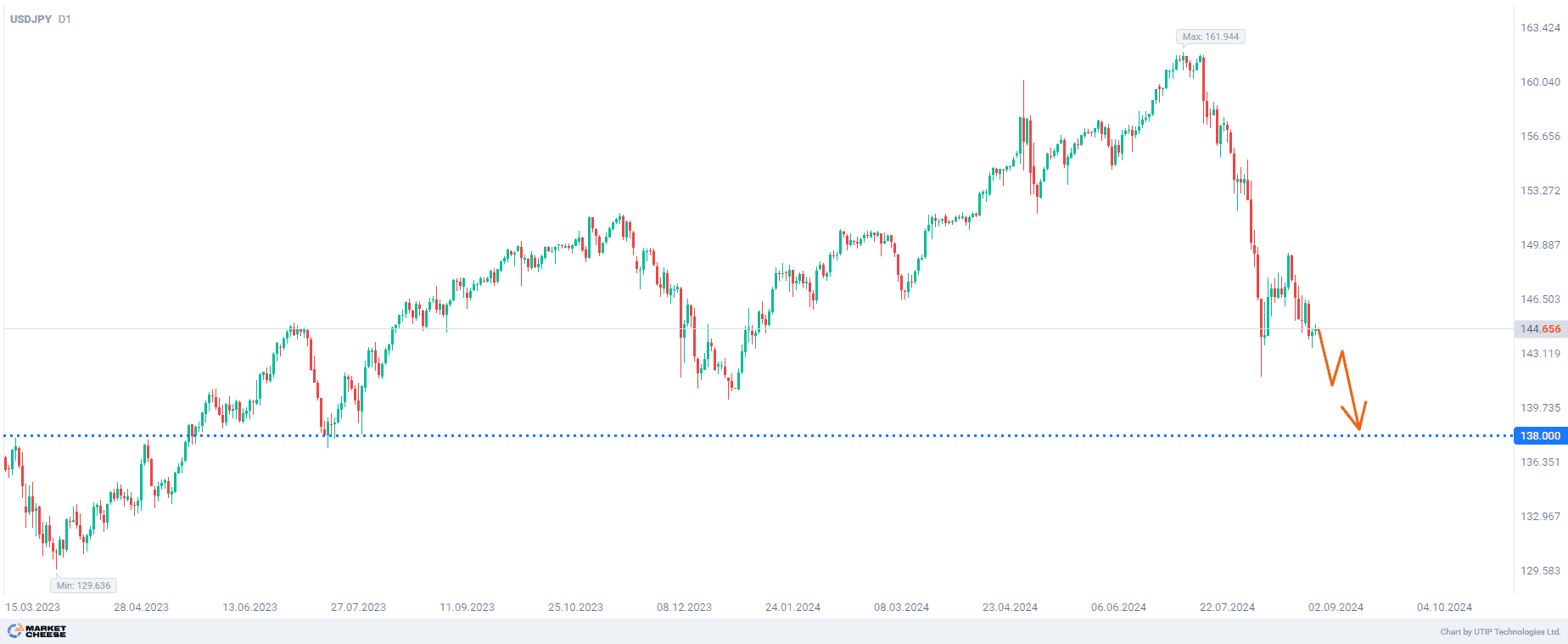

Selling USDJPY up to 138.00

In a speech on Friday, Fed Chair Jerome Powell said that the United States is ready to start cutting interest rates.

At an annual Kansas City Fed's Jackson Hole Symposium Fed Chair Jerome Powell said that “the time has come” to adjust the monetary policy stance as the upside risks to inflation have diminished and the downside risks to employment have increased.

Powell's comments strengthened the Japanese yen and weakened the dollar, with lower interest rates in the US compared to Japanese rates making the Japanese currency more attractive.

Powell's comments came amid data showing Japan's core inflation rate accelerated for a third straight consecutive month in July, with slowing demand-driven price growth potentially complicating the central bank's decision to raise rates further.

Bank of Japan Governor Kazuo Ueda on Friday reiterated his determination to raise interest rates if inflation remains on track to reach the 2% target, suggesting that despite recent market volatility, the BOJ's long-term plan to hike rates remains intact.

However, Ueda also warned that markets remain jittery and may affect the BOJ's inflation forecasts, indicating that the yen and stock price movements will be key in determining the timing of the next rate hike.

Ueda attributed the market volatility seen in early August to rising fears of a US recession, stoked by the country's weak economic data, while the BOJ's interest rate hike in July led to a sharp reversal of one-sided yen falls and a weakening of the USDJPY currency pair.

He said there was "no change to the BOJ's basic stance to adjust the degree of monetary easing if it became convinced that economic and price developments were moving as forecast."

In tightening policy in July, Ueda said the BOJ would raise rates further if inflation remains on track to durably hit its 2% target in coming years.

The latest Reuters poll showed that most economists expect the BOJ to raise rates again this year, but more see the possibility of it occurring in December rather than October, which would still weaken USDJPY.

The final recommendation is to sell USDJPY.

The profit could be fixed at 138.00. The Stop loss could be placed at 152.00.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, doesn’t exceed 2% of your deposit.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account