Selling EURUSD if German CPI does not exceed forecast estimate

This week's eurozone economic data will provide the European Central Bank with crucial information on whether to resume interest rate cuts in September. Investors estimate the probability of such a step at almost 90%.

With the ECB keeping borrowing costs unchanged this month, officials emphasized that the decision in September will depend on a range of economic data due by then.

ECB President Christine Lagarde stressed the importance of such information, claiming that the next decision will be “wide open.”

The first set of numbers was already released last week, presenting a surprisingly negative view of the eurozone economy. Private-sector output did not increase in July, according to S&P Global business surveys, while the monthly Ifo survey pointed to a deterioration in sentiment among German companies.

This is how Bloomberg Economics assesses the situation:

“Our base case is that data released between now and the ECB’s September policy meeting will pave the way for another rate cut then. Favorable energy base effects should leave headline CPI within touching distance from the ECB’s 2% target in the August print, and there will likely be more evidence underlying price pressure is easing, both in services inflation and in the wage data.”

The emerging picture of a slow recovery and stubborn price pressures may prove challenging for the ECB officials. But the details are of greater importance than usual, putting additional weight on the final inflation readings that will be released in mid-July and August.

At the moment, services inflation remains a key indicator, as labor costs play an important role in the sector. ECB Executive Board member Isabel Schnabel said that maintaining this gauge is the main reason why the last steps are still challenging.

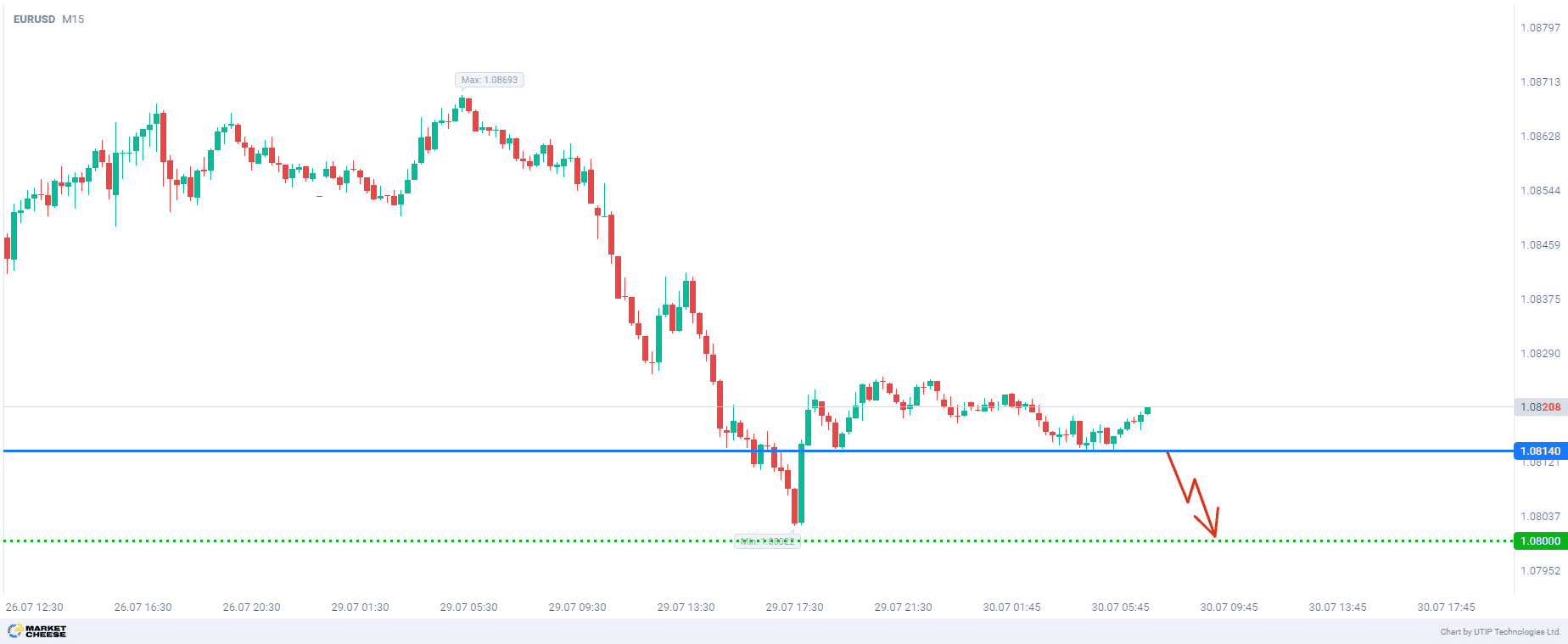

As of today, the movement of EURUSD is likely to be determined by the German Consumer Price Index data. If the actual value does not exceed the forecast, it will push EURUSD down.

The final recommendation is to sell EURUSD in the short-term from the level of 1.0814, provided that the German CPI is not higher than expected.

Profits should be taken at the level of 1.0800. A Stop-loss could be set at 1.0825.

The value of a possible loss should not exceed 2% of your deposit funds.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account