The likelihood of USDJPY reaching the August lows is growing

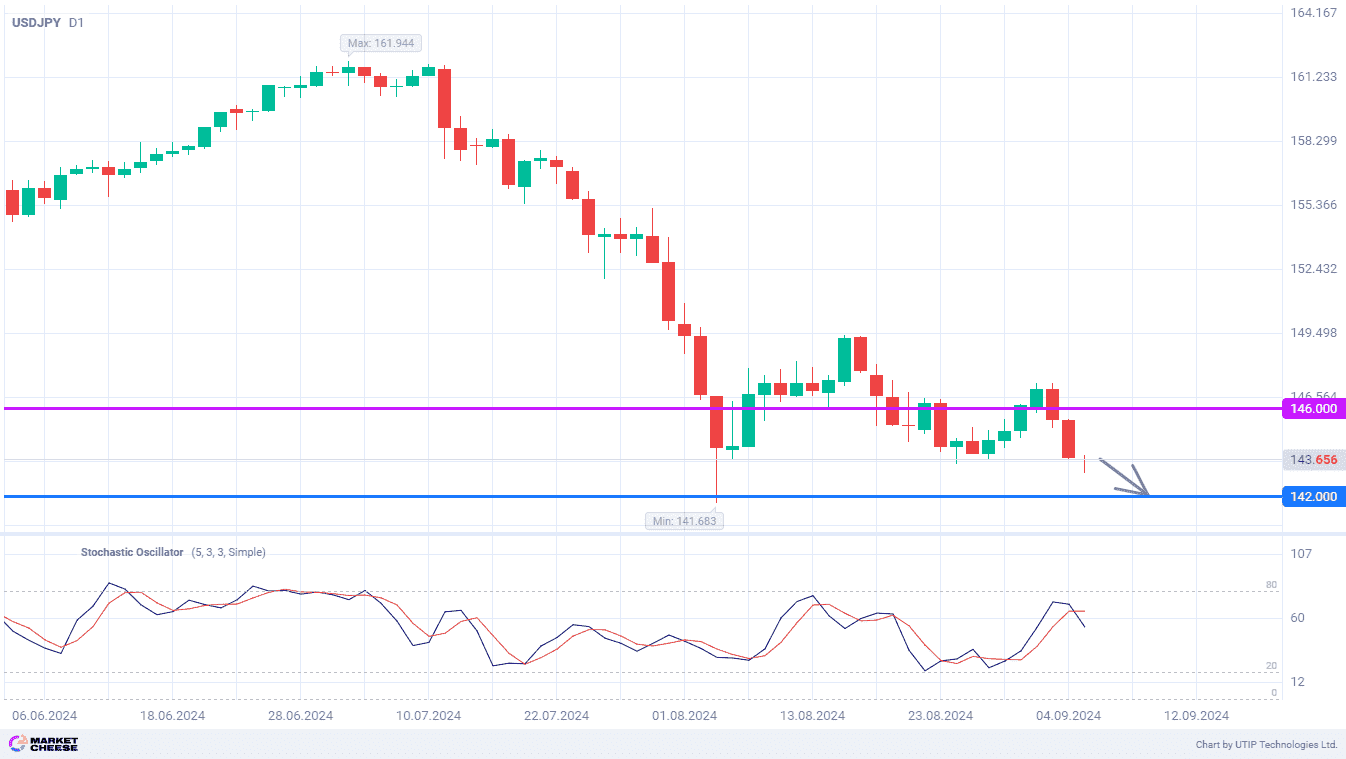

The USDJPY currency pair over the last 2 days leveled all the achievements of the growth wave, which took place at the end of August. Quotes fell under the level of 144, below which the dollar/yen ratio this year fell only during the extremely volatile trading session on August 5. A month later, the price is ready to return to the bottom, supported by both technical and fundamental factors. An attempt to update the lows may meet resistance from the bulls, but the 142 mark is likely to be reached.

Today's data on wages in Japan should support the strengthening of the yen. The growth rate of wages slowed from 4.5% to 3.6%, but analysts expected an even greater decline to 3%. At the same time, the growth of income of employees without bonuses and overtime reached 2.7% - the maximum for 31 years. Such statistics speaks in favor of increasingly stable inflation.

Speaking after the publication of the report, Bank of Japan board member Hajime Takata highlighted the need for further rate hikes in the country. Traders do not expect such a step from the Japanese regulator at the next meeting on September 20, but a new tightening of monetary policy in October is becoming more and more likely. Earlier analysts' forecasts were inclined to the next increase of the key rate of the Bank of Japan only in December.

Arif Husain of T. Rowe Price expects the yen to strengthen even more, especially when paired with the dollar. In his opinion, the wave of USDJPY decline in July-August does not fully reflect the scale of changes in the financial markets. Japanese companies have huge cash reserves placed in dollars and other foreign currencies. Rising rates in Japan against the backdrop of their decline in the U.S. will make the Asian country's securities more and more attractive, stimulating investment inflows and demand for the yen.

The Stochastic indicator on the daily chart of USDJPY turned downward and gave a sell signal, increasing the possibility of the continuation of the downward movement of quotes. If tomorrow's report on the U.S. labor market is not very optimistic, the price will quickly fall to the level of 142.

Consider the following trading strategy:

Sell USDJPY at the current price. Take profit – 142. Stop loss – 146.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account