UK labor market news halted GBPUSD growth wave

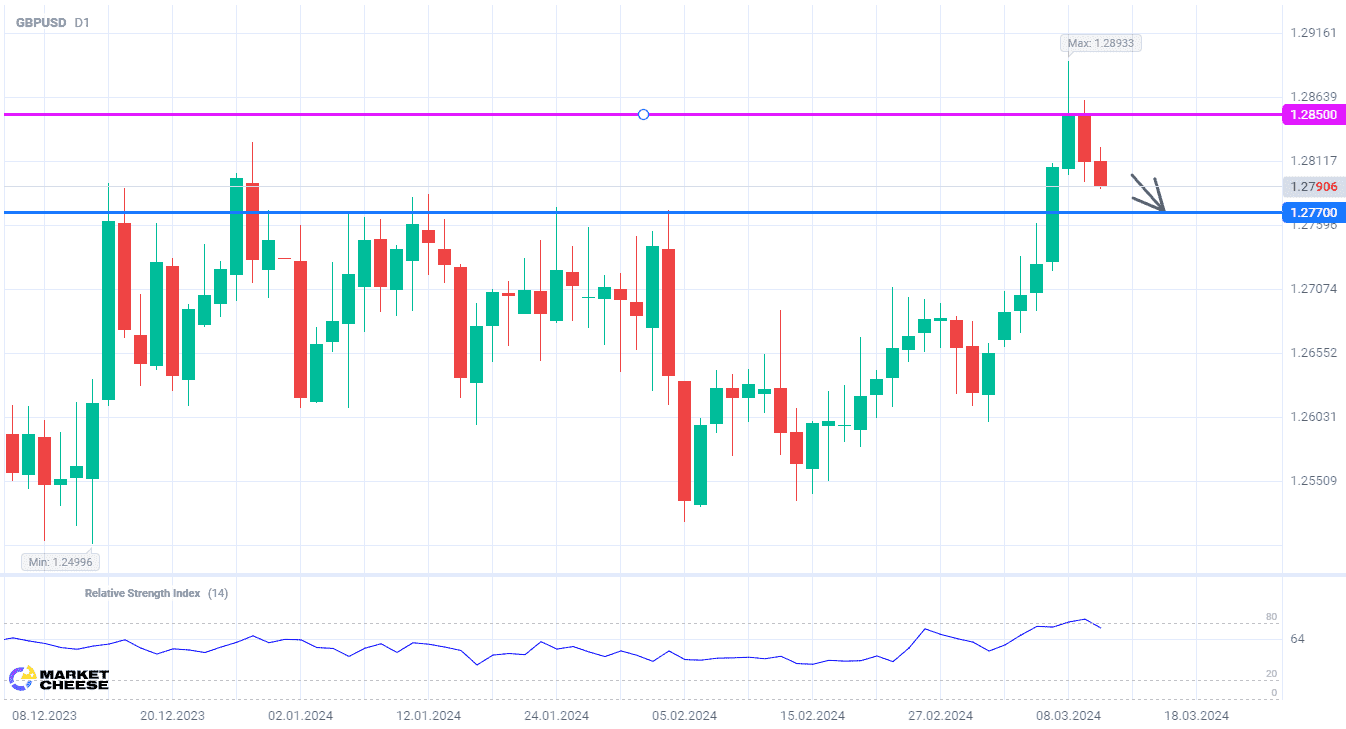

The GBPUSD currency pair showed strong growth momentum last week. At Friday's trading session, a new six-month high was set just below the level of 1.29. However, even then the bears clearly tried to seize the initiative, and the price movement reversal was confirmed on Monday. The quotes moved to a corrective pullback with 1.277 as the nearest target for the sellers.

Yesterday's weakening of the pound against the dollar was driven by the news from the UK labor market. The Recruitment and Employment Confederation (REC) published its monthly demand index, which plummeted to 46.9 in February from 49.4 in January. This is the lowest level of demand for staff in the country since early 2021. REC Chief Executive Neil Carberry highlighted a worrisome trend in the UK labor market, which may soon face even more pressure.

Today's official data from the UK Office for National Statistics confirmed the estimates made by REC representatives. The country’s unemployment rate unexpectedly rose to 3.9%, and the growth rate of wages slowed more than expected — from 5.8% to 5.6%. The increase in wages has been the lowest since October 2022. Given these figures, the British currency keeps depreciating against the dollar.

Yael Selfin, Chief Economist at KPMG UK, does not expect any major changes from the Bank of England after the release of February's statistics on the labor market. However, he predicts a further slowdown in employment and wage growth, which will increase the likelihood of interest rate cuts starting in the summer. British officials consider the dynamics of wages and inflation as the two most important indicators for making a decision on easing monetary policy. As a result, support for the pound may weaken.

Fundamental prerequisites for GBPUSD correction are strengthened by the technical picture. The daily chart shows a strong overbought state of the RSI. If today's US inflation data is worse than expected, the quotes may quickly break down the level of 1.277.

Consider the following trading strategy:

Sell GBPUSD at the current price. Take profit – 1.277. Stop loss – 1.285.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account