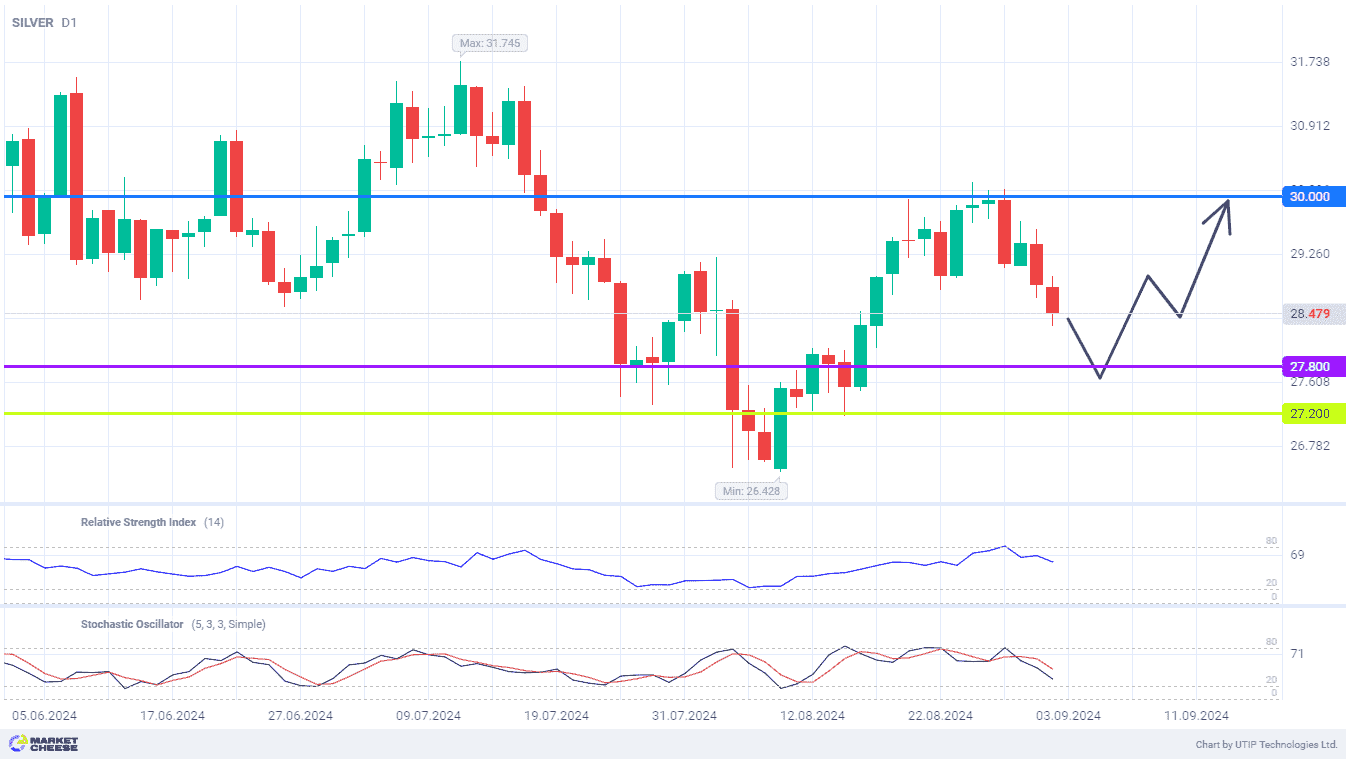

Silver price correction signals a new test of 30 level

As expected in mid-August, silver prices reached the level of $30 per ounce. Attempts to consolidate above this level were unsuccessful, as a result the price started a corrective pullback. By the current moment, silver has already lost almost half of the achievements of the previous wave of growth, which makes it more and more attractive for buying. With the approach to 27.8, bears' activity may decrease, which will allow increasing long positions in anticipation of another test of the 30 level.

David Scutt, City Index expert, notes that silver prices reached their first downward target at $28.77 per ounce. According to his estimates, now silver prices can go to the level of $28.05, and in case of further development of correction to $27.27. In this case, it is appropriate to take profits on short positions, as a more serious fall in silver prices Scutt considers it unlikely.

Officials of City Index pay attention to the economic statistics of the current week. In the U.S. will be presented a report on the labor market for August, the last before the Fed meeting on September 18. The publication of poor data can put serious pressure on the dollar quotes, thus supporting the market of commodities, whose prices are expressed in U.S. currency. Against this background, silver will make a new attempt to reach the $30 mark.

UBS analysts recommend investors to increase the proportion of silver in their portfolios, expecting growth of quotations to the range of $36–38. In the baseline scenario of the Swiss bank, industrial demand for silver in the current year will grow by 50 million ounces (+10%), despite the slowdown in the Chinese economy. Moreover, silver consumption in China shows no signs of decline, and in July the country's companies increased their imports of silver by one and a half times, up to 5 million ounces.

Technical indicators on the silver chart do not show signs of reversal yet. Probably, the corresponding signals will be received in the area of 27.8 mark. Here, bulls have good chances to seize the initiative and gradually return the price to the level of 30.

Consider the following trading strategy:

Buy silver when the price declines to the level of 27.8. Take profit – 30. Stop loss – 27.2.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account