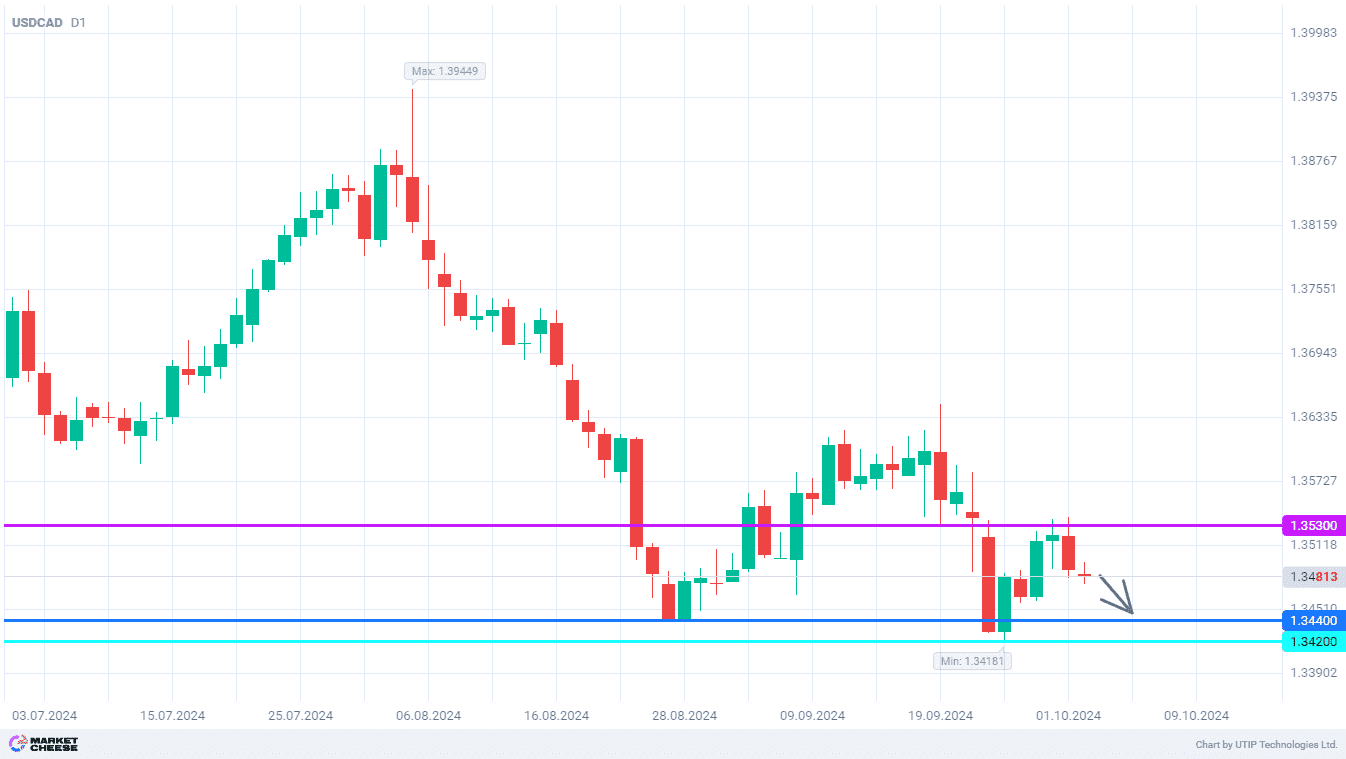

Sharp increase in oil prices will bring USDCAD back to level 1.344

At yesterday's trading session, the USDCAD quotes broke the emerging growth wave and rolled back down from the level of 1.353. The drastically changed news background contributed to the strong growth of the US dollar against most other currencies, but not its Canadian counterpart. Given the new circumstances, the USDCAD pair has good chances to return to the recent lows below 1.344. It is also possible that this level will be reached in the next few days.

The Canadian dollar was strengthened by the aggravation of the geopolitical situation in the Middle East. Traders hurried to get rid of other risky assets, but the Canadian currency avoided a similar fate thanks to the growth of oil prices by 3.5%. The rise in oil prices will support Canada's export revenues and allow the national currency to perform better than its counterparts. Moreover, the sharp increase in the cost of oil was not the only positive news for the Canadian dollar on Tuesday.

The S&P Global data showed a significant improvement in Canadian industrial activity for September. The PMI rose from 49.5 to 50.4, breaking the all-important mark of 50 for the first time since April last year. Commenting on the released statistics, S&P representative Paul Smith stated the positive impact of the three key rate cuts delivered by the Bank of Canada on the sentiment of the country's business community. Now, the pace of monetary policy easing may slow down a bit in order to avoid causing a new surge in inflation.

Similar data on the US were much less optimistic. The ISM manufacturing PMI remained at the August level of 47.2 points, while analysts expected a rise to 47.6. PMI has remained below the level of 50 for 6 months already, increasing fears of recession in the US economy. If Friday's labor market report for the past month confirms this trend, the US currency may come under serious pressure, as well as the USDCAD quotes.

The nearest target for the USDCAD sellers is the level of 1.344, corresponding to the lowest result of August. If successful, the bears may immediately test the lows of last week, just below 1.342.

We can suggest the following trading strategy:

Sell USDCAD at the current price. Take profit 1 – 1.344. Take profit 2 – 1.342. Stop loss – 1.353.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account