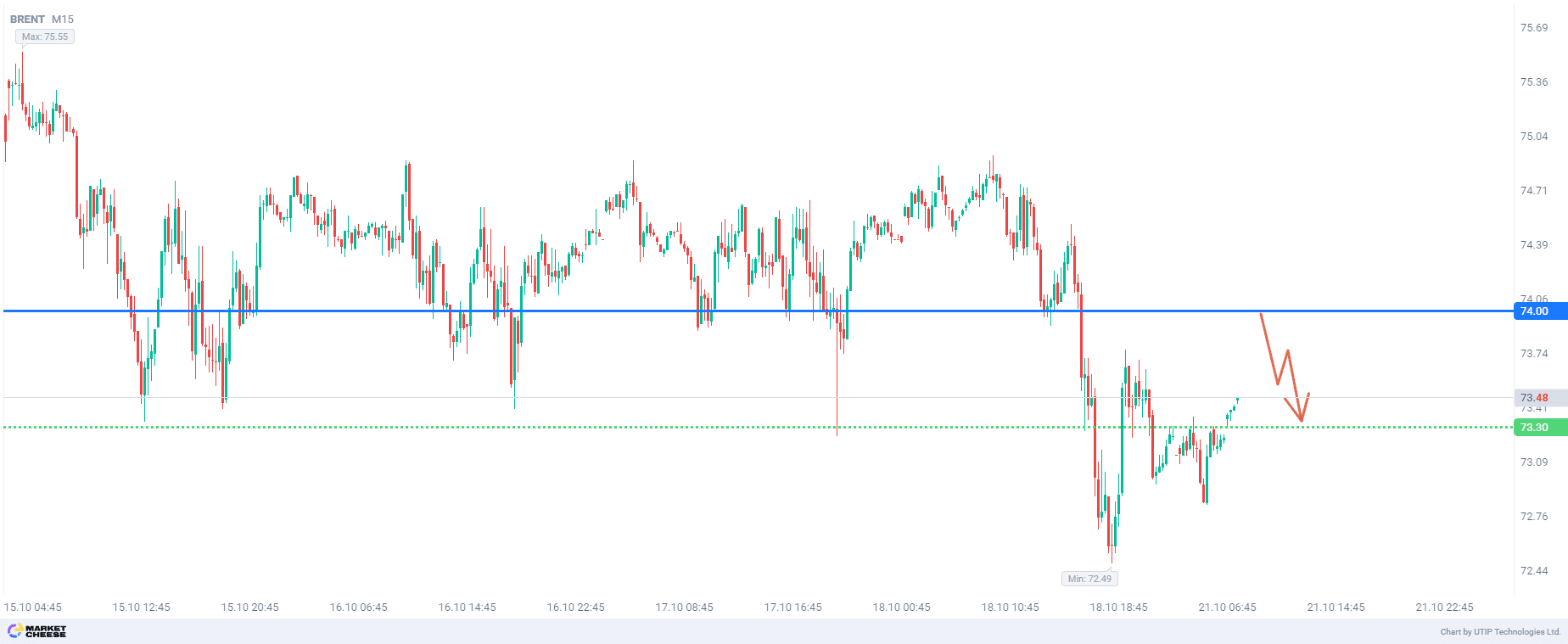

Selling Brent oil from 74.0 level

Last week saw the release of the monthly reports from OPEC and the International Energy Agency on the current state and outlook of the global oil market.

According to the IEA's forecast, oil demand will increase by 860 thousand bpd in 2024. This is a downgrade of 40 thousand bpd from the previous forecast.

In the third quarter, oil demand grew by only 680 thousand bpd, the agency said. This is the lowest growth rate since Q4 2022, when China's economy was still in full lockdown. In 2025, the IEA expects oil demand to grow by just 1 million bpd.

The IEA notes a significant slowdown in China's oil demand. According to the agency, China accounted for 70% of demand growth in 2023, while this year and next year, it will account for only 20% each.

The OPEC group also lowered its forecast for global oil demand growth in 2024 (for the third time in a row), this time by 106 thousand barrels per day.

In absolute terms, oil demand in 2024 will amount to 104.14 million barrels per day. The forecast for demand growth in 2025 is also lowered - by 102 thousand barrels per day to 1.6 million barrels per day.

The forecast is lowered mainly due to actual data received and lower expectations for demand in some regions.

According to the OPEC report, the Organization for Economic Cooperation and Development (OECD) countries will only add 0.1 million bpd to oil demand growth in 2024. At the same time, demand in non-OECD countries will increase by 1.8 million barrels per day.

The report notes that half of the growth in oil supply in 2024 will come from the United States. Canada, Brazil and China will also be important drivers of oil supply growth.

If the general pessimistic scenario outlined by the IEA and OPEC is confirmed in reality, it is worth selling Brent oil at any technical resistance level reached.

As of today, this resistance level is the round mark at 74.0 dollars per barrel of Brent oil.

The overall recommendation is to sell Brent with a pending limit order at the 74.00 mark.

Profit could be taken at the level of 73.30. A stop loss could be set at 74.50.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, does not exceed 2% of your deposit.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account