Where to Start?

How to trade on Forex?

Imagine that a country's national currency is an asset like stocks, commodities or precious metals. The whole secret is to buy the asset cheaper and then sell it more expensive. You can do the opposite, first sell more expensive and then buy cheaper.

Whether the currency is rising in value or getting cheaper, there is always an opportunity to make money on Forex.

The most important thing is to recognize the market trend correctly and in time. Economic news analysis, as well as paid and free indicators and automatic trading systems and signals will help you in this.

What should you know before going to market?

Learn the basics of the Forex market. Before you start trading, it is important to understand what the Forex market is, how it works, and which currency pairs are available for trading.

First of all, you need to understand basic terms such as what a "lot", "spread", "pips" and other important concepts are.

Read about the different types of analysis. Studying technical and fundamental analysis will help you understand how to analyze the market and make informed trading decisions.

Technical analysis is based on charts and indicators, while fundamental analysis focuses on economic and political events.

Determine your goals and risks. Before you start trading, it is important to determine your financial goals, risk tolerance and comfort level.

Developing your own trading plan and strategy will help you understand which trading style is best for you.

Define your trading strategy. Writing your own trading strategy will help you determine your style and approach to trading.

This includes your choice of time frames, market analysis methods, money management rules and the level of risk you are willing to accept.

Where to start Forex trading?

-

Choose a Forex broker. A lot depends on it: trading conditions, speed of execution of orders, reliability of quote flow, consulting support and convenience of conflict resolution.

Many of these factors can be checked while opening a demo account. By the way, this demo account with a virtual balance is an irreplaceable thing, definitely necessary for trading, especially for beginners.

-

Practice on a demo account. Even if you have an excellent grasp of the theory, it is worth trying different trading strategies on a virtual account before risking real money. It is very difficult to predict exchange rates based only on public information about what is happening in different countries. Therefore, to help players there are programs that analyze technical indicators of currency movements and help to build trading strategies.

-

Open a real account. Have you practiced on a demo account? Have you practiced the different strategies you learned during the training and chosen a few that suit you? Now you can open a real account. You determine the amount on the account yourself, but forex-dealers may have their own limits on the minimum deposit. It is better to start with a deposit that you will not be afraid to lose.

It is not a fact that your strategy tested on a demo account will be as successful on a real account. You will have to spend some more time and money to refine it and develop your style. You can use several strategies at once, so you can reduce your risks a bit.

Where to start Forex trading?

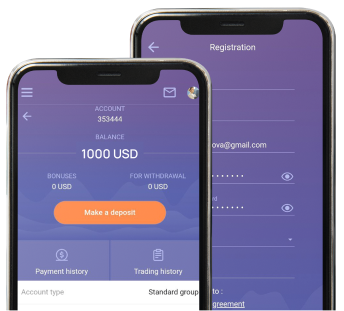

Create a Trader's Room

Your personal account management system that allows you to create demo and live accounts, make deposits, withdrawals and more

Sign up

Choose a trading platform

Download the trading platform for your Desktop device or trade in the mobile version for Android or iOS

Start trading

Log in and start practicing on a demo account or make a deposit to start trading on a live account

Start tradingTrade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account