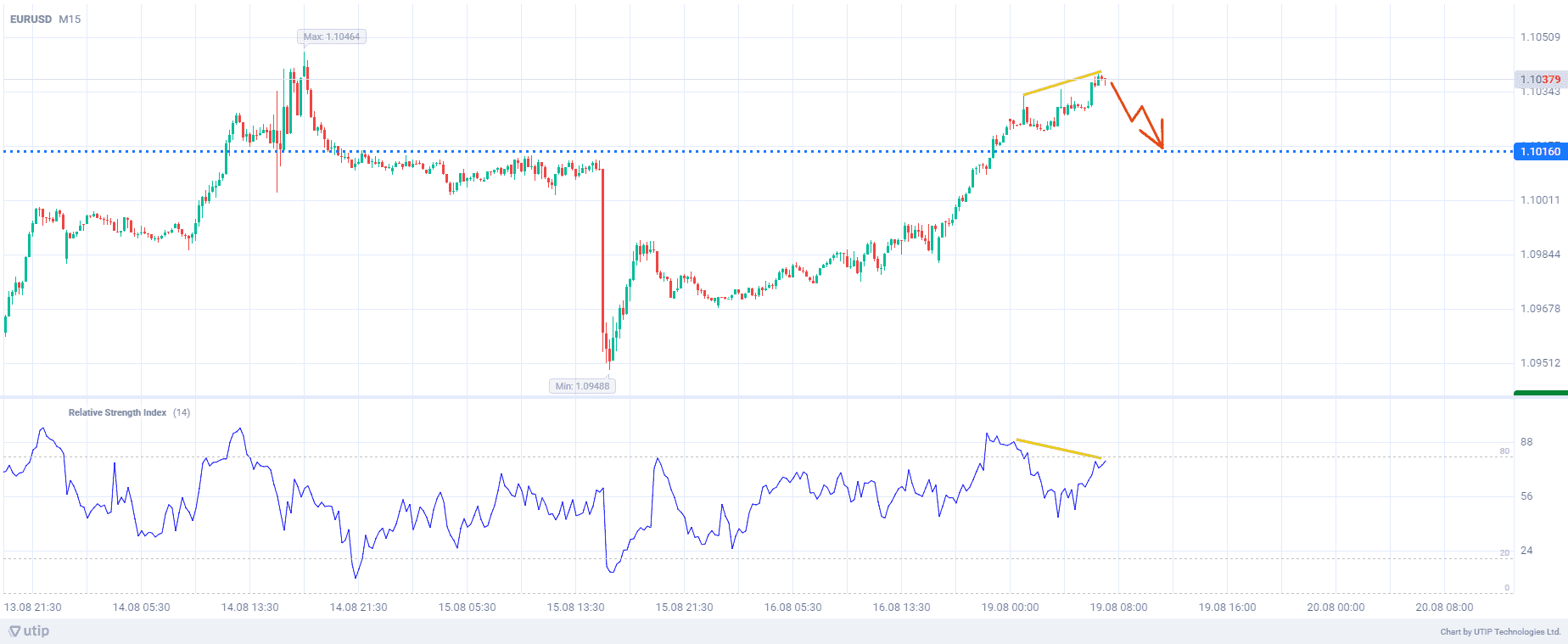

Selling EURUSD with target of 1.1016

Last week's flow of crucial US economic data including the Bureau of Labor Statistics’ consumer price index and the Department of Commerce's retail sales report showed that inflation continues to decline, approaching the Federal Reserve's target of 2%, while consumer spending remains at optimal levels, and fears of an economic slowdown have eased.

Data released on Friday showed that US single-family homebuilding dropped to a near one-and-a-half year low in July, while the University of Michigan's preliminary report showed a stronger-than-expected improvement in consumer sentiment in August.

Positive economic data fuels this growth, instilling greater confidence among investors and traders that it may be possible to avoid recession and that the Fed will start cutting rates in September.

This week, global central bankers will be speaking at the Jackson Hole symposium in Wyoming, and Fed Chair Jerome Powell will deliver a keynote address on Friday, which may clarify expectations regarding the trajectory of US interest rate cuts.

According to CME's FedWatch, financial markets are pricing in a 74.5% chance of a 25-basis-point rate cut by the Fed at the conclusion of its September policy meeting, with the chance of a significant 50-basis-point cut dropping to 25.5%.

Thus, recent data, including the strong retail sales report, indicate that inflation is indeed declining, and the economy is on track for the expected cooling.

In the medium term, the EURUSD currency pair may have already exhausted its growth potential and considered the forthcoming policy easing in its quotations. The pair is technically overbought, which suggests a possible downward correction.

The formed EURUSD divergence also indicates a possible downward correction.

The overall recommendation is to sell EURUSD.

Profit could be taken at 1.1016. A Stop loss could be set at 1.1060.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, does not exceed 2% of your deposit.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account