Sharp slowdown in Canadian inflation brought USDCAD back to growth

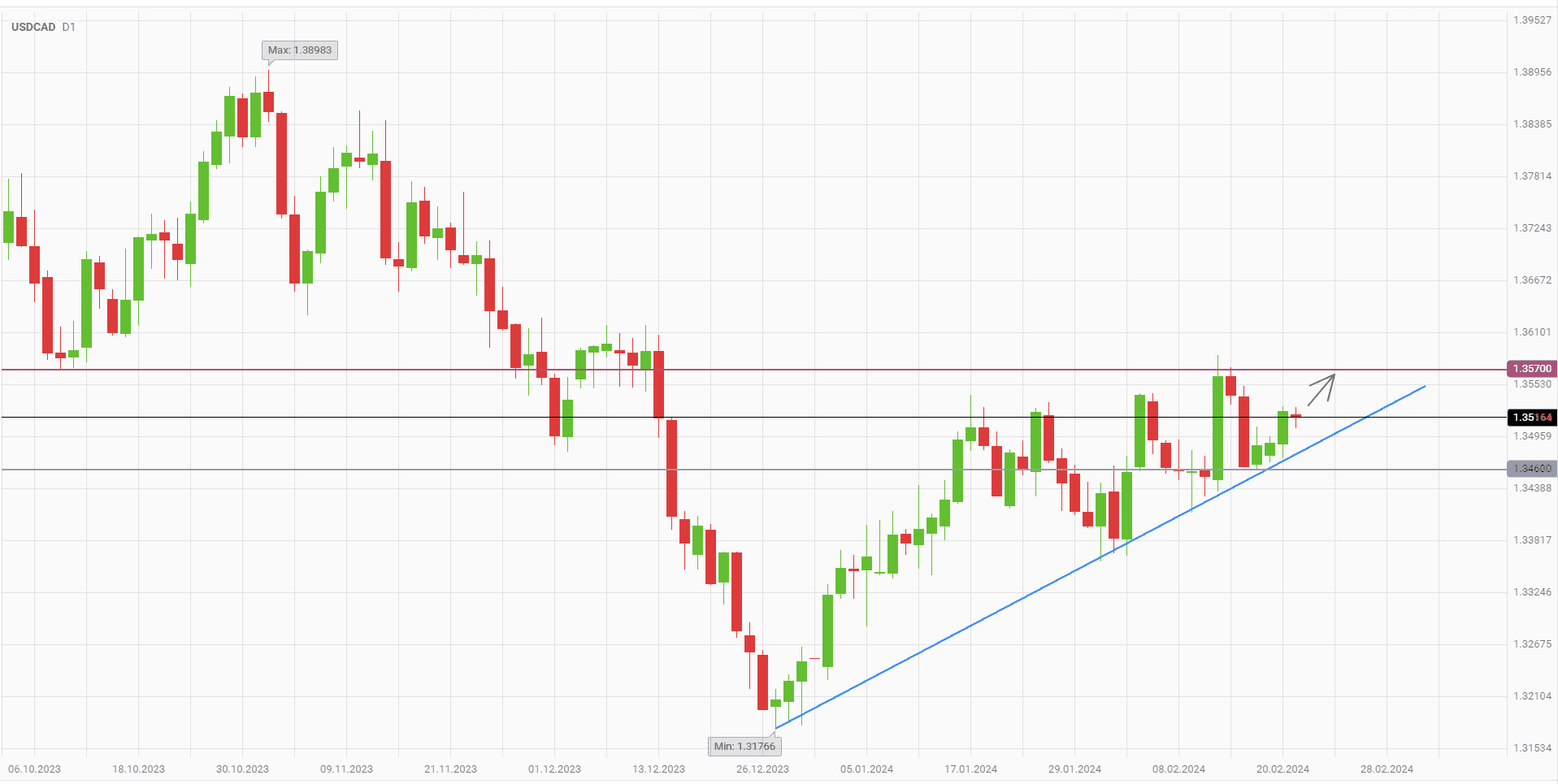

The USDCAD currency pair is rebounding after a pullback from the 2-month high set last week. The quotes found support on the medium-term uptrend line, lasting since the end of December. Buyers of the Canadian dollar did not dare to break the trendline, and now there is a new wave of price growth. Given the news background, USDCAD may quickly return closer to the 1.357 level.

The reason for the Canadian currency weakening was yesterday's inflation statistics for January. Price growth slowed down much stronger than analysts had predicted — from 3.4% to 2.9% compared to expectations of 3.3%. Inflation dropped below 3% for the first time since last June. On a monthly basis, the Consumer Price Index remained unchanged, while a rise of 0.4% was expected.

Andrew Grantham, an economist at Canadian Imperial Bank of Commerce, noted the significant impact of weak household demand on inflation. In his opinion, the data may change the situation and encourage the Bank of Canada to cut rates earlier. Forex market participants have already raised the probability of monetary policy easing in April from 33% to 58%.

In addition to the price growth statistics, the Canadian regulator is under growing pressure from the country's government. During yesterday's speech, Prime Minister Justin Trudeau said that he expects interest rates to decline in the near term. British Columbia Premier David Eby took an even tougher stance and accused the central bank of raising inflation by increasing mortgage interest rates. Under such circumstances, the Bank of Canada will have difficulty defending the need to maintain the current monetary policy.

An additional factor supporting the USDCAD growth may be the Fed's January meeting minutes, which will be released this evening. In case of hawkish rhetoric of American officials USDCAD will face a strong bullish inflow. Their nearest target will be 1.357.

Consider the following trading strategy:

Buy USDCAD at the current price. Take profit – 1.357. Stop loss – 1.346.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account