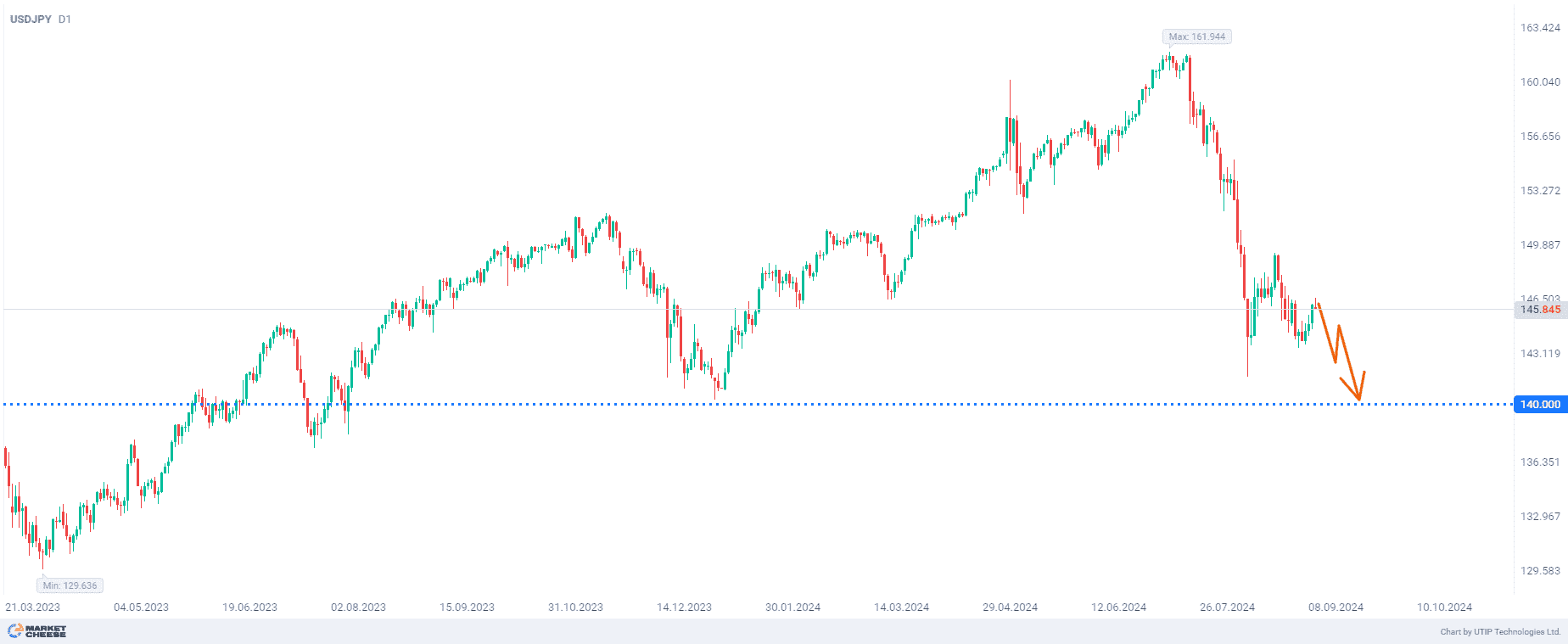

Selling USDJPY to 140.0

This week on Friday, the last U.S. labor market data before the crucial September Fed meeting will be released. In case the state of employment showed further cooling, it will draw the final line for the dollar weakening, including in the USDJPY currency pair.

From a technical point of view, USDJPY is aiming for its landmark level of 140.0, which is like a magnet that has been attracting and pushing the price away from itself over the past two years. Price tested this level from top to bottom at least five times since mid-2022. Now, with strong fundamentals, the pair is set for a strong breakdown of this level.

Federal Reserve Chairman Jerome Powell said in Jackson Hole last month that “it's time” to cut rates, while the Bank of Japan, on the contrary, suggests that further rate hikes are possible, with the bank's governor Kazuo Ueda in his comments directly pointing to just such a scenario.

Investors are divided on the timing of the next possible interest rate hike by the Bank of Japan, but all agree that it will happen anyway, which supports the yen.

U.S. economic data and the Fed's monetary policy remain key in determining the scenario of future USDJPY movement. Swap traders are betting that the Fed will cut rates by at least 25 basis points in September, and with a probability of 1 in 4 expect an even bigger cut of 50 basis points.

The final recommendation is to sell USDJPY provided that the unemployment rate in August will be higher than the forecast estimate of 4.2%.

Profit could be taken at 140.0. A stop-loss could be set at 151.0.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, does not exceed 2% of your deposit.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account