Silver is getting higher amid expectations of Fed speeches and key economic data

Silver prices are rising on Monday amid expectations of statements from the Federal Reserve (Fed) officials during the week and the release of U.S. macroeconomic data.

On Tuesday, market participants will focus on the U.S. consumer price index (CPI) data. Also, retail sales on Thursday and producer price index (PPI) on Friday are expected to be released in the U.S. this week. In addition to macroeconomic data, seven Fed officials will speak this week and their remarks will increase the dynamics in the markets.

Last week, several officials, including Chairman Jerome Powell, noted that they need more clear evidence of declining inflation before they make a decision to ease policy.

The probability of the Fed cutting interest rates at the March meeting is extremely low, say traders. At the same time, according to LSEG's IRPR app, chances of a rate cut in May are estimated at 62%.

As for long-term forecasts, according to the Silver Institute, due to its wide range of applications, the white metal may hit record highs in 2024. It is not only precious, but also industrial. Silver is used in the manufacture of solar panels, automobiles, electronics and jewelry.

More active industrial consumption will be the main catalyst for growth in global demand for silver this year. According to the organization's experts' forecasts, its price will reach $30 per ounce.

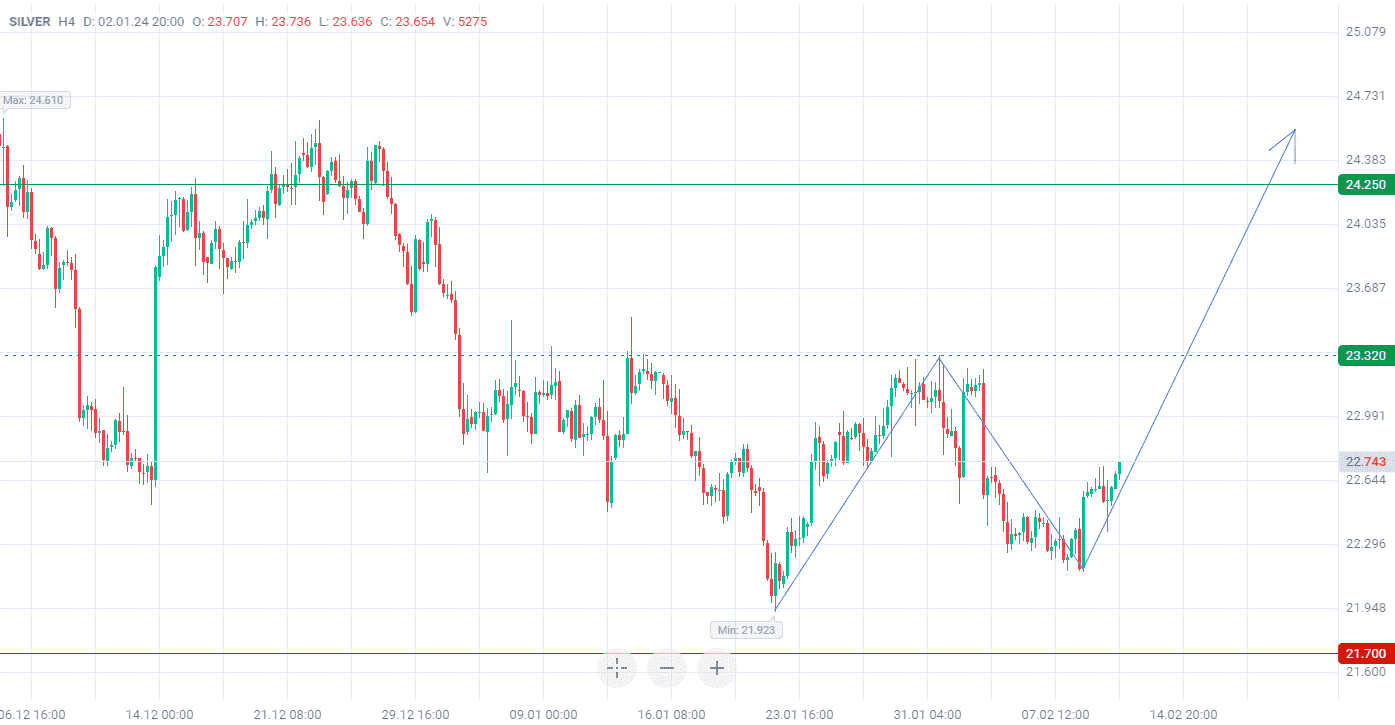

Silver quotes are in a broad correction on the D1 timeframe.

On the H4 timeframe, silver price has left the downtrend. In terms of wave analysis, the price is in the process of forming the third ascending wave. Breaking through the top of the first wave at 23.320 will strengthen the upward movement.

Signal:

The short-term outlook for Silver is to buy.

The target is at the level of 24.250.

Part of the profit should be fixed near the level of 23.320.

A Stop-loss should be placed at the level of 21.700.

The bullish trend has a short-term character, so the trade volume should not be more than 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account