Selling Brent on low value of US business activity index

Tomorrow Tuesday at 20.45 and again at 21.00 (GMT+3.0), the ISM Manufacturing New Orders Index and the ISM US Manufacturing PMI will be released.

The ISM Manufacturing New Orders Index is a leading indicator reflecting the expected volume of industrial production in the future. It is worth noting that in the US this indicator has been declining since April this year (except for a slight increase in June).

The start of the Fed's monetary policy easing cycle should trigger growth in industrial activity in the future, but now it is difficult to tell how long it will take. The dynamics of PMI may remain under the impact of negative inertia for a long time to come.

Along with the PMI in the manufacturing sector, the dynamics of the Manufacturing New Orders Index indirectly points to the value of future demand for raw materials and other production inputs. Therefore, further decline in the values of these indicators may cause a fall in oil prices in the short term.

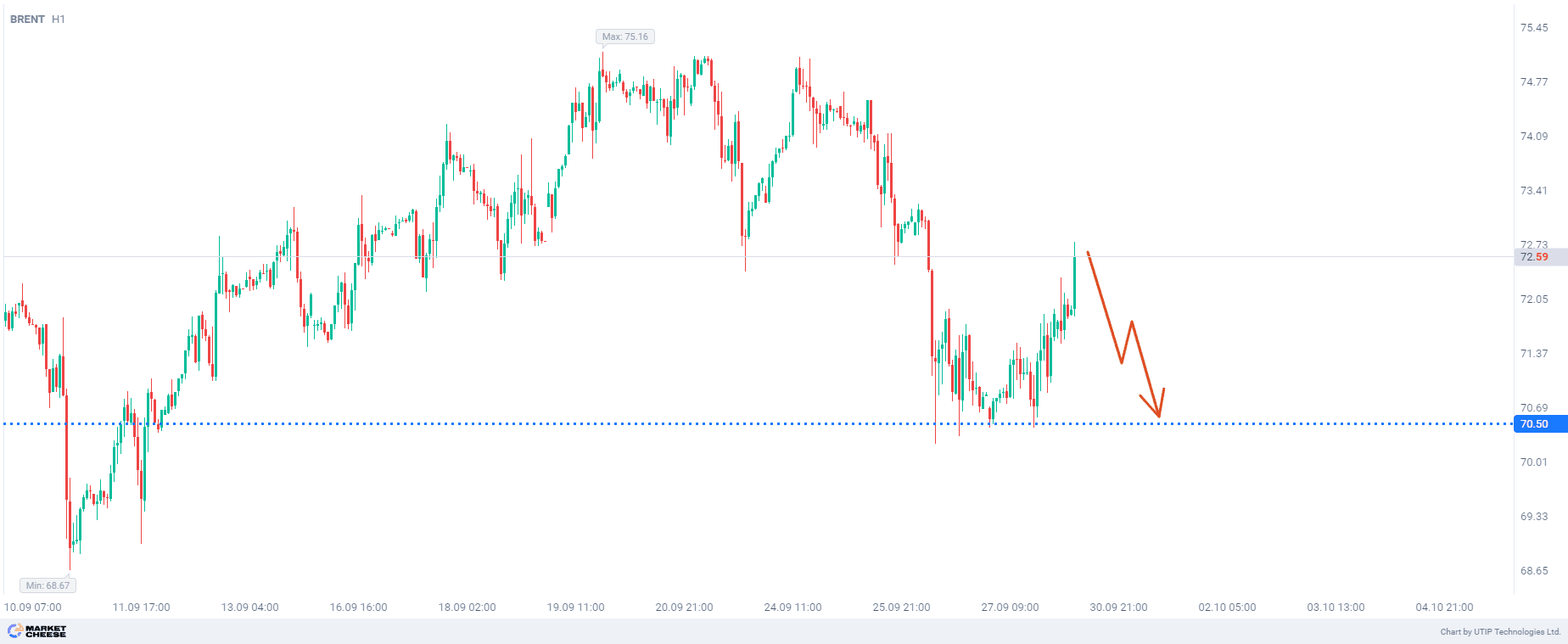

The target of such a short-term decline may be the previously formed local lows on the hourly timeframe. For Brent oil, the level of 70.5 can be considered as a target.

The final recommendation is to sell Brent oil, in case the actual value of the ISM US Manufacturing PMI is below 47.0 and the value of the ISM Manufacturing New Orders Index is below 44.2.

It is recommended to enter the transaction on selling Brent, provided that the price at the time of entry is not lower than the level of 72.5 dollars per barrel. Otherwise, it is better to avoid entering the trade.

We take profit at the level of 70.5. The loss is fixed at the level of 74.0.

The volume of the opened position should be defined in such a way that the value of the possible loss, fixed with the help of a protective stop order, amounts to no more than 2% of the size of your deposit funds.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account