Technical indicators may limit fundamental growth of BTCUSD

BTCUSD quotes reached a record high of $71,799 during yesterday’s trading session. This surge took place after an announcement of the British financial regulator about its willingness to work with cryptocurrencies.

The UK's Financial Services Authority announced on Monday that it has approved requests from Recognised Investment Exchanges to establish a market segment for exchange-traded notes (ETNs) backed by cryptocurrencies in the country. This requires exchanges to guarantee strict trading controls, ensuring that it is well organized and provides proper protection for professional investors. They also must comply with all the requirements of the UK Listing Regime. This includes issuing and disclosing information in prospectuses on a regular basis.

The decision by British regulators follows moves by US agencies that recently approved the first-ever spot bitcoin exchange-traded funds (ETFs). The US Securities and Exchange Commission (SEC) has given the green light to ETFs from BlackRock, Fidelity, Grayscale and other large companies that have been actively trading in the market already.

Increased popularity of the world's top cryptocurrency was driven by money flows into new spot bitcoin ETFs. In addition, the price of the digital asset is supported by hopes for imminent interest rate cuts by the US Federal Reserve.

According to LSEG, capital inflows into the 10 largest spot bitcoin ETFs in the US slowed to a two-week low one week before March 8, but still reached almost $2 billion.

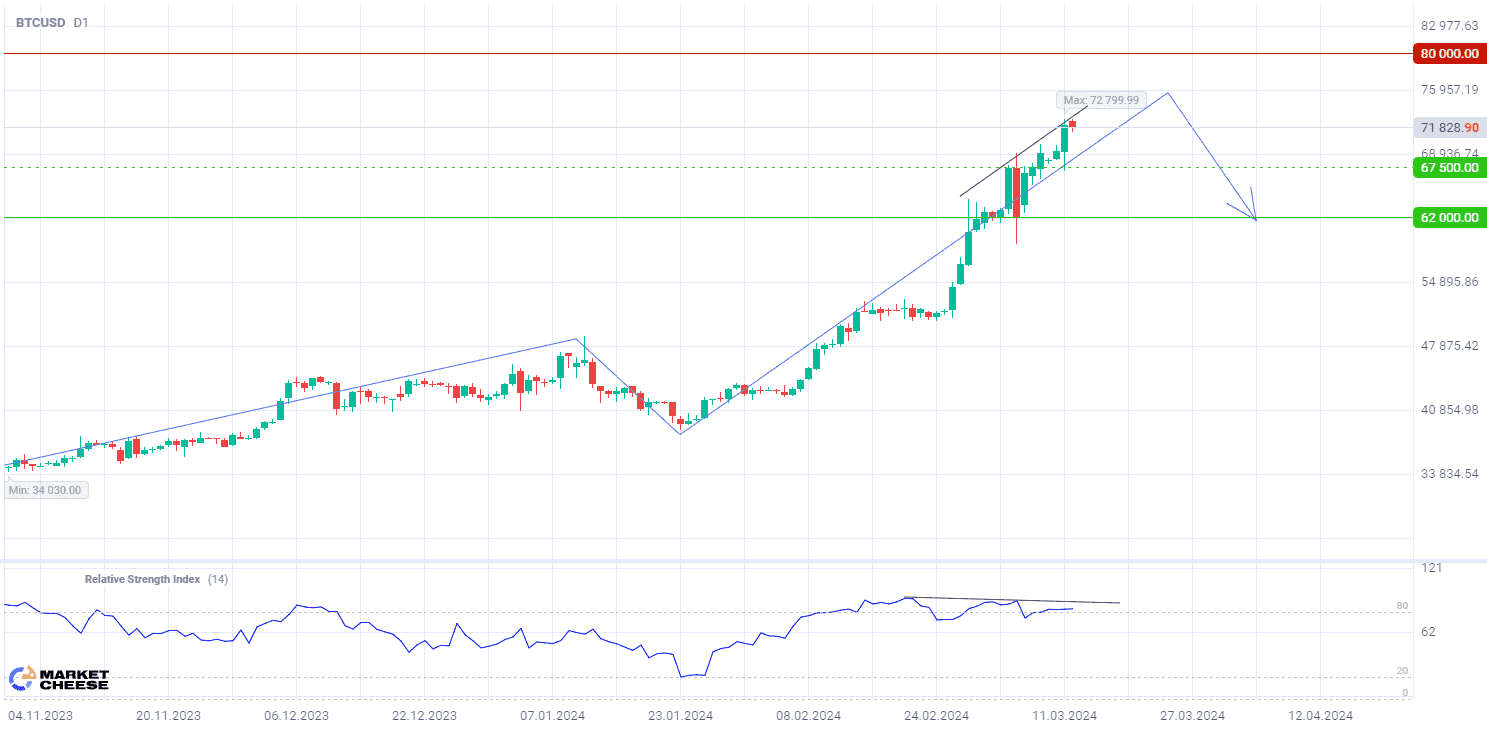

BTCUSD quotes are forming a new uptrend on the D1 timeframe.

In terms of wave analysis, the price is forming the third ascending wave. This wave has already repeated the length of the previous one. Divergence of the Relative Strength Index (RSI) (standard values) shows a possible downward change in the price direction and the formation of a new descending wave.

Signal:

The short-term outlook for the BTCUSD pair suggests selling.

The target is at the level of 62,000.

Part of the profit should be taken near the level of 67,500.

A Stop-loss could be set at the level of 80,000.

The bearish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account