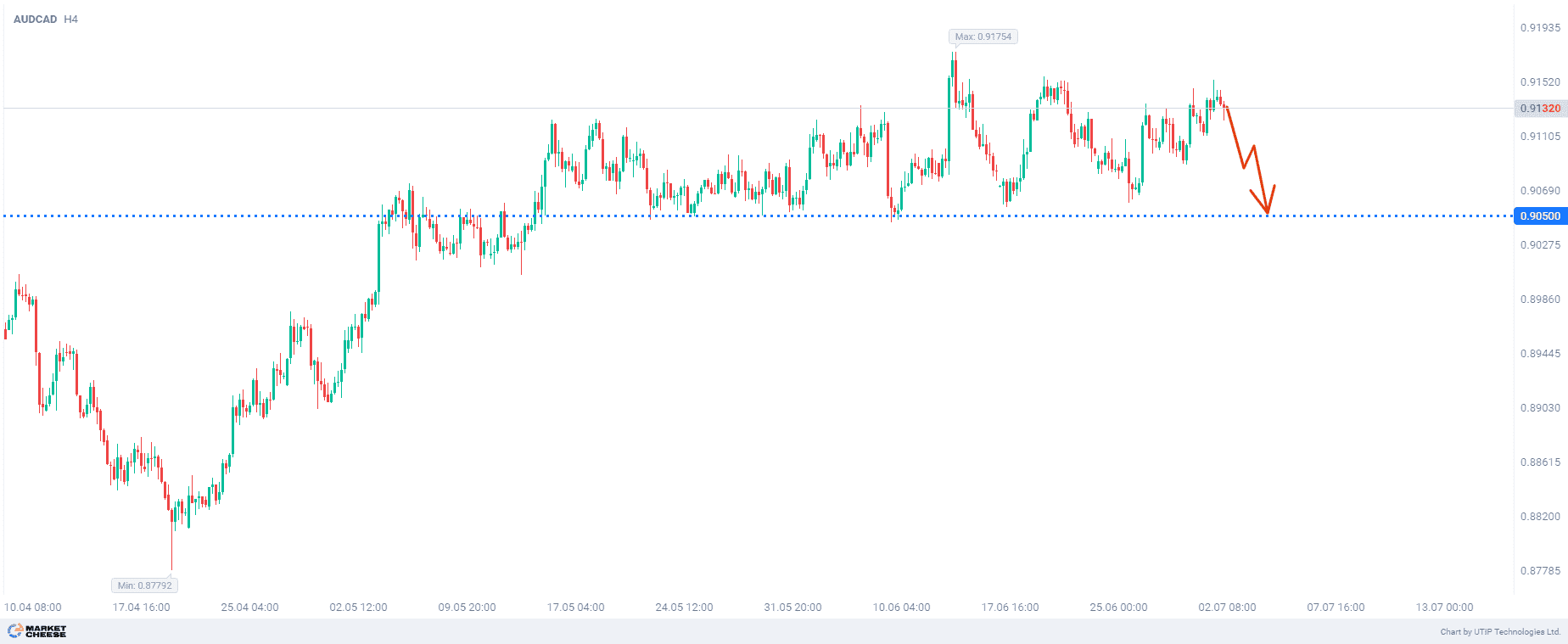

The scenario of the RBA interest rate hike is likely to be considered by the market and included in the AUDCAD quotes, so slower inflation in the Australian economy will relieve this tension and turn the quotes down to 0.9050.

The overall recommendation is to sell AUDCAD if the next data on consumer inflation in Australia will be lower than forecasts.

Profits should be taken at the level of 0.9050. A Stop-Loss could be set at the level of 0.9200.

The possible loss should not exceed 2% of your deposit funds.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account