Selling EURUSD to 1.0850 on PPI reading above June level

Today at 16:30 (GMT), a series of U.S. producer price indices will be released for the month of July. Inflation rate is assessed by a number of related indices, the most important of which are the Consumer Price Index (CPI), the Personal Consumption Expenditures (PCE), and the Producer Price Index (PPI).

The mechanism of interrelation between them works in such a way that a high value of the producer price index will be reflected in consumer prices after some time, i.e. to some extent this is a leading indicator of the level of inflation in general.

Now that the countdown to the Federal Reserve's likely first rate cut in September has begun, each of the remaining reports on inflation and the labor market has a large and very nervous impact on the market, causing high and sometimes unwarranted volatility.

It is forecast that the value of the producer price index (year on year) will amount to 2.3%, compared to 2.6% in the previous period. At the same time, no change in the index value (month to month) is expected, it is estimated to remain at the previous level of 0.2%.

The forecast for the narrower core index is even more optimistic. The month-to-month rate is expected to fall from 0.4% to 0.2%, while the year-to-year change is forecast to be 2.7%, down from the previous reading of 3.0%.

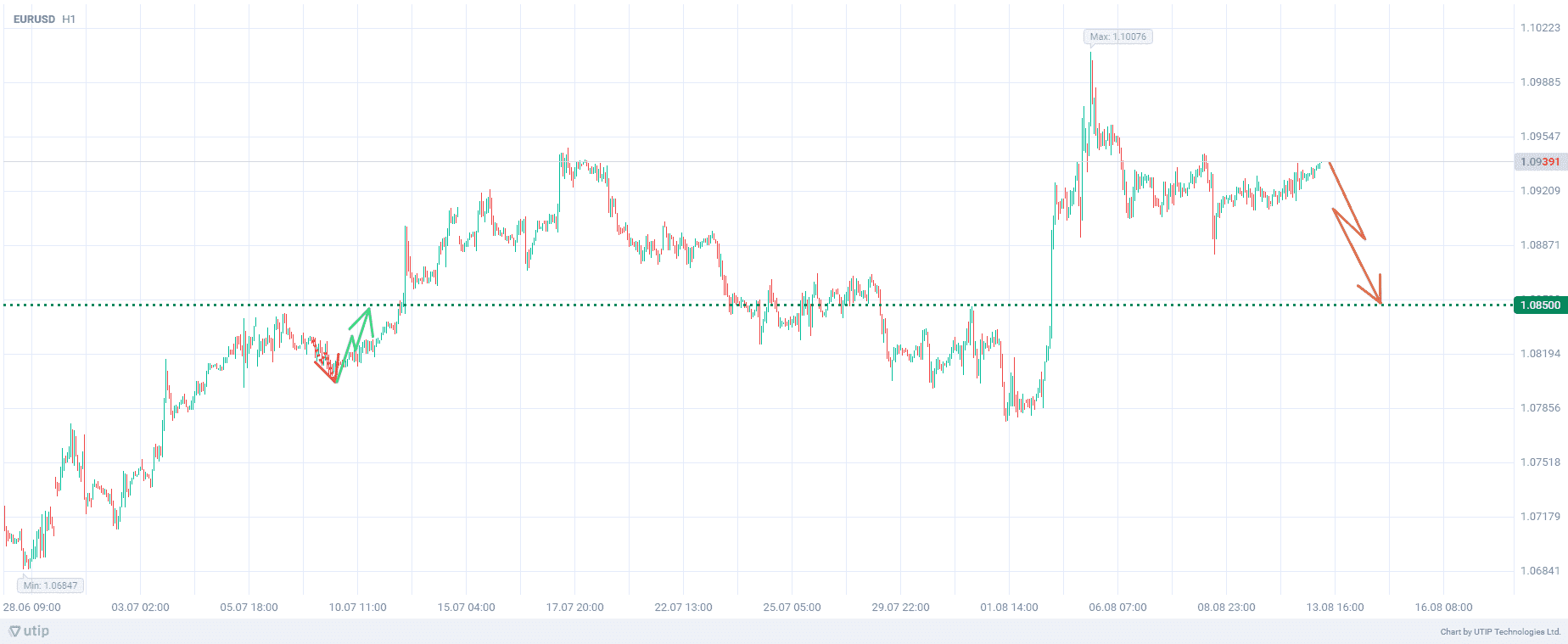

To achieve a stronger impulsive move in EURUSD, consider a scenario in which the forecast expectations are not met and producer prices inflation turns out to be not only higher than the forecast, but also higher than the previous period's values. In this situation, EURUSD is likely to fall sharply to the support level of 1.0850.

The overall recommendation is to sell EURUSD in case July PPI readings are higher than June readings.

Take profit at the 1.0850 level. A stop loss could be set at 72.0.

The volume of the opened position should be set so that the value of the possible loss, defined with a protective stop order, does not exceed 2% of the size of your deposit.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account