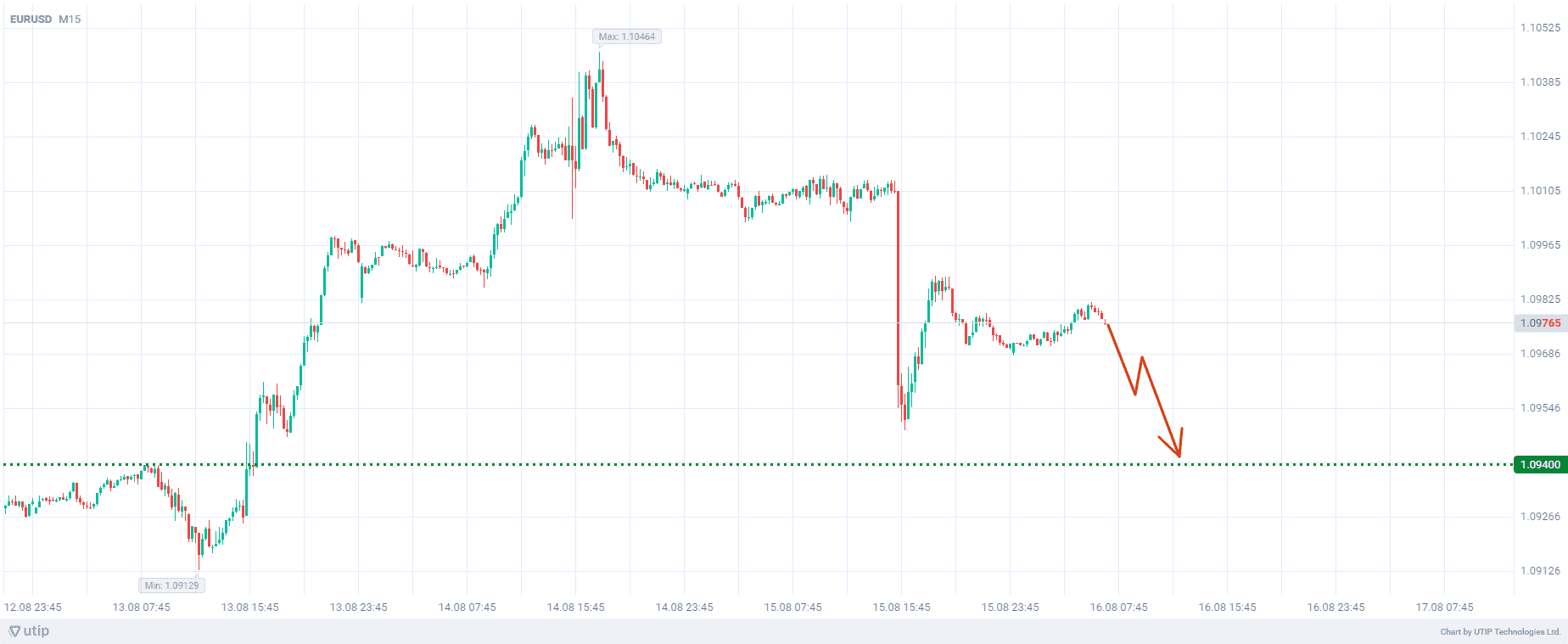

Selling EURUSD to 1.0940

A number of crucial US economic indicators were released yesterday.

Weekly jobless claims fell 7,000 to 227,000,

Continuing claims dropped 7,000 to 1.864 million.

Retail sales jumped 1.0% in July; core sales gained 0.3%.

Manufacturing production fell 0.3%.

The number of Americans filing new claims for unemployment benefits fell to a month-low last week, suggesting a sustained slowdown in the labor market and dashing financial market hopes that the Federal Reserve could cut interest rates by 50 basis points next month.

The economy's resilience was supported by other data showing retail sales rose in July by the most in a year and a half.

Nevertheless, the labor market continues to support consumer spending through still high wage growth. A separate report from the Commerce Department's Census Bureau showed that retail sales jumped 1.0%, the largest increase since January 2023, following a downwardly revised 0.2% drop in June.

Retail sales rose 2.7% year-over-year in July. Motor vehicles and parts dealers' sales increased by 3.6%, offsetting a 3.4% drop in June.

Online store sales rose 0.2% after a 2.2% jump in June. Sales at gasoline stations grew 0.1%. Building materials and garden equipment stores sales increased 0.9%.

Retail sales excluding automobiles, gasoline, building materials and food services rose 0.3% last month. These so-called core retail sales correspond most closely to the consumer spending component of gross domestic product.

Last month's gain and an increase in core retail sales in June led to higher consumer spending growth early in the third quarter.

Morgan Stanley economists raised their third quarter consumer spending growth forecast to an annualized rate of 2.8% from 2.1%.

The flow of upbeat reports was somewhat overshadowed by the third Fed report showing that manufacturing production fell 0.3% in July after remaining unchanged in June.

Financial markets, according to CME Group's FedWatch tool, have lowered the probability of a half-percentage-point rate cut to 27.5% from 41.5%. They now see a 72.5% chance of a 25-basis-point rate cut, up from 58.5% previously.

Thus, recent data, including the strong retail sales report, indicate that inflation is indeed declining, but the economy is far from the expected cooling. Investors now expect the Fed to lower borrowing costs in September by no more than the usual quarter of a percentage point.

The EURUSD currency pair has probably exhausted its upward potential in the medium term, so EURUSD is likely to start declining towards its strong support at 1.0940.

The overall recommendation is to sell EURUSD.

Profit could be taken at 1.0940. A Stop loss could be set at 1.1010.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, does not exceed 2% of your deposit.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account