Silver prices dropped indicating need for correction ahead of US data release

Silver prices are lower on Monday as investors await more economic data from the United States.

Personal Consumption Expenditures (PCE) price index increased by 2.7% year-on-year last month, the Commerce Department's Bureau of Economic Analysis reported on Friday. It remained at the level of March. However, this was not enough for the Federal Reserve (Fed) to ease its monetary policy. The central bank will probably need more time to achieve its 2% annual inflation target.

Price cuts by major US retailers and new data showing a slowdown in consumer spending may boost the Fed's confidence in lower inflation. According to the CME FedWatch Tool, traders are now pricing in about a 54% chance of a rate cut in September.

Silver market participants will be watching for national PMI data from the Institute for Supply Management (ISM) today. Since the white metal has both precious and industrial characteristics, a confirmation of manufacturing activity below the 50 level may further decrease its value.

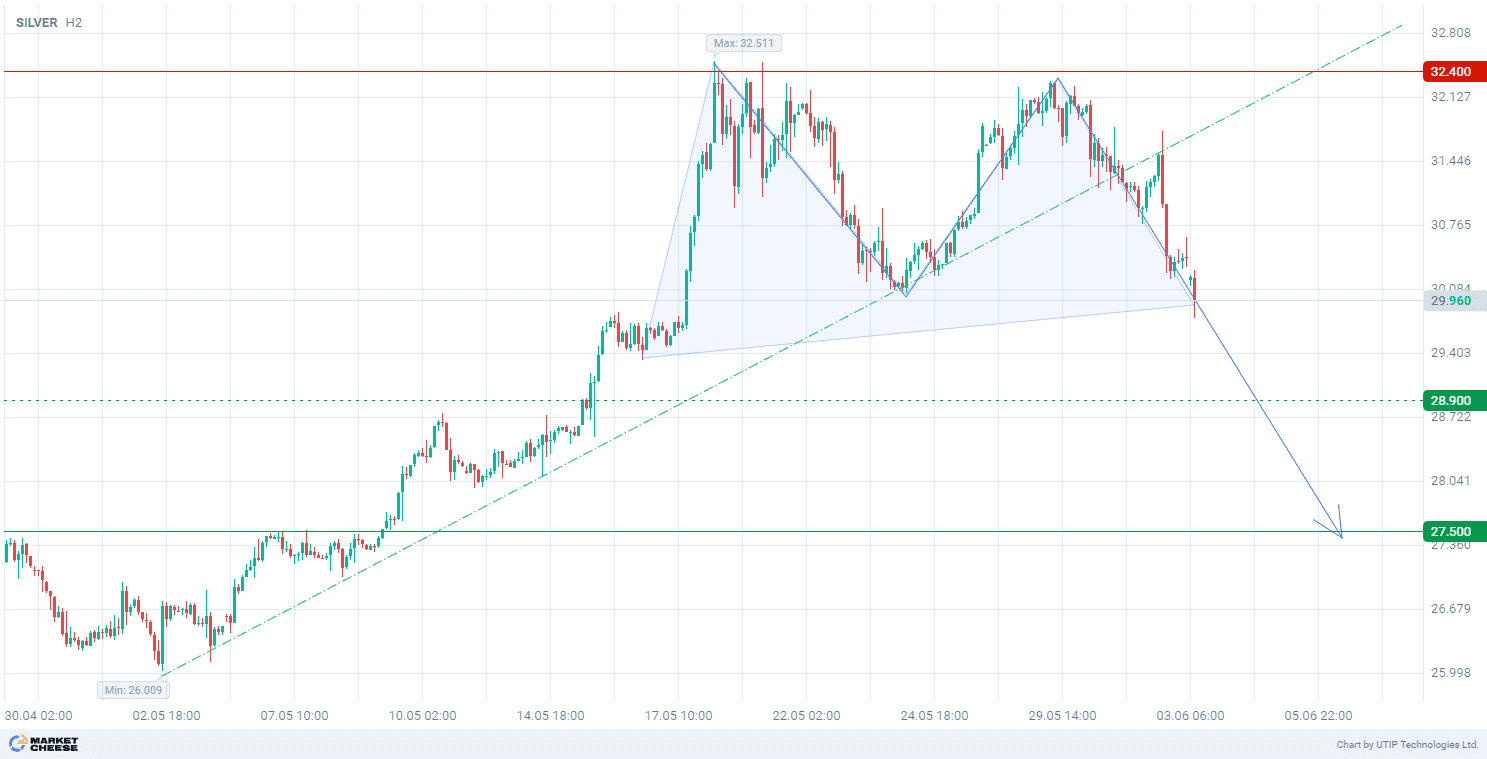

At the technical level, silver prices exited the uptrend on the H4 timeframe. In addition, a double-top pattern is forming on the chart. This usually indicates a slowdown in the recent uptrend and increases the likelihood of a short-term downward reversal.

In terms of wave analysis, the price is forming the third descending wave on the H2 timeframe. Breaking through the top of the first wave at 30.050 will strengthen the bearish movement.

Signal:

The short-term outlook for silver suggests selling.

The target is at the level of 27.500.

Part of the profit should be taken at the level of 28.900.

A Stop-loss could be set at the level of 32.400.

The bearish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account