Selling GBPUSD if Bank of England officials support rate cut

The Bank of England plans to keep interest rates at a 16-year high of 5.25% as core inflation pressures remain firm.

Earlier, the bank’s Governor Andrew Bailey stated that he was "optimistic that things are moving in the right direction" and that a rate cut in June might be a possible option.

Now the medium-term outlook seems less encouraging despite data on Wednesday showing that headline inflation in May fell back to the Bank of England's target of 2% for the first time in almost three years, reaching the target faster than in the United States or the eurozone.

Services inflation fell to lower levels than the Bank of England expected, dropping only to 5.7% rather than 5.3%. Private sector wage growth is nearly double the rate that the Bank of England considers compatible with 2% inflation.

Last month, the central bank forecast inflation to rise to around 2.6 percent by the end of the year as the impact of recent lowering of households' regulated electricity bills waned.

None of the 65 economists surveyed by Reuters last week said they expected the Bank of England to follow the European Central Bank's lead and cut rates this month, with the next meeting on August 1 looking by far the most likely date for policy easing to begin.

Instead, a repeat of May's 7-2 vote split is expected, when Deputy Governor Dave Ramsden and external Monetary Policy Committee member Swati Dhingra both voted in favor of a quarter-point cut. If, this time, the number of votes for the rate cut is more than 2, it will provide strong short-term momentum to send GBPUSD lower.

Financial markets are dubious about a rate cut happening in August. On Wednesday, they estimated its probability of only 30%, with the first cut more likely to occur in September. There is also a risk of a delay until November, similar to the expectations concerning the US Federal Reserve.

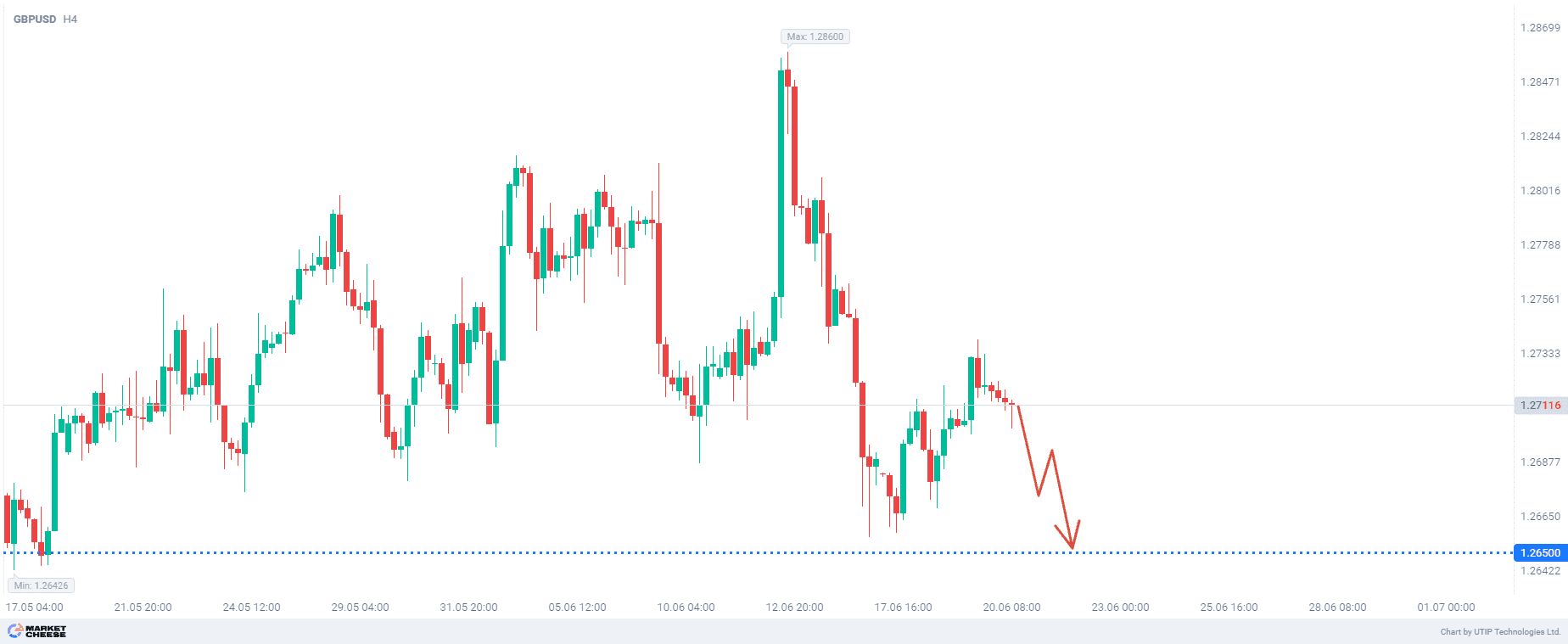

The final recommendation is to sell GBPUSD if the number of votes for the rate cut is more than two.

The profit could be fixed at the level of 1.2650. The Stop-loss could be placed at the level of 1.2750.

The possible loss should not exceed 2% of your deposit funds.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account