Selling EURUSD in case expectations of lower U.S. inflation are not confirmed

The much-awaited U.S. consumer inflation figures for June will be released today at 16:30 GMT.

It is believed that in recent weeks market participants have come to accept the likely scenario of a two-step Fed rate cut: in September and December. This scenario will be relevant if CPI readings continue to decline gradually and the labor market cools. Any sharp deviation from these expected vectors of events in the direction of inflationary growth and labor market heating will lead to an immediate revision of this scenario, which will lead to a sharp strengthening of the U.S. dollar and a decline in EURUSD rate.

The value of the consumer price index (year-on-year) is expected to fall from 3.3% to 3.1%.

At the same time, the core CPI (y/y) will remain at the same level as in May, at 3.4%.

The total number of people receiving unemployment benefits is expected to increase from 1,858 thousand to 1,860 thousand.

The market's reaction is particularly strong when events begin to develop in the opposite direction to the mainstream. The market waits for inflation to cool down and prices it in even before the statistical data are released, and the impulse to move in the opposite direction will be all the stronger if the actual data do not justify the expectations. This backwardation approach can be used in today's trading plan.

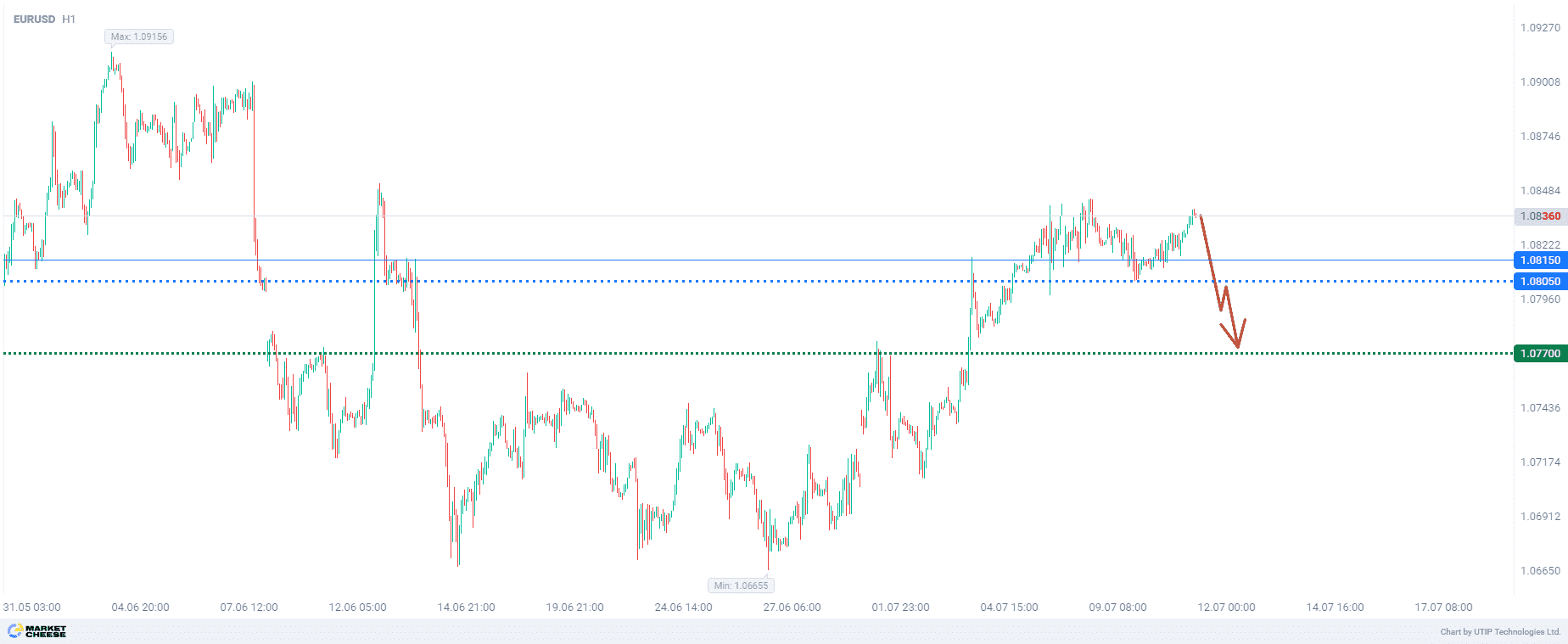

From a technical perspective, EURUSD has two targets below the current price level — the supports at 1.0805 and 1.0770.

The final recommendation is to sell EURUSD if the CPI (year-to-year) is above 3.3% and the total number of people receiving unemployment benefits is below 1.850 thousand.

Otherwise, do not enter the market.

Profit could be taken at the level of 1.0770. A stop loss could be set at 1.0870.

The amount of possible loss should not exceed 2% of your deposit funds.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account