Selling USDJPY with a target at 137.00 amid expectations of Fed rate cuts and BOJ statements

The USDJPY currency pair on Thursday stabilized near the weekly support at 143.45. This consolidation was due to expectations of the data on employment and inflation in the United States for signals on the Federal Reserve's policy path.

Federal Reserve Bank of Atlanta President Raphael Bostic on Wednesday said that with inflation down farther and the unemployment rate up more than he anticipated, it may be "time to move" on rate cuts.

According to CME's FedWatch tool, there is a 65.5% chance of a 25-basis-point cut and about a 34.5% for a 50-basis-point cut next month.

Today, market participants are awaiting U.S. initial jobless claims data. On Friday investors’ interest will be focused on Personal Consumption Expenditures (PCE) data, the Fed's preferred inflation gauge.

Meanwhile, Bank of Japan Deputy Governor Ryozo Himino on Wednesday reiterated the central bank's stance that it would continue to raise interest rates if inflation stayed on course. His comments echo the comments from Governor Kazuo Ueda. He suggested that recent market volatility would not derail its long-term rate hike plans.

A poll by Reuters showed a majority of economists expect the BOJ to hike rates again this year, but more see the chance of it happening in December rather than October.

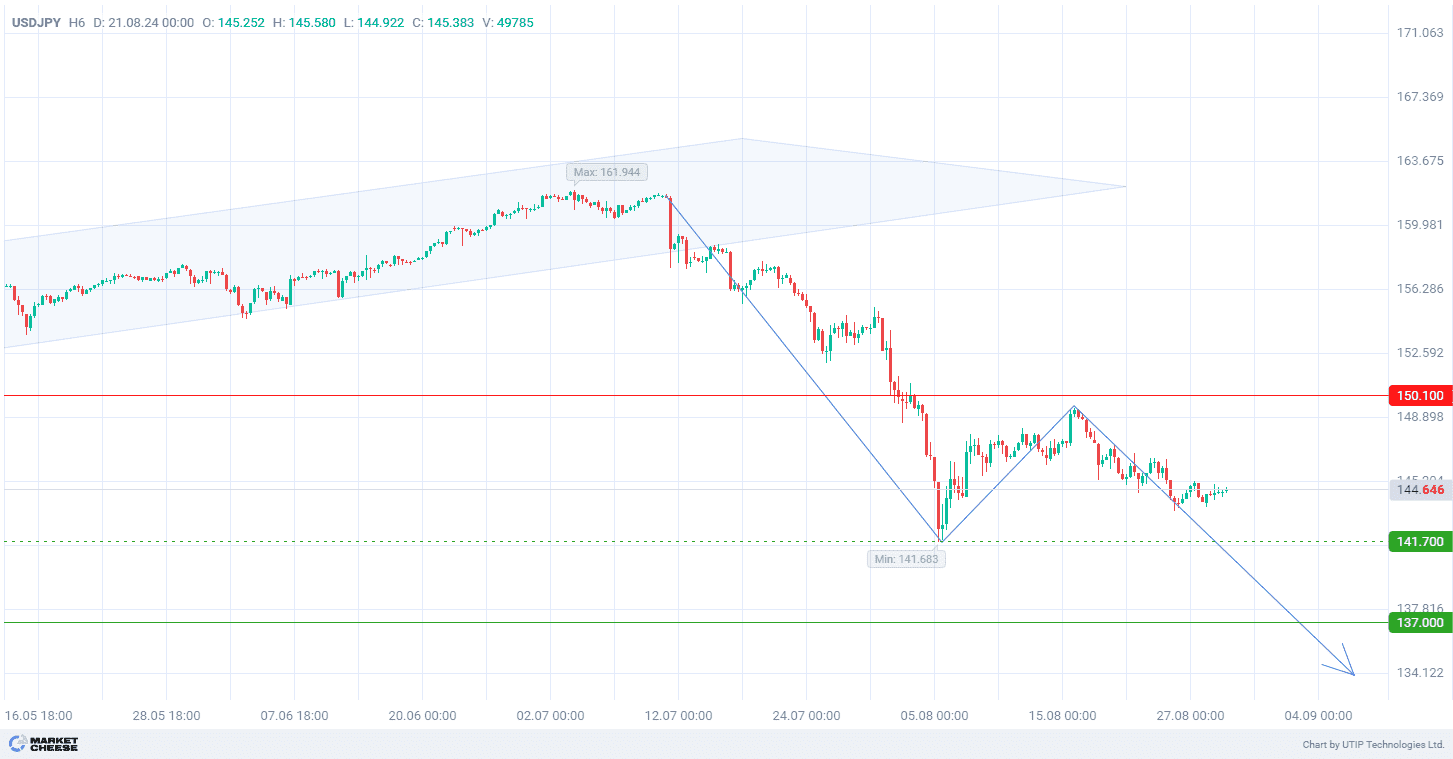

From the technical point of view, the downtrend of USDJPY accelerated after the exit from the uptrend on the D1 timeframe.

According to the wave analysis, the price is forming the third downward wave on the H6 timeframe. Breaking through the first wave at 141.70 will strengthen the current downtrend.

Signal:

The short-term outlook for the USDJPY currency pair is to sell.

The target is at the level of 137.00.

Part of the profit should be fixed near the level of 141.70.

The Stop loss could be placed at the level of 150.10.

The bearish trend is of a short-term nature, so it is suggested to limit the trading volume to no more than 2% of your capital.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account