Silver price growth is supported by Fed rate cuts and geopolitical instability

On Monday, silver prices are trading below $31.42, following an all-time high rally in gold and significant changes in monetary policy by the Federal Reserve.

The Fed's decision to cut interest rates by 50 basis points sent shockwaves through the market. Silver prices, which benefit from low interest rates due to the metal’s non-yielding nature, rose sharply on the back of a weaker US dollar. Fed Chairman Jerome Powell signaled further cuts, including one more cut of 50 basis points by the end of the year.

According to the CME FedWatch tool, traders estimate the probability of a 50 basis point rate cut in November at 51% and a potential for another 25 basis point cut at 49%.

Investors are awaiting the release of US Personal Consumption Expenditures Price Index data on Friday. This may affect subsequent inflation forecasts.

Meanwhile, the emergence of new players in the Middle East crisis raises the risk of widespread regional instability, supporting demand for precious metals. However, weakening retail sales in Asia and a possible contraction in industrial demand from China could hold silver back.

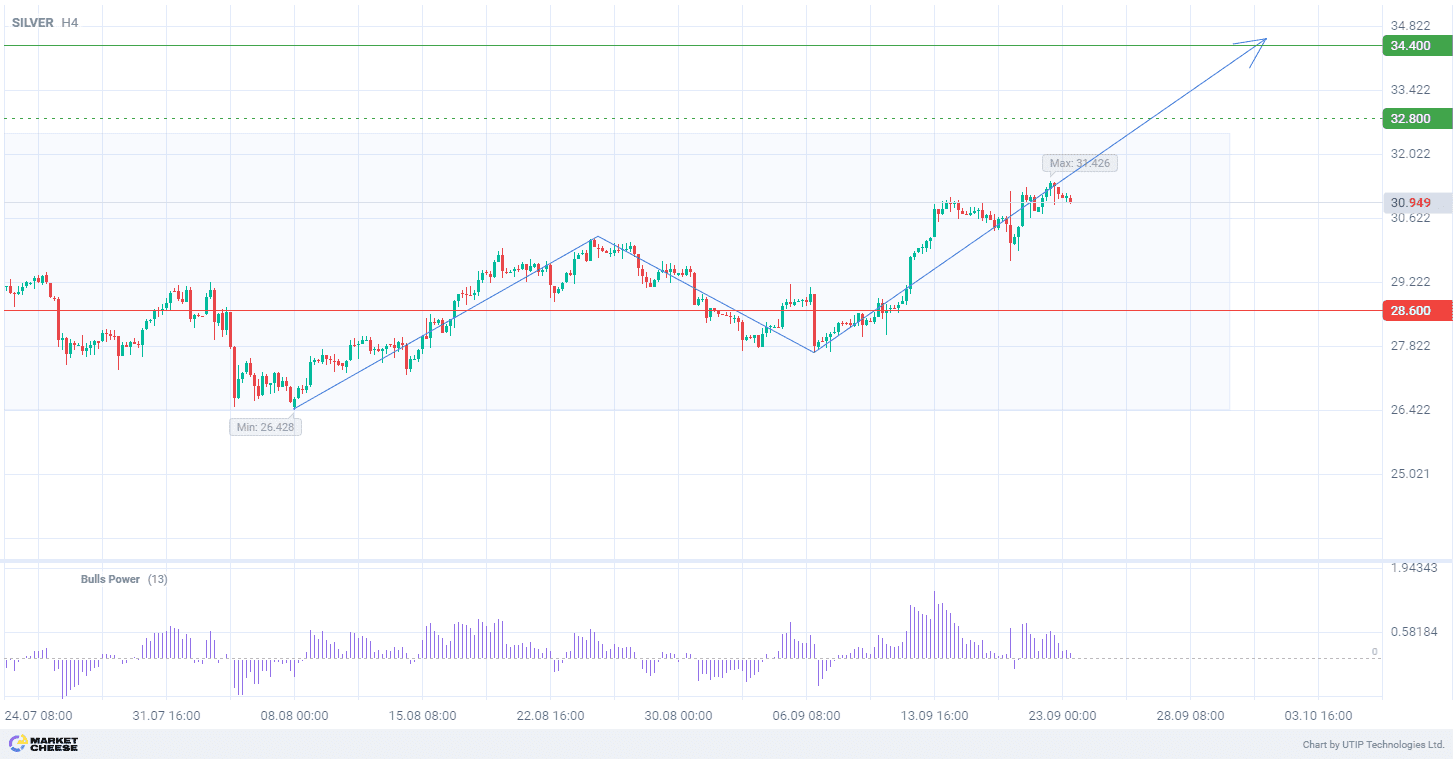

From a technical point of view, silver prices on the D1 timeframe are in a broad correction. In terms of wave analysis, on the H4 timeframe the price is currently forming the third ascending wave. The breakthrough of the top of the first wave at 30.25 has already occurred, indicating a possible strengthening of the upward momentum. Bulls Power indicator (standard values), which is in the positive zone, confirms the strength of “bullish” sentiment and suggests the continuation of the upward trend.

Signal:

Short-term outlook for silver is to buy.

The target is at the level of 34,400.

Part of the profit should be fixed near the level of 32,800.

The stop-loss is placed near the level of 28,600.

The bullish trend is of short-term nature, so it is recommended to keep the volume of trade to no more than 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account