Silver’s support at $22 reaffirmed its strength

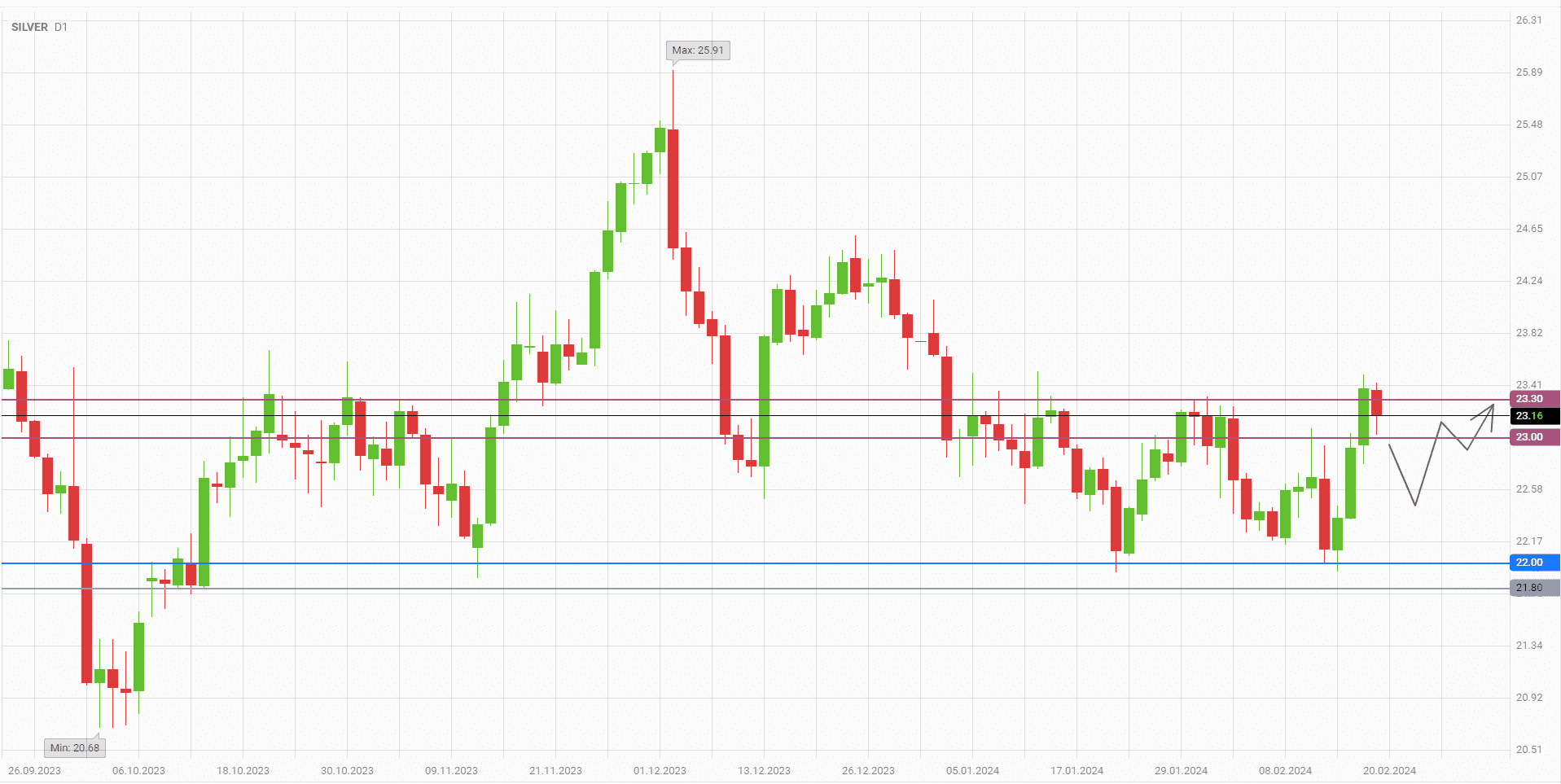

Silver prices showed a strong rebound from the support level of $22 per ounce last week. As it was stated in the previous forecast, the fall in the white metal price quickly attracted the buyers who turned the price movement in the opposite direction. The upward momentum successfully reached the target above 23, after which the bulls decided to take short-term profits. In Monday's trading session the price pullback is seen, which can be used to build up long positions again.

Since the beginning of 2024, the most successful tactic for trading silver is to wait for a rebound in prices from one of the 22–23.3 flat's limits and further movement to the other limit. Now, in addition to the technical picture, there is also an important fundamental growth factor for the white metal. News from Mexico may have a significant impact on the long-term outlook for the global silver market.

Current Mexican President Andres Manuel Lopez Obrador has proposed to ban open-pit mining in the country. Obrador is unlikely to get a majority of votes in Congress, but his “most likely” successor Claudia Sheinbaum plans to approve the proposal as part of her election program. The country's mining industry has already expressed serious concerns about this bill.

Nowadays, open-pit mines and quarries in Mexico account for 60% of all mineral production. The country is the world's number one silver producer, as well as a major supplier of gold and copper. A potential ban on open-pit mining could be damaging for the entire mining industry. Given that the Mexican authorities have not issued a single permit for new projects since 2018, the silver supply may already be seriously reduced in the coming years. And this is the most important factor for the price growth.

For short-term silver buying, it is better to wait for a deeper correction. A price drop below 22.5 will provide a good opportunity to open long positions. The growth benchmarks of the 23–23.3 range remain the same.

Consider the following trading strategy:

Buy silver in the 22–22.5 range. Take profit 1 – 23. Take profit 2 – 23.3. Stop loss – 21.8.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account